Webull UK is rolling out LSE-listed shares and exchange-traded funds on its platform alongside a two-tier account structure, marking the latest move by the broker to build market share in Britain's retail investment sector.

Webull UK Adds Domestic Shares, Tiered Accounts in Platform Overhaul

The FCA-authorized subsidiary of Webull Corporation is launching Webull Go, a commission-free account offering U.S. stocks, options, FTSE 100 constituents and 20 ETFs, alongside Webull Meridian, a £5 monthly subscription tier that provides access to roughly 1,000 UK-listed equities and ETFs. The Meridian account is priced at £0.01 through year-end.

Webull is also flattening its U.S. equity commission to $0.10 per trade across both account types, down from a variable rate of 2.5 basis points with a $0.10 minimum. The change comes as fee pressure mounts across digital brokerages competing for active traders.

"By introducing UK shares and ETFs alongside flexible account options, we're giving our customers more tools to match their goals and trading styles," Nick Saunders, Chief Executive Officer at Webull UK, said in a statement. "Lower costs, broader access and a straightforward experience remain central to our mission as we grow in the UK market."

The UK share and ETF offering runs on infrastructure provided by Berlin-based Upvest, which handles brokerage, settlement and custody for the new products. Webull UK first announced the Upvest partnership in June, when introduced fractional shares and ETFs trading.

The Meridian tier includes multi-currency accounts, reduced foreign exchange fees and early access to future products.

The UK Retail Market Competition Intensifies

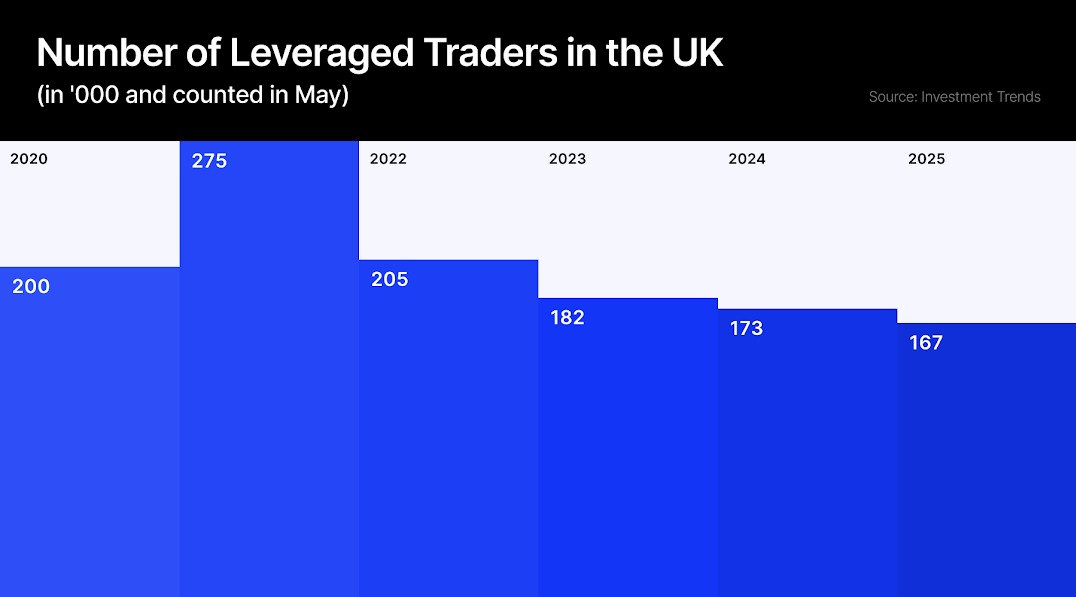

The account launch comes as several platforms have entered or expanded in the UK market this year. Robinhood rolled out its desktop trading platform in June, targeting the country's 11 million desktop traders, while Revolut launched stock trading services for its 650,000 UK users after receiving FCA approval late last year.

IG Group introduced 24/5 trading on 110 U.S. stocks in September, allowing clients to trade outside standard market hours. Ultima Markets secured FCA authorization in July and plans to begin onboarding UK customers in 2026.

The flurry of activity marks a shift after several years of brokers exiting the UK amid tighter regulations. OANDA added share CFDs on U.S. and European stocks in February, while Moneta Markets obtained an FCA license in August through an acquisition.

The battle for retail clients is evident not only in the UK market. FinanceMagnates.com recently reported that similar developments are taking place in Poland, where new players are entering the market and local firms have started to sharply reduce commissions in an effort to attract new customers

Webull Expands Globally

Webull Corporation, which went public on Nasdaq under the ticker BULL this year, operates licensed brokerages in 14 markets across North America, Asia Pacific, Europe and Latin America. The company reported more than 24 million registered users globally and has been adding markets throughout 2025.

Upvest processes over 2 million orders weekly and counts Revolut, N26 and bunq among its clients. The firm secured FCA approval in 2024 and has been expanding operations in the UK following earlier partnerships across continental Europe.

The Webull UK launch in July 2023 initially focused on U.S.-listed securities. The addition of domestic shares broadens the platform's appeal to UK-based investors seeking exposure to local companies alongside international markets.

A month ago, the company strengthened its presence in Europe by opening new Dutch headquarters to oversee operations across the Old Continent.

Related stories: