Remember trading journals? For years, they have been recommended to novice and more experienced investors to meticulously track the history of their transactions in the Forex market, helping to develop trading discipline and risk management patterns.

Although the days of trading journals kept in notebooks or spreadsheets are long behind us, FZCO aims to offer retail traders in Europe a new approach to recording their transactions. To this end, it has introduced the Tradelytic platform, intended to serve as a modern trading journal.

Tradelytic Has Attracted over 2,000 Traders in a Month

According to information shared with Finance Magnates, Tradelytic has been operating in the European market for a month and has already been used by over 2,100 retail traders. The tool's creators claim that it helps streamline the investment decision-making process and achieve better long-term results thanks to stricter capital and risk management rules.

"The challenges rooted within Forex trading have dominated discussions for a while, often casting a shadow over the profession. This was a significant driver behind creating and launching Tradelytic," commented Luke Gregory, the CEO and Founder of Tradelytic.

Copy Transactions Directly from MetaTrader 4

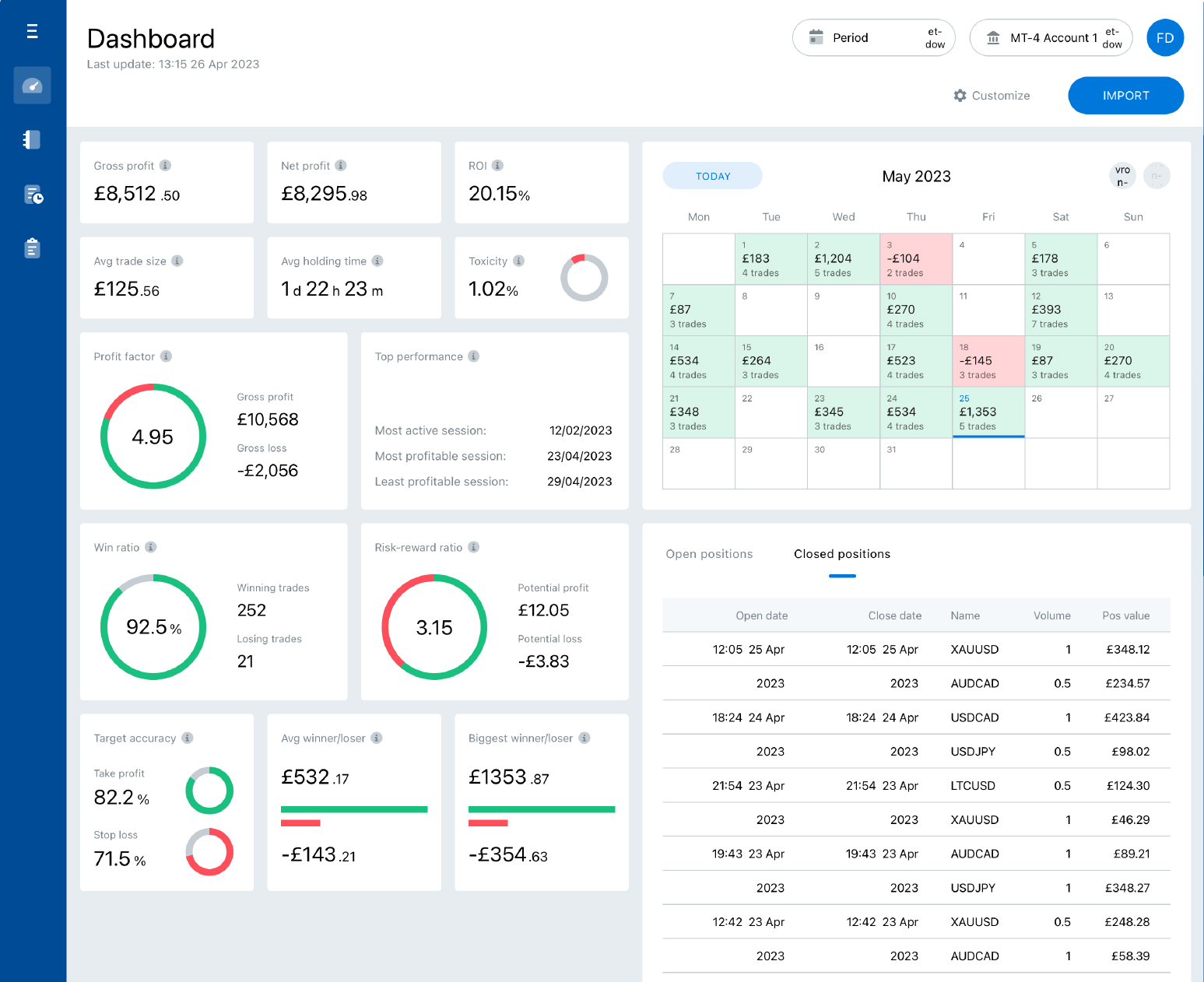

Tradelytic combines a traditional investment journal with an automated tool for identifying investment formations. The technological solutions used within the platform also have elements of a social platform. Users can share their strategies, thoughts, and results with others via “Share a Trade” update.

Inside the platform are features for automatic transaction importing and advanced filtering tools. Upon logging in, users can add their trading accounts from MetaTrader 4. Providing login details will automatically transfer all historically executed transactions and will allow for the addition of further information in the trading journal.

Other features include automatic price tracking, interactive charts, customizable templates, multi-currency support, and the ability to track commissions and fees charged by brokers.

"We wanted to create a platform backed by powerful technology intertwined with a journal to help foster a more robust mindset for traders whilst simultaneously working to shift the narrative surrounding the profession," Gregory added.

Why You Should Keep a Trading Journal

Keeping a trading journal is one of the essentials for any trader looking to improve their results. Here are some key reasons why maintaining a detailed log of your trades can help you become a more disciplined, consistent, and ultimately profitable trader:

- Track your progress: a trading journal allows you to easily track your progress over time. By recording details like profit/loss per trade, win rate, risk/reward ratio, etc. you can measure your performance and see how you are improving.

- Enforce discipline: writing down a trade plan for each trade makes you carefully think through your reasoning and strategy. This helps resist the urge to make impulsive, emotional trades.

- Learn from mistakes: looking back through your detailed trade log allows you to evaluate both wins and losses. You can assess what went right or wrong and avoid repeating mistakes.

- Test and refine strategies: recording extensive trade details provides important data you can analyze to determine if your trading strategies are working.

- Build confidence: seeing the number of winning trades accumulate in your journal provides tangible evidence of your ability. This boosts your confidence in your skills.

In summary, consistently maintaining a detailed trading journal leads to better trade planning, stronger discipline, improved mindset, effective strategy analysis, and greater confidence.