October was one of the strongest months for the dollar (and weakest for the euro) in over a year. Despite above-average volatility driven by the upcoming U.S. elections and interest rate expectations, spot foreign exchange (Forex) volumes showed no increased activity from institutional investors. In some cases, trading volumes fell to nearly five-month lows.

Dollar-Dominated October Failed to Boost FX Volumes

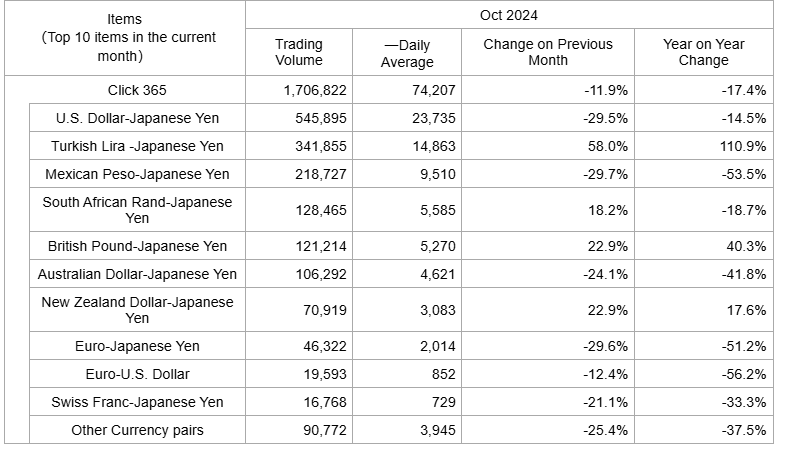

Click 365, the currency trading platform on the Tokyo Financial Exchange (TFX), recorded another month of declining trading volumes, shrinking 12% compared to September to 1.7 million contracts. Year-over-year, the decline was almost 17.5%, with average daily volume (ADV) at 74,200 contracts.

The steepest month-over-month declines were seen in trading on the popular USD/JPY pair, where depreciation reached 29.5%, with trading volume shrinking to 545,900 contracts.

ADV depreciation was also visible in the U.S. market and spot currency trading on the Cboe exchange. The indicator reached $42.8 billion, compared to $46.87 billion in September. However, October had two more trading days (23 vs. 21). As a result, total volume was slightly higher at $984.9 billion, though these are the lowest values since June, well below August's near-record $1.1 trillion.

For FXSpotStream, October brought a notable slowdown. Total ADV was $93.1 billion, the lowest since May 2024, with spot ADV at $66.8 billion, also the lowest in nearly six months.

Falling Euro Shows No Impact on FX Activity

In Europe, German stock exchange -owned 360T recorded another month of volume decline in October, sliding to $657.7 billion from $661 billion reported a month earlier. ADV consequently shrank to $28.6 billion, compared to $31.5 billion reported in September.

As for Euronext FX's Fastmatch, there was a slight rebound after a very weak September. Total volumes bounced to $602 billion after falling to $579 billion in the previous month. However, more trading days meant ADV performed worse, sliding from $28 billion to $26.5 billion.

Compared to last year's results, the values are significantly better. Euronext FX reported a total volume of just under $508 billion in October 2023, while 360T reported $586 billion.

The EUR/USD currency pair declined by 2.3% in October, marking its most significant drop since September 2023. Concurrently, the U.S. dollar rebounded from multi-month lows, experiencing one of its strongest rallies against a weighted basket of currencies since September 2022.