Yet more interest appears to be surfacing at enterprise level in the big data arena, further alluding to the dynamic which is emerging in which a large corporate development relating to infrastructure is taking place on an almost daily basis.

Today, Russian enterprise database and infrastructure colocation company IXcellerate has released a white paper detailing what the firm considers to be practical methodologies by which companies can future-proof their investment in Russia’s financial trading environment by selecting the correct datacenter solution.

Sights Set on Russian Venues

Moscow’s MICEX and RTS exchanges have gained momentum of late as venues which are beginning to drive a requirement for increased connectivity, as explained to Forex Magnates by Emmanuel Carjat, CEO of TMX Atrium following the company’s completion of an ultra-low latency route from Moscow to London.

“Demand for connectivity is currently most prevalent between Moscow and London, enabling participants to take advantage of the trading opportunities available between the International Order Book (IOB) and the Moscow Exchange equity market” explained Mr Carjat in March this year.

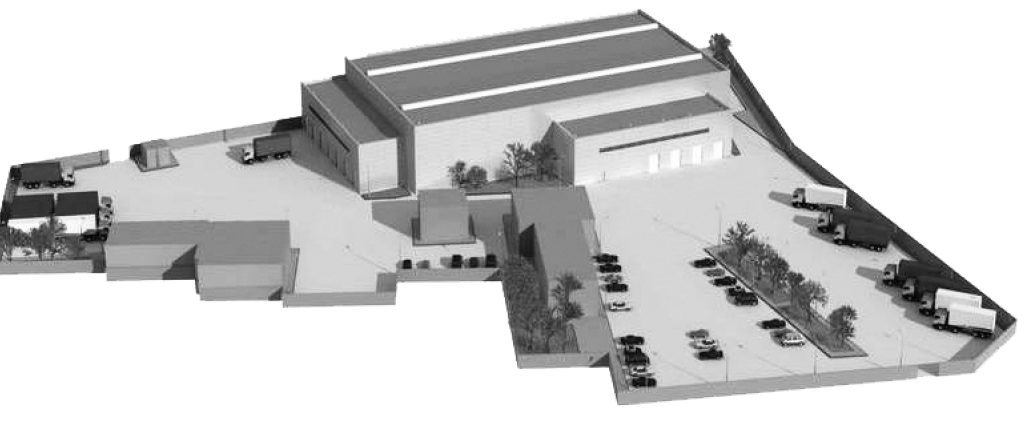

The IXcellerate Facility in Moscow, Russia

For IXcellerate, the merger of the two main financial exchanges (Micex and RTS) to form the Moscow Exchange has generated considerable demand for the infrastructure company to prepare its framework for market participants wishing to connect to Russia’s venues.

The whitepaper discusses what needs to be understood and the necessary steps to be taken in order to make the most of any early mover advantages in this fast developing ecosystem. In addition, various key players such as Andrew Powell, International DMA Sales at URALSIB, BSO Network Solutions Managing Director Fraser Bell, and Christopher McConville, Executive Director, Equities at UBS Investment Bank, have contributed their opinions and experiences while addressing the current state of Russia’s electronic financial markets, as well as the infrastructure and connectivity challenges faced in Moscow.

IXcellerate’s CEO Guy Willner explained in a corporate statement today that “finance organizations which are able to anticipate and quickly adapt to this fast-changing environment will clearly emerge as market leaders, and it is obvious that demand is growing in Moscow for high-end datacenters to act as a foundation for this new market.”

With an experienced management team, multiple carrier choice and a central location. IXcellerate offers a real solution in Moscow at the same quality level as high end financial data centers in New York, Singapore and London,” said Mr. Willner

Point to Point vs Colocation

Interestingly, carrier-neutral company IXcellerate is not the only organization with an interest in big data solutions connecting London with Moscow. As highlighted by Mr. Carjat, the ethos is similar however in the case of IXcellerate, the emphasis is on colocation rather than point-to-point connectivity.

Such database and big data solutions are not without competition, most of which is coming about as a result of cutting edge technology being developed and implemented after a long period of time during which Europe and Russia were a long way behind North America in terms of infrastructure quality.

Big Data, Big Acquisitions

Big data solutions have been the interest of both TIBCO and Software AG just recently, both having acquired Streambase and Apama respectively.

Datacenter availability is also improving rapidly, with Volta’s new London facility already connected to eight telecommunications carriers and major venues worldwide in readiness for its opening later this year representing the first new datacenter in Central London in over 12 years, and reducing the reliance on Slough’s LD4 facility.

IXcellerate take the view that a consultative approach to future-proofing should be taken from the company, at the outset in order that market participants can grow their infrastructure effectively in order to keep ahead of the latency game.

The company maintains the view that even if the money to build a shining new datacenter is available there today, with the true value of datacenters being ‘best-in-breed’ efficiency, it is hard to compete with professional providers in terms of datacenter best practice.

Initial build-out no longer guarantees functions throughout, facilities need to have well thought capacity planning before construction and be updated regularly to stay at the top of the game.

The white paper itself categorizes capital expenditure, operating costs, power supply and cooling, infrastructure upgrades taking into account hardware equipment changes which take place constantly and rapidly, impacting the supporting infrastructure equipment.

The IT upgrades / replacements create additional costs, on top of overbuilds which may result in expensive empty space, reducing efficiency.

Location, Location, Location

It is of importance to consider the physical location of data centers, and IXcellerate details many geographical and technological factors which should be borne in mind, plus redundancy and scalability factors.

Traditionally a datacenter has an expected life span of 15-25 years. The fairly rigid and unchanged image of a datacenter for decades however is no longer valid, along together with the static model as demonstrated by the recent cloud-based solutions offered by CFN Services and SS&C, both of which use a virtual machine model.

A datacenter is of course still a long-term business despite the reduced amount of physical hardware in today’s solutions, but the success lies in extensive long-term capacity modeling, well planned in conjunction with phased build-outs.

Datacenter new builds experience failure sooner than expected may be because of less experienced human resources on the industry, or in some cases, they are forced to compromise the better long-term design to meet short-term requirements.

The capability to respond to changing requirements, adding space and power density efficiently is essential as is an on-demand model with a sound commercial proposition and clear return on investment.

US Liquidity Exodus?

Traditionally, the United States has been home to the world’s fastest and highest quality infrastructure for the trading industry.

This is still very much the case, however with the impending Dodd-Frank Act looming and potentially a latency floor being imposed on trading venue execution times, as well as extensive trade reporting becoming very much common practice, it will be interesting to see whether the large investments in European and Russian connectivity to bring them up to modernity drive volume abroad.

Yesterday’s connection of SS&C to TMX Atrium’s community is a case in point, in which SS&C confirmed to Forex Magnates that this particular alliance took place mainly to expand SS&C’s presence into Europe. Could others follow?