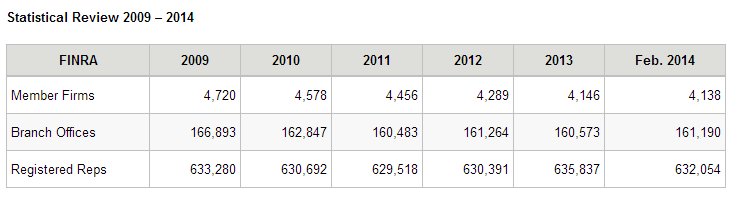

The not-for-profit Financial Industry Regulatory Authority (FINRA), who oversees some 4,135 of its member firms representing over 150,000 registered representatives, and a total of 532,054 brokers, has today announced an investor alert to the public at large within the U.S. and thus cautioning over 300 million Americans of the risk of bitcoin investments.

As numerous regulatory authorities, central banks and other authoritative organizations have recently announced their stance on Bitcoin, including its legality or lack thereof within their respective jurisdictions, as well as various warnings concerning the risks of digital currencies, FINRA is the latest to make such an announcement.

The independent non-governmental agency today issued a new investor alert called “Bitcoin: More than a Bit Risky” with the “Bit” reference appearing as a pun intended, as the agency emphasized the risks that trading bitcoins poses to investors.

The allure of digital currencies has also lured victims into traps as fraudsters look for the next best thing to exploit using bitcoin as their latest vehicle.

Bitcoin Platforms under the Alert

In the alert, FINRA said that in addition to the speculative risks related to price volatility, there is also the risk of fraud related to firms claiming to offer bitcoin payment platforms and other bitcoin-related products and services.

Despite the risks, as the interest in digital currencies has skyrocketed evident by the widespread media attention on related developments, several foreign exchange online brokerages have launched related products to capture this building wave of cyrpto -currency enthusiasm.

FINRA's Investor Alert was described by the regulator as having been added to a growing chorus of Bitcoin-related warnings from other regulators, and how the threat of Bitcoin-related fraud is a real danger for investors looking to make a quick profit from Bitcoin.

For example, on February 19, 2014, the SEC suspended trading in the securities of Imogo Mobile Technologies Corp, which had announced testing of a new mobile platform for Bitcoin a few weeks earlier, as per the press release.

FINRA Regulatory Actions Declining Alongside Membership Totals

The regulator has seen a decline in the number of its regulated members as fierce competition among participants have caused an exit for some brokers not able to handle the pressure including the costs of doings business in the U.S.

Last year, via its 3,400 employees dedicated to market integrity and investor education, and from 20 offices across the U.S., FINRA referred 660 fraud cases for prosecution, and $74.5M in fines and restitution were levied against fraudulent traders in 2013.

The regulor also launched a data analysis tool, and the agency monitors some 6 billion share trades every day, as per data listed on its website.

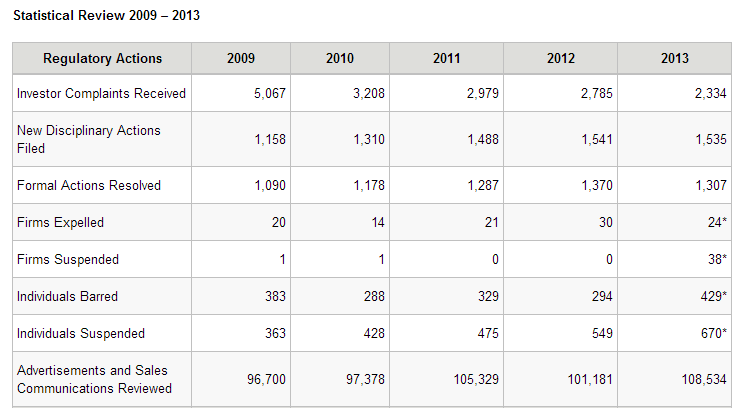

In addition, after the wave of regulation that blanketed Wall Street firms following Dodd-Frank, meeting regulatory obligations and capital requirements have been too big a compliance challenge for some regulated broker-dealers. The above chart shows the numbers, including regulatory actions that FINRA took against some of its member for related member violations.

This trend has also been seen to a much larger degree in the realm of retail foreign exchange which has seen the number of retail foreign exchange dealers squeezed in the last few years, with the NFA recently looking to rid its Forex dedicated board seat, as FX is thought to be less relevant to the regulator - after regulations had driven out nearly a dozen brokers.

Gerri Walsh, FINRA's Senior Vice President for Investor Education, commented in the official press release, "Speculators drawn to Bitcoin trading should understand that Bitcoin prices have fluctuated widely, and wildly, almost from the currency's inception."

Gerri Walsh, FINRA's Senior Vice President for Investor Education

Ms. Walsh added regarding the advent of fraud, "Investors looking to get in on the ground floor of a Bitcoin-related company should realize that fraudsters may see the latest digital currency trend as a chance to steal their money through old-fashioned fraud."

In addition to a warning, FINRA published a more detailed review of Bitcoin and discussed many of the risks associated with buying and selling Bitcoin.

As recent events make clear, "Platforms that buy and sell bitcoins can be hacked, and some have failed", the press release read, indirectly citing the demise of Mt.Gox, which has recently filed for bankruptcy protection in Japan.

In addition FINRA added how unlike U.S. banks and credit unions that provide certain guarantees of safety to depositors, there are no such safeguards provided to bitcoins residing in so-called "digital wallets."

Bitcoin Risks Highlighted in Detail by FINRA

Some of the risks of Bitcoin included in the udpate from FINRA today, were listed as follows in the official press release:

- Digital currency such as Bitcoin is not legal tender. No law requires companies or individuals to accept bitcoins as a form of payment. Instead, Bitcoin use is limited to businesses and individuals that are willing to accept bitcoins. If no one accepts bitcoins, bitcoins will become worthless.

- Platforms that buy and sell bitcoins can be hacked, and some have failed. In addition, like the platforms themselves, digital wallets can be hacked. As a result, consumers can—and have—lost money.

- Bitcoin transactions can be subject to fraud and theft. For example, a fraudster could pose as a Bitcoin exchange, Bitcoin intermediary or trader in an effort to lure you to send money, which is then stolen.

- Unlike US banks and credit unions that provide certain guarantees of safety to depositors, there are no such safeguards provided to digital wallets.

- Bitcoin Payments are irreversible. Once you complete a transaction, it cannot be reversed. Purchases can be refunded, but that depends solely on the willingness of the establishment to do so.

- In part because of the anonymity Bitcoin offers, it has been used in illegal activity, including drug dealing, money laundering and other forms of illegal commerce. Abuses could impact consumers and speculators; for instance, law enforcement agencies could shut down or restrict the use of platforms and exchanges, limiting or shutting off the ability to use or trade bitcoins.

There are a number of exam priorities that FINRA said it had in the beginning of the year for 2014, including enhancing suitability determinations that firms make, with guidance provided in regulatory notice 13-31.

In addition, FINRA added that some of its other exam priorities included reviewing Cyber Security to help ensure that firm's policies and procedures and the security of their infrastructure will suffice to protect sensitive customer data against hackers and any resulting cybertheft or unauthorized access.

Other priorities included AML and Best-execution, Algo & HFT and Trading Programs, as well as recidivist brokers who follow a pattern of complaints or sale practices abuses - in order to swiftly investigate against them.