MFF founder recounts struggles after CFTC freeze

In an exclusive interview with Finance Magnates following the abrupt shutdown of My Forex Funds (MFF) in 2023, CEO and founder Murtuza Kazmi detailed the financial and emotional toll of the CFTC’s enforcement action.

The regulator’s sudden asset freeze wiped out one of the largest players in the prop trading space overnight, cutting off payments to traders and employees alike.

Reflecting on the saga, Kazmi insisted that MFF “would have won the case regardless” and argued that the alleged misconduct by regulators unfairly destroyed market confidence.

FundingTicks prop firm winds down

There is no doubt prop trading firms are under growing strain. This week, FundingTicks announced plans to wind down its operations as part of what it calls a “strategic plan” to redirect resources toward areas that provide greater long-term value for clients and partners.

- Weekly Recap: Ripple-LMAX Pact Brings Stablecoins Closer to Mainstream; Will London’s IPOs Rebound?

- Market Wrap: Prop’s Rule Changes Spark Debate; Can Kraken–Deutsche Börse Pact Boost Crypto?

- Weekly Recap: FXCM, Tradu to Slash 100+ Jobs; 1/3 of eToro Trades Now in 24/5 Extended Market Hours

The announcement follows a wave of backlash last year, when FundingTicks introduced controversial rule changes for its traders. These included a one-minute minimum trade hold for scalping strategies, tougher daily profit targets, and lower profit splits.

Plus500 halts new CFD onboarding in Spain

Struggles are also visible in the CFD space. Plus500 stopped opening new CFD trading accounts for residents in Spain. This step comes against the backdrop of Spain enforcing some of Europe’s toughest rules on how firms can promote and distribute CFDs to non-professional clients.

Regulators in the country heavily restrict marketing, bonuses, and high-leverage offerings, pushing providers to reassess whether acquiring new retail CFD customers in Spain remains viable.

Tickmill posts 40% jump in volumes

However, not all is doom and gloom. Tickmill closed 2025 on a strong note, processing $2.36 trillion in client trading volume across 123 million trades over the year.

Average monthly volumes climbed 40% compared with 2024, while the total number of trades executed rose 24%. December 2025 was the broker’s busiest month, with client turnover reaching $300 billion, highlighting a year-end surge in market engagement.

XTB volumes surge 76%

Also soaring, XTB’s Polish clients traded 16 billion zlotysin securities on the Warsaw Stock Exchange in 2025, a 76.3% jump from the prior year that still trailed the firm’s 115% surge in account numbers.

That growth left XTB controlling about 33% of all Polish brokerage accounts but only 1.7% of WSE trading volume, according to market data cited by financial daily Parkiet.

XTB Financial Performance and Forecasts

Metric | FY 2024 (Actual) | FY 2025 (Forecast) | FY 2026 (Forecast) |

Net Profit (Zlotys) | 859.4 million | 673 million | 1.0 billion |

Net Profit (USD) | $238 million | $186.4 million | $277.2 million |

New Clients | 498,438 | 865,000 | 1.3 million |

Dividend per Share | 5.45 zlotys ($1.51) | 4.30 zlotys ($1.19) | — |

Heading into its preliminary fourth-quarter results, the public-listed broker expects a rebound, as analysts at Noble Securities forecast a 205 million zloty net profit for Q4 2025, lifting estimated full-year earnings to 673 million zlotys.

cTrader volume doubles

Tech providers are also seeing solid growth. Spotware reported a 105% year-on-year jump in live USD trading volumes on its cTrader platform in 2025, as the number of traders using the venue climbed past 11 million. The growth underscores cTrader’s strengthening position in the multi-asset trading platform space.

Over the same period, the fintech expanded beyond its flagship platform by launching a liquidity bridge, growing its marketplace offering and embedding AI across core operations. It also onboarded 104 new clients, deepening its reach among both brokers and proprietary trading firms.

eToro leads Australia’s CFD market

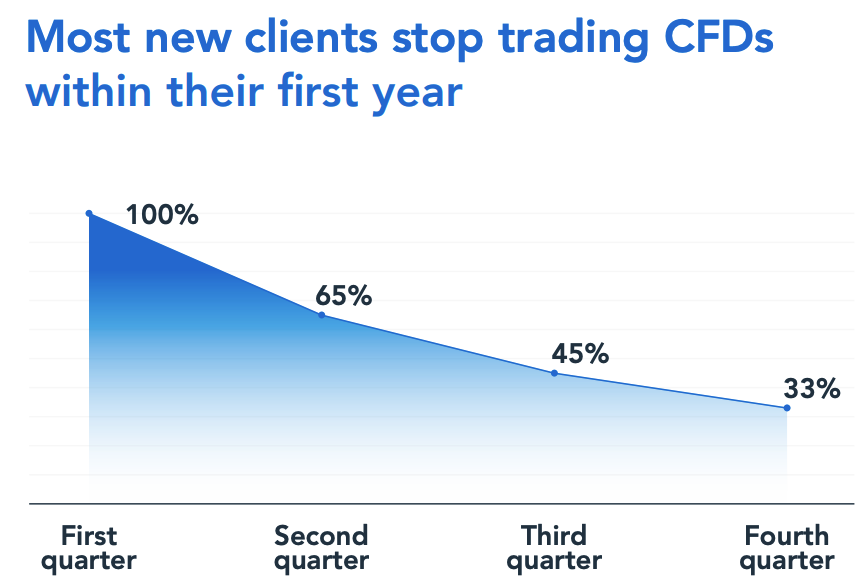

Down under, eToro controls 45 percent of existing CFD traders, while Capital.com captured 14 percent of newly opened CFD accounts, the highest share among brokers, according to ASIC.

The market itself is highly concentrated, with only a handful of brokers taking most of the business. After eToro, Plus500’s Australian unit holds 12 percent, IG 8 percent, and Pepperstone and CMC Markets 7 percent each, leaving little room for smaller rivals.

However, the regulator is tightening the grip. ASIC secured about AU$40 million (US$27 million) in refunds for more than 38,000 retail CFD investors after a review of the sector. It found that over half the CFD brokers in the country either offered “margin discounts” to retail traders or breached other obligations.

“InstiTail” trading gains momentum

Meanwhile, brokers are increasingly giving retail traders access to tools and concepts that were once the preserve of institutional desks, narrowing some of the practical gaps between the two segments.

With margins under pressure globally, retail and institutional players have strong incentives to standardize technology, share infrastructure and grow volumes. However, key differences persist around latency requirements, how balance sheets are deployed, and the level of customization expected on pricing, risk and workflow.

How Singapore institutions rethink crypto

Can crypto really earn a permanent place alongside FX in institutional portfolios? Institutional traders in Singapore are taking a closer look at this. However, significant hurdles still need to be cleared.

Questions around liquidity depth, counterparty risk and operational readiness continue to hold some firms back. Regulators, meanwhile, draw a firm line between the two markets.

FX is governed by long‑standing capital markets and banking rules, while crypto falls under the Payment Services Act and related Monetary Authority of Singapore frameworks for digital payment tokens, keeping digital assets in a separate regulatory bucket.

Shareholder activism: loud in US, quiet in Europe

Away from this industry, shareholder activism reached a record level in 2025, with 255 campaigns launched worldwide, surpassing the previous peak in 2018.

More investors than ever now see activism as a way to force change and unlock value at listed companies, offering a source of alpha just as traditional stock-picking continues to lose ground to passive strategies and indexing.

Yet this surge has not been evenly spread across markets. In Europe, shareholder activism fell by almost 20 percent in 2025, dropping to its lowest level in a decade and highlighting a stark contrast with the more assertive US landscape.

Davos 2026: tokenization is “the name of the game”

Discussions on digital assets at the World Economic Forum have evolved beyond speculation to focus on tangible, real-world applications.

This year’s narrative reflected a more mature stage in the industry’s development, where implementation, rather than ideology, dominated the agenda. Global financial leaders described tokenization and stablecoins as the defining trends of 2026, signaling a shift toward institutional adoption.

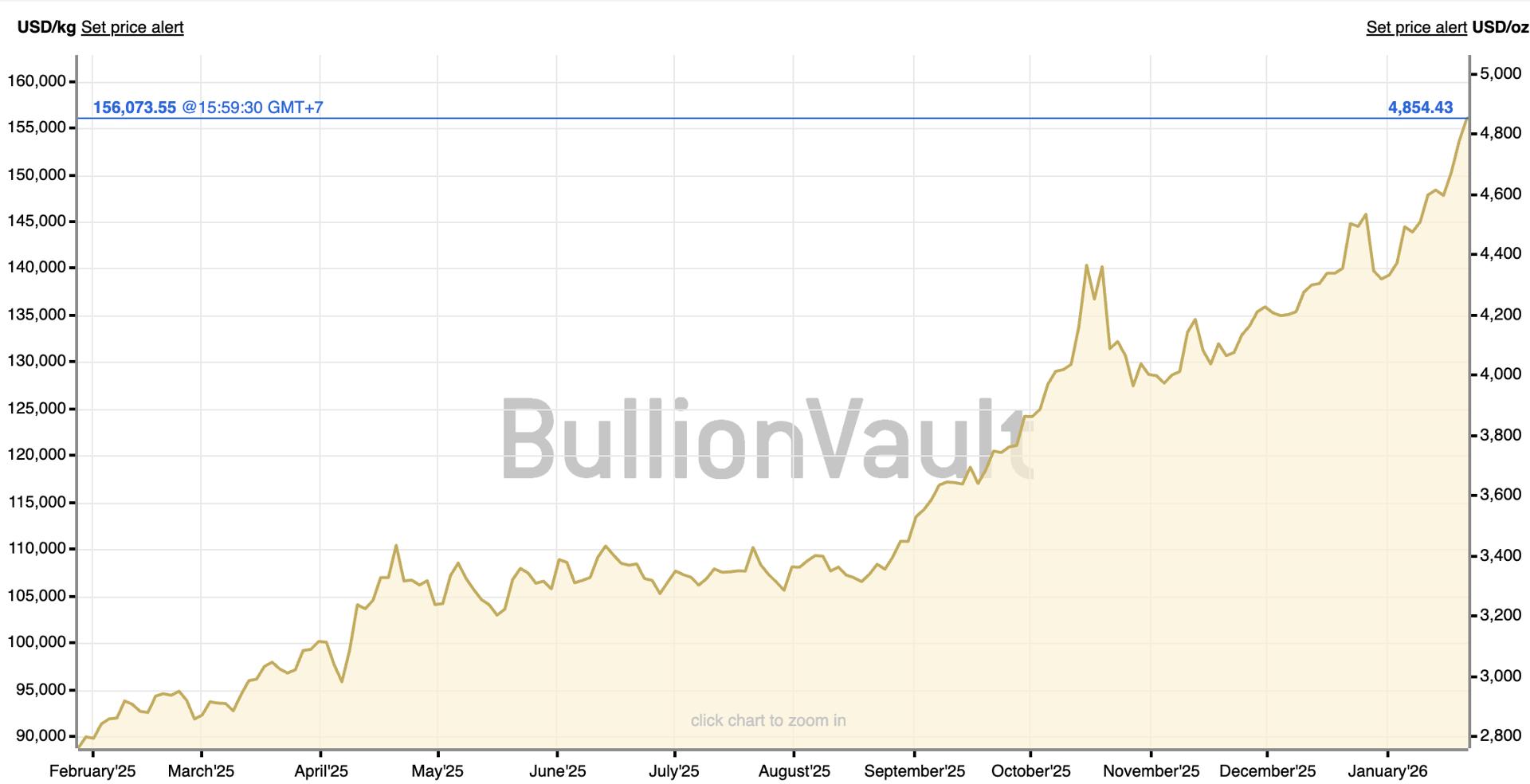

Gold leads trading activity at Axi

Meanwhile, recent volatility in precious metals is reshaping the market landscape. Gold has emerged as the leading trading instrument at Australian broker Axi, underscoring a wider trend across the CFD sector as traders flock to the heightened volatility in precious metals.

The metal surged to a record high of about $4,888 per ounce earlier this week before easing to around $4,836. After rising 65% in 2025, gold has already gained another 12% in the opening weeks of 2026, extending its remarkable rally.

In institutional liquidity, sticking to “business as usual” can be risky when market conditions undergo major changes. For a long time, the industry has viewed gold (XAU) and silver (XAG) pricing, spreads, and financing costs as largely fixed.

But the latest moves in precious metals aren’t just another market trend – they represent a fundamental change in how these markets function.