eToro opens 24/5 trading on the top 100 US stocks

In this week’s roundup of key industry developments, eToro, the publicly listed Israeli fintech firm, launched 24/5 trading for 100 of its most popular U.S. stocks, to enable users to buy and sell shares, including names like Mastercard, Snap, and Alphabet, outside regular market hours, Monday through Friday.

All order types remain available during extended sessions. The company also announced plans to introduce tokenized shares and spot-quoted futures (SQFs) as part of its broader product expansion.

📢 Just dropped:

— eToro (@eToro) July 29, 2025

24/5 trading on 100 popular US stocks.

Start trading around the clock.

eToro joins a growing list of retail brokers offering extended-hours trading, which allows users to trade 100 U.S. stocks 24 hours a day, five days a week.

While not a new feature in the industry, 24/5 trading has become increasingly common as demand rises from investors in Asia and other regions seeking access to U.S. equities outside regular market hours.

However, limitations remain. The U.S. Securities and Exchange Commission (SEC) has previously warned that trading outside standard hours can involve reduced liquidity, wider bid-ask spreads, or even a lack of price quotes.

Robinhood crypto revenue falls

Robinhood’s crypto revenue fell sharply in Q2 2025, dropping to $160 million from $252 million in the previous quarter—a 36.5% decline. Despite the slowdown, the company pointed out that crypto revenue nearly doubled compared to the same period last year. This was the second consecutive quarter of declining crypto revenue for Robinhood, after peaking at $358 million in Q4 2024.

The company has attributed the decline to fluctuating trading volumes, and CEO Vlad Tenev has emphasized efforts to reduce reliance on crypto by diversifying the platform’s revenue streams.

XTB’s profit rises amid plans to add physical crypto

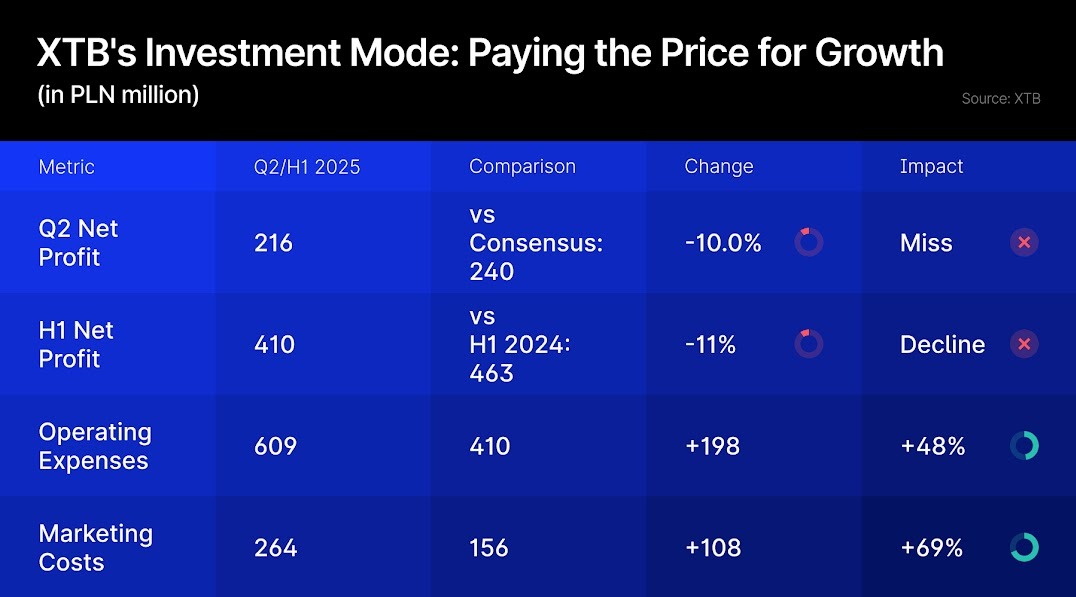

Meanwhile, XTB, the Polish retail broker, reported revenue of PLN 580 million (USD 150.8 million) in Q2 2025, matching its performance from the previous quarter. Despite flat revenue, pre-tax profit rose by 11.2% to PLN 260.7 million (USD 67.8 million), supported by lower costs. Net profit came in at PLN 216.1 million (USD 56.2 million), according to preliminary results.

Total expenses dropped 7.2% to PLN 292.9 million (USD 76.2 million), with marketing spend falling by about 13% to PLN 123 million (USD 32.0 million), even as the broker maintained campaigns across Europe.

The Polish broker also announced plans to expand its product lineup by introducing physical cryptocurrencies and options. It currently offers crypto trading through contracts for differences (CFDs).

CFD broker AETOS surrenders FCA license

In the UK, AETOS, a contracts for differences broker, surrendered its licence from the Financial Conduct Authority, signaling a full exit from the UK market.

According to the FCA registry, AETOS gave up its authorisation last month and is no longer permitted to offer regulated products or services. The broker also filed a "Solvency Statement" with Companies House, an action typically associated with corporate restructuring or capital reduction.

Is the reporting burden about to ease in the UK?

In matters of regulations, the UK’s Financial Conduct Authority has scaled back the amount of data it collects from firms that arrange or advise on retail investment products.

The market is measuring future results and earnings. Right now what the market's sniffing out is access to new markets at a reciprocal tariff price somewhere around 15%. That's the assumption. Now, let's take Europe. This is big news. That's a massive market to gain access to.… pic.twitter.com/knVPPmrGYR

— Kevin O'Leary aka Mr. Wonderful (@kevinolearytv) July 29, 2025

From 27 June, these firms no longer need to submit certain details, including information on individual adviser complaints. While the FCA is looking to streamline regulation , market behavior often appears driven more by sentiment than hard data.

This is evident in recent market trends, such as Spain’s recovery, which reflects a shift in investor mood rather than a sudden improvement in economic fundamentals.

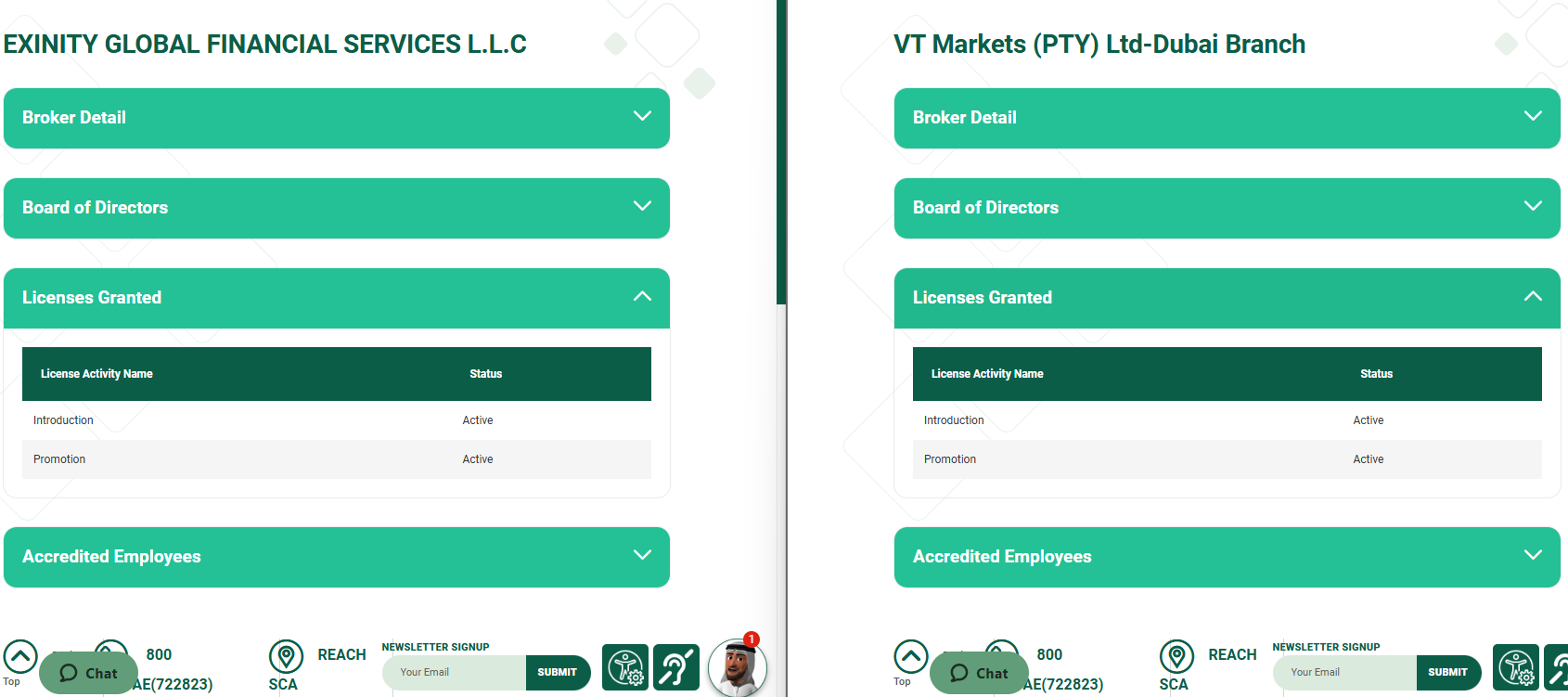

Exinity, VT Markets secure Dubai licenses

In our exclusive coverage, Exinity and VT Markets received licences from Dubai’s Securities and Commodities Authority (SCA), allowing them to offer contracts for differences (CFDs) in the region.

VT Markets operates under its own name, while Exinity runs multiple brands, including FXTM. Exinity, owned by Andrey Dashin, no longer lists the Alpari brand as part of its group, which now holds only a Comoros licence.

MyFunded Futures' licensing bid

In the prop trading space, US-based prop firm MyFunded Futures is planning to become a fully licensed Introducing Broker regulated by the NFA and CFTC. The move is aimed at leading the company’s brokerage setup and registration process.

Despite these plans, MyFunded Futures is not yet listed in the NFA’s BASIC database under either “MyFunded Futures” or “MyFunded,” indicating that registration is still in progress.

More numbers: CFI Financial, Capital.com's results

CFI Financial reported a record $1.51 trillion in trading volume for the second quarter of 2025, more than half of its total 2024 volume of $2.79 trillion. The sharp increase highlights rising interest in retail trading during a period of heightened market activity.

The surge coincided with volatility triggered by tariff-related announcements from U.S. President Donald Trump, which several brokers described as some of their busiest trading days. IG Markets also saw elevated client activity in April and recently reported record annual results.

Additionally, Capital.com saw a 22% rise in trading activity during the second quarter of 2025, executing over 59 million trades. The total trading volume reached $850 billion for the quarter.

Index and commodity markets remained the most active segments, with recent tariff measures influencing trading patterns across both asset classes.

AI drives surge in electricity costs

Finally, data centers running AI tools like ChatGPT are consuming massive amounts of electricity, and the impact is starting to show up in power bills.

In the U.S., this strain could worsen under Donald Trump’s proposed energy policies, which may prioritize fossil fuels and scale back green energy incentives.

Millions of Americans across the eastern U.S. are seeing their monthly electric bills spike, and many of them have no idea why. But there’s a culprit: data centers that power artificial intelligence.

— The Washington Post (@washingtonpost) July 30, 2025

The data centers consume huge amounts of electricity, and as a result, are… pic.twitter.com/lUHwTEzSdv

While air conditioning and household appliances have long been blamed for high summer energy costs, the rapid growth of AI use is now a major factor.