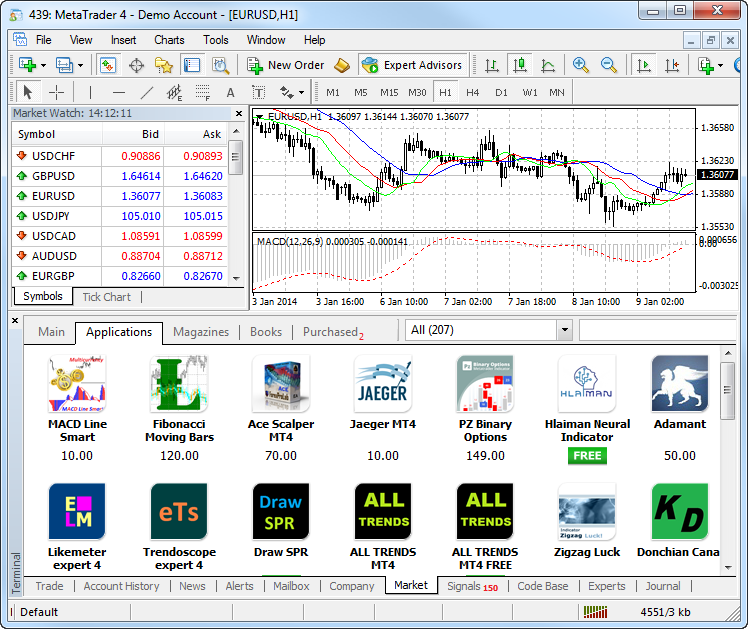

MetaQuotes has today announced that it is preparing to launch an upgrade to its MetaTrader 4 platform on February 3 this year, with a view to expanding the trading environment provided by its MQL4 language, as well as adding a 'Market' tab in order that the application store can be accessed directly from the platform, a setting which is becoming increasingly commonplace within retail FX platform functionality.

Smooth Transition?

Somewhat controversially, MetaQuotes performed a series of corporate initiatives during the course of last year, which began in March when the company unveiled a server-side build which appeared to level constraints at providers of third party solutions which adapt the MetaTrader 4 platform for use with Liquidity providers rather than market-making retail FX firms.

Two weeks subsequent to that particular build, MetaQuotes rolled out a software upgrade, to which a number of companies responded that it had generated incompatibilities with certain ancillary software. Some technology providers experienced technical conflicts, as in the case of Tools For Brokers, who published a notice to their clients that the release of MetaTrader 4 build 482 affected their Orders Add function and trade duplicator plugins.

Reassurance of Compatibility

These occurrences in March gave way to an onslaught against third party software providers by MetaQuotes, which ranged from the company's reactionary stance taken toward MT4i, in which the company blocked MT4i's interface add-on, before launching a four-pronged diatribe against Tradeo, myfxbook, ZuluTrade and Tradency for allegedly hacking a MetaTrader 4 protocol.

In late May, MetaQuotes revealed that it plans to launch a third party software market place, in which developers must submit their applications and tools to MetaQuotes in order that they may only be offered via MetaQuotes, and with the imminent launch of the upgrade to MetaTrader 4 in February, MetaQuotes has stated categorically on its pre-launch notice that, "There is no need to worry about the operability of the previously developed trading robots and indicators, as the runtime environment copy of the previous MQL4 version is used to maintain compatibility. Thus, old EX4 files work correctly and exactly the same way as before."

Whether this has come as a result of MetaQuotes having achieved its objective in institutionalizing the software providers so that they are not able to independently offer applications and tools which are compatible with MetaTrader 4, or that it is a matter of concern regarding competing platforms which are gaining consistent market share by providing application-based interfaces and extending a welcome to external developers, is a matter for contemplation.

Forex Magnates spoke to Andrew Ralich, CEO of oneZero, in order to ensure full understanding can be conveyed from an industry professional whose business requires extensive knowledge of such builds and upgrades. "At oneZero we keep in close contact with the team at MetaQuotes to ensure our plugin technology adapts seamlessly with the evolution of the MT4 Platform," explained Mr. Ralich.

" We have been testing and working with this new build for over a month now. We are looking forward to further guidance from MetaQuotes on their server level 'App Store' which was displayed at the Cyprus and Macau iFX EXPO conferences," he concluded.

Functional Changes

When installed, MetaQuotes has confirmed that the upgrade will perform automatic copying of MQL4 applications when updating from previous builds.

In the previous builds of MetaTrader 4 client terminal (509 and older), all MQL4 applications were stored in the following sub directories of experts root directory as listed here:

experts - Expert Advisors (trading robots),

expertsindicators - custom indicators,

expertsscripts - scripts (MQL4 applications for a single run on the chart),

include - source code MQH and MQ4 files implemented into other programs,

libraries - libraries in the form of MQ4 source codes and EX4 executable files compiled from them. They are used for the dynamic call of the functions contained there by other MQL4 programs,

files - special "file sandbox". MQL4 applications are allowed to execute file operations only within this directory.

In the new MQL4 version, the file structure for storing the source codes has changed. Now, all MQL4 applications should be located in the appropriate folders of data_folder>MQL4 directory as follows:

experts - Expert Advisors (trading robots),

Indicators - custom indicators,

Scripts - scripts (MQL4 applications for a single run on the chart),

include - source code MQH and MQ4 files implemented into other programs,

libraries - libraries in the form of MQ4 source codes and EX4 executable files compiled from them. They are used for the dynamic call of the functions contained there by other MQL4 programs,

Images - image files for using in resources,

files - special "file sandbox". MQL4 applications are allowed to execute file operations only within this directory.

With the emphasis among platform developers increasingly heading toward application availability from within, it is clear that MetaQuotes, despite the prevalence of state-of-the-art competition, is intent on maintaining its position of strength among retail FX companies.

MetaTrader 4 Set to Include 'Market' Tab

As of February 3