The Polish-listed broker XTB reported a 24% drop in 2025 net profit to PLN 643.8 million, as sharply higher marketing and operating costs more than offset record revenues driven by strong client and volume growth.

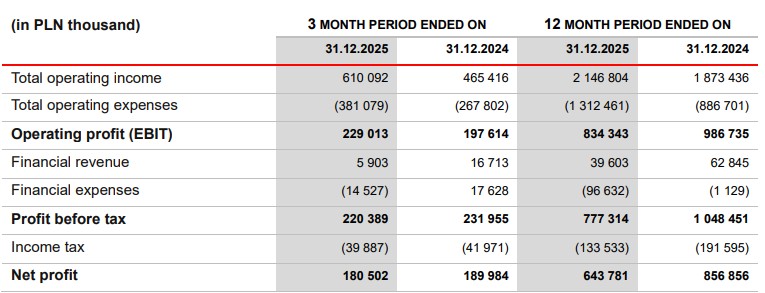

According to the preliminary results released Thursday, total operating income rose 15% year‑on‑year to PLN 2,146.8 million, up from PLN 1,873.4 million in 2024. This was boosted by a 70% increase in active clients to 1,189,422 and a 41.3% rise in CFD volume to 8,866,381 lots.

However, EBIT declined 15% to PLN 834.3 million as operating expenses jumped 48% to PLN 1,312.5 million from PLN 886.7 million.

Favorable Conditions in Key Assets

The group said the revenue increase reflected more clients, higher trading activity and favorable conditions in key asset classes, even as profitability per lot fell to PLN 215 from PLN 275.

- XTB Eyes $186M Income in 2025 as New Traders Flood Platform

- XTB Trading Volumes Jump 76% as Poland's Bull Market Roars

- XTB Adds 442K Polish Accounts in 2025 as December Rush Pushes Market Past 2.5 Million

In the fourth quarter alone, operating income climbed to PLN 610.1 million from PLN 465.4 million a year earlier, supported by strong demand for commodity and U.S. index CFDs and a quarter‑on‑quarter rebound in unit profitability per lot to PLN 208.

Net profit in the fourth quarter slipped 5% year‑on‑year to PLN 180.5 million, as costs continued to trend higher.

XTB highlighted that Q4 revenues benefited from elevated client trading in gold, cocoa and natural gas, while trading in equity indices remained comparatively subdued despite record levels in major U.S. benchmarks.

More financial reports: Virtu Financial’s Trading Income Jumps 34% in 2025 amid Market Volatility

On the cost side, marketing was the main driver of the 2025 expense surge. Marketing spend increased by PLN 240.2 million year‑on‑year to PLN 585 million as the group rolled out broad multi‑market campaigns and sponsorships, including its largest‑ever global branding push in the second half.

Expanding Client Base

The client base expanded rapidly despite higher outlays. XTB acquired 864,286 new clients in 2025, up 73% from 498,438 in 2024, taking total clients to 2,164,867 from 1,361,564.

The number of active clients rose from 701,089 to 1,189,422, although average operating income per active client fell to PLN 1.8 thousand from PLN 2.7 thousand as lower unit profitability and a more mass‑market profile diluted per‑client revenue.

Client assets on the platform increased to PLN 45.8 billion from PLN 27.5 billion, driven by higher holdings in shares and ETFs as well as larger CFD positions and cash balances.

Looking ahead, the Management Board warned that cost inflation will continue.

It estimates that total operating expenses in 2026 could be up to around 30% higher than in 2025, with marketing potentially rising by about 50% as the group continues to chase client growth and brand visibility.