The Cyprus Securities and Exchange Commission (CySEC) has officially withdrawn the investment license of FIBO Markets Ltd, finalizing a process the forex broker initiated late last year.

CySEC announced the decision was made during its Aug. 25 meeting, formally revoking the company's Cyprus Investment Firm (CIF) authorization number 118/10. The regulator cited FIBO Markets' express renunciation of its license as the reason for the withdrawal.

FIBO Markets Loses Cyprus License

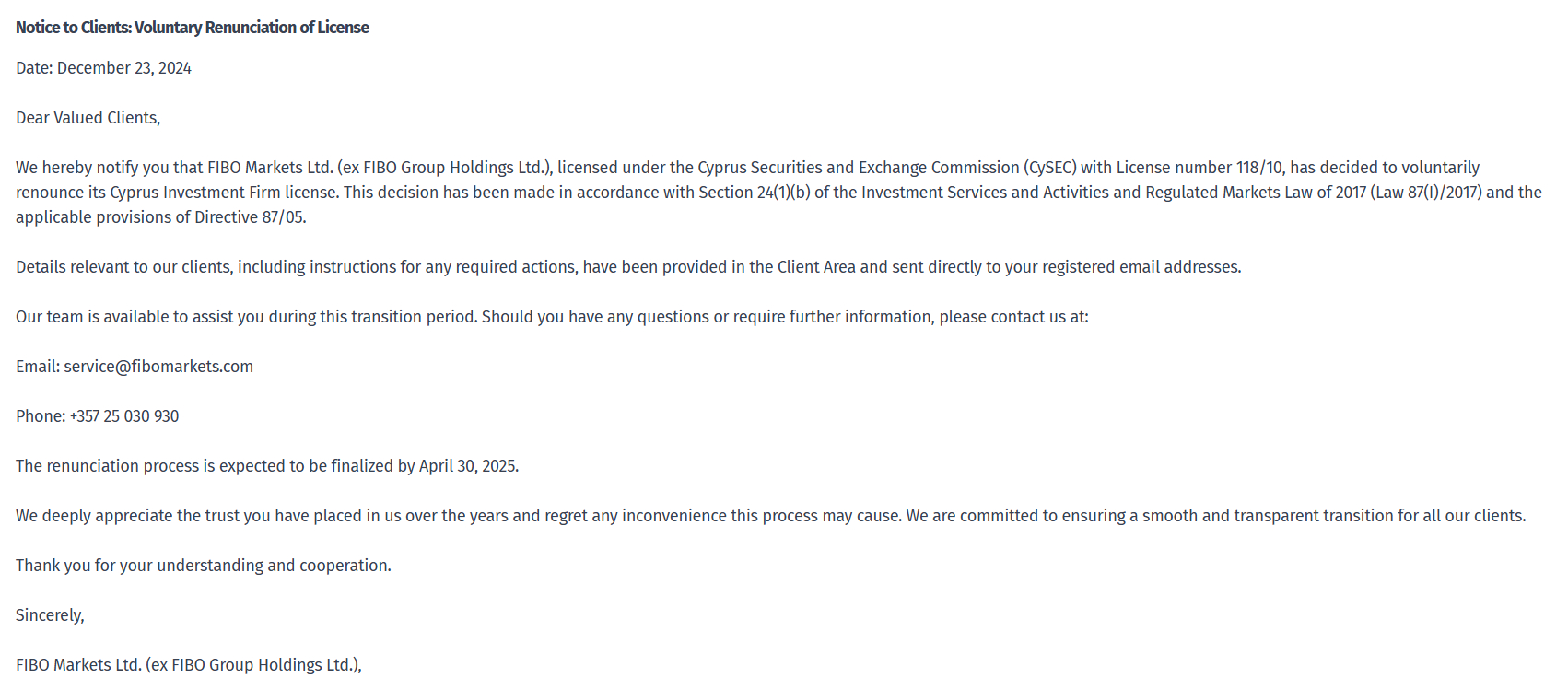

The move caps a months-long wind-down process that began in December 2024, when Fibo Markets Ltd (ex FIBO Group Holdings Ltd), told clients it would voluntarily surrender its CySEC license. At the time, the company said it expected the renunciation process to wrap up by April 30, 2025.

“We deeply appreciate the trust you have placed in us over the years and regret any inconvenience this process may cause. We are committed to ensuring a smooth and transparent transition for all our clients,” the company commented back in December.

FinanceMagnates.com reached out to company representatives for comment, but no response had been received at the time of publication.

While the FiboMarkets.com website now states that the license has been surrendered, the FIBOGroup.com website remains active, and the company is regulated by the Financial Services Commission (FSC) in the British Virgin Islands (license number SIBA/L/13/1063).

CySEC Takes Broader Regulatory Action

The FIBO Markets license withdrawal comes alongside broader enforcement activity by CySEC. The regulator announced today (Thursday) that four other investment firms have lost their authorizations and been removed from the Investors Compensation Fund.

CySEC withdrew licenses from Oasis Wealth Management Ltd, The Alternative GMI Ltd, Itrade Global (CY) Ltd, and Viverno Markets Ltd. The regulator simultaneously removed these companies from the ICF membership roster, though existing client compensation rights remain protected for past investments.

It is worth noting, however, that these are purely technical moves stemming from the earlier withdrawal of licenses from the mentioned entities. For example, in the case of Viverno Markets, a B2B unit of BDSwiss, authorization was revoked in May after the company had not provided services for more than six months.

The other three firms, including Itrade Global, which operates the Tradewell and TradeFW brands, had given up their licenses some time ago, as had FIBO.