As our regular readers will know, scammers are everywhere. Some are sophisticated, some are not. But in all the many stories of delinquency, degeneracy and dastardliness that Finance Magnates has covered, you'll struggle to find a stranger story than this.

At the beginning of January, Finance Magnates reported on the Austrian Financial Market Authority’s (AFMA) advice not to trade with Ortner Marcus, a trading firm purportedly operating out of Vienna and London.

The firm, which claimed that it was investing in currencies, digital assets, Equities , and green bonds, also said that it was regulated by the Financial Conduct Authority (FCA) ).

There was nothing unusual in all of this. Websites belonging to fraudsters, which claim they are regulated and offer dubious investment products, pop up every day.

Ortner Marcus turned out to be quite different from most of these other firms. That’s because the company actually has a page on the FCA’s website.

Again, this is not unheard of. Scammers occasionally create ‘clone’ websites designed to mimic a legitimate firm and use its FCA license number to give themselves an air of legitimacy.

But in the case of Ortner Marcus, the FCA page belonging to the firm is bizarre.

Taste the Caribbean!

Most FCA licensed businesses have a Companies House number attached to them. That number is listed on their page on the regulator’s website. For those unfamiliar with the organisation, Companies House is a directory of all businesses registered in the UK.

A screenshot from the Ortner Marcus website. The text states the FCA number and links directly to the Ortner Marcus page on the regulator's website

For Ortner Marcus, the Companies House number listed on the firm’s FCA page links only to a now-defunct restaurant or food supplier called Taste The Caribbean.

Companies House describes the firm as providing “food services.” Based in the northern English city of Newcastle when it was operational, the company shut down in mid-2013.

The ghost firm

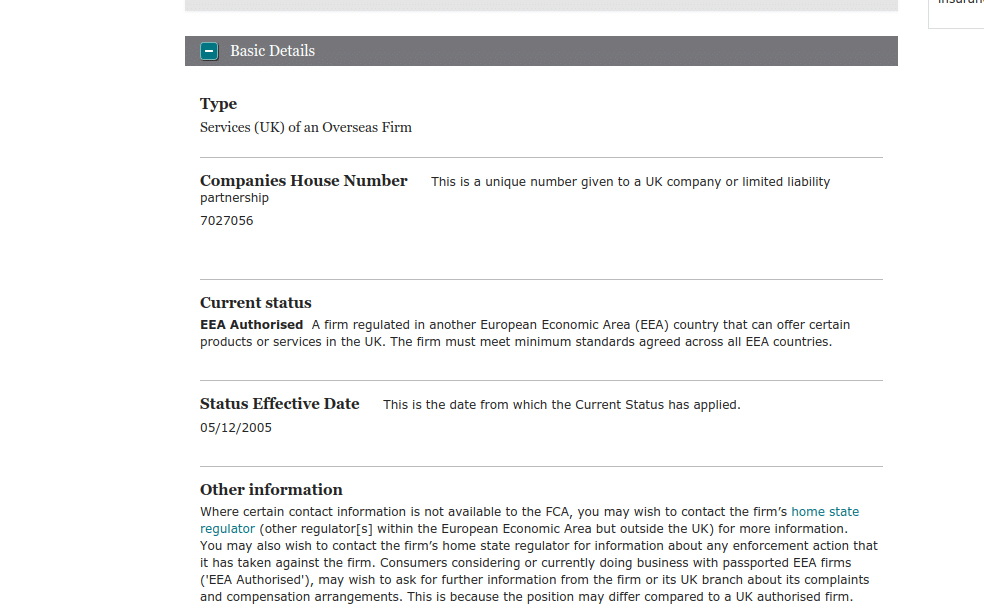

Aside from the peculiar Companies House connection, the FCA page also states that the firm was regulated by the Bundesministerium Für Wirtschaft Und Arbeit. This was an Austrian regulator that, after merging with two other government agencies, ceased to exist in 2008.

According to the FCA, Ortner Marcus has been passporting into the UK since 2005. The AFMA, however, has no firm of that name listed on its companies database.

A screenshot of Ortner Marcus' details on the FCA website. The image was captured on 31/01/2019.

Speaking to Finance Magnates, an AFMA spokesperson said that Ortner Marcus could have registered itself as an insurance distributor. If that is the case, the firm wouldn’t need its approval and thus wouldn’t be on its database.

The problem here is that Austrian authorities also keep a list of registered businesses - both active and dissolved. There is no company called Ortner Marcus in that database.

Just to be on the safe side, we checked the German database of regulated firms. Again, no firm called Ortner Marcus cropped up.

Doing some old fashioned research by browsing through Google, this author couldn’t find a single firm anywhere in the world, named Ortner Marcus, that focuses on the financial services industry.

No response from the regulator

Finance Magnates reached out repeatedly to the FCA to determine why Ortner Marcus was connected to a Caribbean restaurant and who the firm was actually regulated by.

Despite repeated follow-ups by the author, and several assurances that an answer would be provided to us, at the time of publication, no answer was forthcoming.

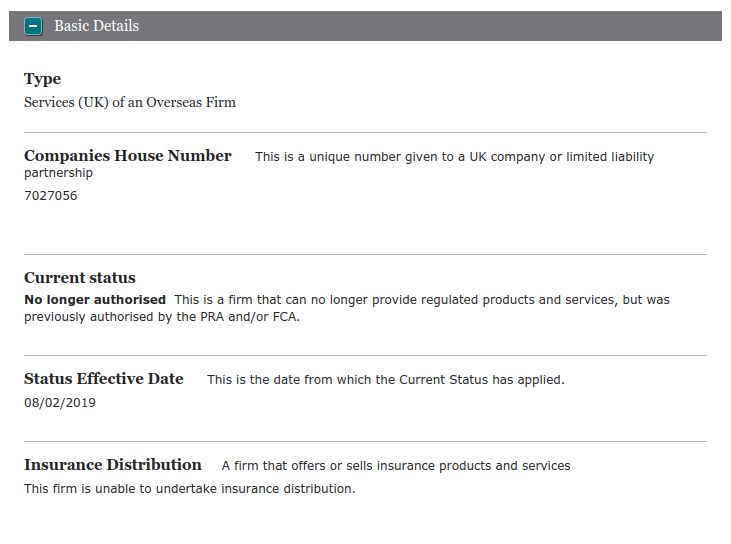

A screenshot taken from the Ortner Marcus web-page on the FCA website on 13/02/18. Note that the details have been changed but the bogus Companies House number remains.

It appears that the FCA wasn’t ignoring us entirely, however, as the Ortner Marcus web-page was edited just three days after we had followed up with them for the third time.

The FCA now states that the company is not permitted to carry out activities in the UK and there is no reference to it being authorised to operate in the European Economic Area. A date on the website indicates that the change was made on the eighth of February.

...And no help from RBS

The change may now have been made but, for some, it’s too little, too late. A victim of the Ortner Marcus scammers told Finance Magnates that he had been complaining to the FCA for three months with no results.

The same victim also said that their initial skepticism about the investment was eased by the fact that the regulator had seemingly given the firm its thumbs up.

Despite the edits to the web-page, the FCA still has some questions to answer. For instance, why is a Caribbean "food services" company still linked to a firm that allegedly provides financial services? More importantly, how did this company get on the FCA’s website and who even gave it a regulatory license in the first place?

The victim of the scam that Finance Magnates spoke to was also able to pass on the bank details of the fraudsters.

Amazingly, and assuming the sort code is real, the fraudsters are using a Royal Bank of Scotland (RBS) business account.

Just as the FCA had refused to help the fraud victim, so too had RBS ignored him for several months.

Finance Magnates reached out to RBS to see if the victim’s claims were legitimate and determine if it was possible to find the fraudsters. At the time of publication, no reply was forthcoming. Importantly, we were not asking the bank if they could pass on private details to us but only if they, in theory, could identify who held the Ortner Marcus account.

This sort of behavior would be somewhat excusable if, as many scammers do, the fraudsters were using several shell companies and were near-impossible to track down.

But in this instance, it should be incredibly easy for RBS to determine who the scammers are.

According to RBS' own website, in order to open a business account with the bank, a customer needs to provide their name, address and, in most cases, a Companies House number.

Ortner Marcus at Companies House

There is one firm called Ortner Marcus registered with Companies House. According to filings posted on the database, the firm, which provides marketing services, was launched in October of 2018 - just two weeks after the ortnermarcus.com domain was registered.

In December of last year, an ortnermarcus.co.uk domain was registered which, given that its contact information matches with data on the Companies House page, almost certainly represents the firm registered with the database.

It may just be a coincidence that this firm has the same name as the scam firm and was founded around the same that the fraudsters started operating.

Of course, determining whether that is the case would be made much easier by a joint effort from the FCA and RBS. Until the bank and regulator decide to do some investigating of their own, we’re unlikely to know what is really going on.

In the meantime, the Ortner Marcus scam website is no longer directly accessible and its phone line has been disconnected. That means we’re unlikely to see any more retail traders fall prey to the crooks running the site but, if the regulator had done its job, that might have never happened in the first place.