The United Kingdom's Financial Conduct Authority (FCA) announced today it has fined State Street UK, the brand operated under State Street Bank Europe Limited and State Street Global Markets International Limited, a total of £22,885,000 in connection with overcharging six of its clients between June 2010 and September 2011. The transactions involved mostly securities and included Forex Exchange and futures, among other investments carried out in State Street UK's Transition Management (TM) business line, which had helped with the transition and restructure of large portfolios of certain clients, according to the description in the official announcement posted by the FCA. According to a transcript of the FCA filed action, which brings along with it the hefty £23 million fine, the actions described were considered to be construed as misconduct as the fees charged were higher than what clients had already pre-agreed to, in relation to certain investments that State Street UK's TM business had been transacting for the six clients referenced in the document. In addition, the FCA noted that certain staff and management had deliberately tried to conceal the overcharging as markups hidden in spreads, among other examples described in the case brought by the U.K. regulator. The firm's clients in the UK were said to include large investment management firms and pension funds holding the funds and savings of retail investors, and the failings were self-reported by State Street UK after it came to the attention of the firm's senior management. Six Clients Affected, Yet Overcharging Totaled Nearly a 1/4 of Total Revenue While only six clients were said to be affected, the combined fees and charges levied through undisclosed commissions and hidden markups totaled $20,169,603, and the complaint summary said that the firm had deliberately provided false information to these clients despite holding itself out to certain clients as complying with the T-Charter rules. A statement was announced today by State Street UK's parent company, State Street Global Markets (SSGM), one of the largest custodians in the U.S and operator of the popular Currenex Platform business for Forex, which said it has since rectified the errors and had let go of staff involved in the misconduct, among other items noted in the statement (an excerpt of which can be seen below). State Street UK had already agreed to settle at an early stage of the FCA’s investigation and had therefore qualified for a 30% discount and saved nearly £10 million by doing so, a given choice considering that it had self-reported the series of incidents as noted above. The applicable rules pertaining to all FCA member firms found in the FCA handbook, was updated yesterday with several changes that go into effect today, as seen in the excerpt from the FCA update below:

![FCA handbook updates [source: FCA]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/01/FCA-handbook.jpg)

FCA handbook updates [source: FCA]

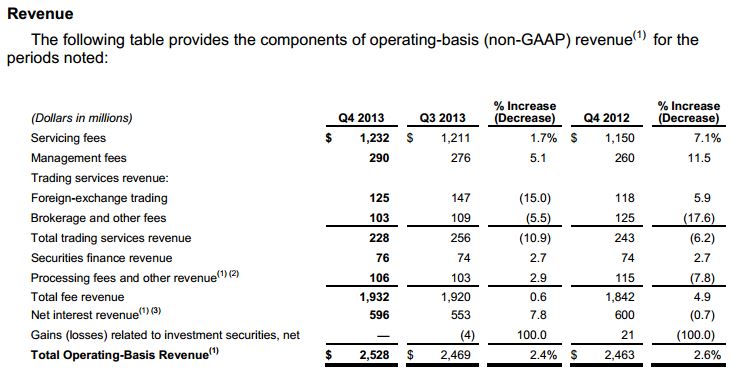

State Street Global Markets FX Volumes Take a Dip in Q4 2013 In the financial results just reported last week by State Street for Q4 and full-year 2013 figures, Foreign Exchange volumes dipped in the fourth quarter of 2013 when compared to the same period in the prior year (Year-over-Year). Moreover, Foreign-exchange trading revenue also dropped to the tune of 15.0% from the third (prior) quarter of 2013, primarily blamed due to lower volatility in Q4 when compared to Q3 Volatility in FX markets, as described in its press release dated January 24th, 2014. From a year-over-year perspective, fourth quarter foreign exchange trading revenues in 2013 were up 5.9% when compared same period in the prior year, and attributed to higher volumes and volatility during that period, whereas brokerage and other fees decreased 5.5% from the third quarter of 2013 to $103 million, primarily due to lower transition management revenue. Looking back at revenues cited during the relevant period of the FCA complaint announced today, total revenues during the relevant period (during the investigation) derived by State Street UK from the TM business was $77,904,287, and therefore the revenue from overcharging as noted above and which was determined "illegitimate" (revenue) in the FCA complaint represents nearly a 1/4 of total revenue from the TM business (during that period). Cooperation Discounts Fine by 30%, State Street Says it Emerged Stronger Considering that the group has just reported nearly $10 billion in revenues for 2013, it's not clear how much the fine will impact its metrics materially or not. Forex Magnates' reporters spoke to a member of State Street's press office, who was unable to provide further comment in addition to the statement already released, and the available metrics on its website. However, the matter was noted as being that of a historical one, and thus a matter the company clearly hopes to put behind them.

Excerpt of SSGM 2013 Q4 Reported Financials

Looking at such metrics, SSGM highlighted that its new asset servicing mandatesduring the fourth quarter of 2013 had totaled $392 billion and net new assets to be managed were $5 billion, thus indicating that in the scope of the fine of its subsidiary it may only represent a small fraction of its overall business - historically speaking, when looking at assets under management (AuM) of which the firm has some $2.3 trillion, along with $27.4 trillion in custody. Apparently, the size of the fine was determined in relation to revenues earned as a result of the overcharging, based on the program the FCA has in place for calculating such fines and encourages cooperation from firms under investigation, such as that of prior FCA cases reported by Forex Magnates concerning AML. The complaint also noted that during the relevant time State Street UK's TM had a large market share of the TM business segment and how the lack of competition could have driven the overcharging, while the misconduct at play has since been dealt with swiftly following State Street self-reporting the matter to the regulator in 2011. State Street Issues Statement on FCA Enforcement Notice State Street had self-reported the event to the regulator, as described in the statement it issued today regarding the FCA enforcement notice, and as can be seen in an excerpt of the full statement, provide below: Today brings a conclusion to FCA’s inquiry into the overcharging of six EMEA-based transition management clients in 2010 and 2011 that we self-reported in 2011. We deeply regret this matter. Over the past several years, we have worked hard to enhance our controls to address this unacceptable situation.

The FCA in its notice is critical of our business controls within the UK transition management business and our control functions in the UK at that time. We acknowledge these as historical problems and have undertaken extensive efforts to address both, including strengthening the controls, procedures and governance within our UK transition management business. In 2011, we dismissed individuals centrally involved in the overcharging of transition management clients. Their behavior was unacceptable and a significant departure from the high standards of conduct and transparency that we expect and certainly not consistent with the manner in which our employees act on behalf of clients every day. Also in 2011, we notified all transition management clients about the overcharging, only six of whom were directly affected. We continue to have an open and transparent dialogue with our transition management clients to ensure they are aware of the actions we have taken over the past several years to strengthen our controls. We believe we now have industry leading controls within our transition management business and have bolstered our control functions in the UK, broadening the depth of talent that oversees our businesses. [...] A full copy of the State Street Statement was published on the homepage of their corporate website, and a copy of the FCA complaint is also available on the regulator's main page. Complaint by FCA Cited Internal Communications Linking the Misconduct While the FCA is not a price regulator, the actions surrounding the amount of the fees charged were considered to be construed as misconduct as the amounts charged were higher than what clients had already agreed to in writing, in addition to efforts noted as deliberate to conceal hidden charges . Although the findings were initially self-reported by State Street UK, this was only in response to the matter being brought to light by a customer complaint - which eventually reached senior management and prompted the firm to take action and bring the attention to the FCA. As an example, according to an excerpt of the complaint filed by the FCA dated January 31, 2014, certain markups were added to the spread and not visible initially on the trade analysis report, and while this was noted as having been done deliberately, a client was later told, “Our trading desk in the US has erroneously applied commissions of 1 bp of yield to trades that should have gone through at zero commission.” Commenting in the official press release from the FCA, Tracey McDermott, Director of Enforcement and Financial Crime, said:

Tracey McDermott, Director of Enforcement and Financial Crime at FCA and Executive FCA Board Member

“The findings we publish today are another example of a firm that has acted with complete disregard for the interests of its customers. State Street UK allowed a culture to develop in the UK TM business which prioritised revenue generation over the interests of its customers. State Street UK’s significant failings in culture and controls allowed deliberate overcharging to take place and to continue undetected. Their conduct has fallen far short of our expectations. Firms should be in no doubt that the spotlight will remain on wholesale conduct.” FCA Speaks Out on Severity of Findings, Measures Implemented Already The FCA said that State Street UK’s Transitions Management (TM) business had developed and executed a deliberate strategy to charge clients substantial markups on certain transitions in addition to the agreed management fee or commission, and these markups had not been agreed upon by the clients and were concealed from them. The systemic weaknesses in State Street UK’s business practices and control environment around the UK TM business were so serious that the overcharging only came to light after a client notified staff that it had identified markups on certain trades that had not been agreed upon. Those responsible then incorrectly claimed both to the client and later to State Street UK’s compliance department that the charging was an inadvertent error, and arranged for a substantial rebate to be paid on that false basis. They deliberately failed to disclose the existence of further markups on other trades conducted as part of the same transition. The FCA views State Street UK’s failings to be at the most serious end of the spectrum, as noted in the regualtor's press release. State Street UK acted as an agent to its TM clients and held itself out as being a trusted advisor. Accordingly, it breached a position of trust. Furthermore, the overcharging accounted for over a quarter of its TM revenue, said the FCA. When the failings were uncovered, State Street UK was found to have breached three of the FCA’s Principles of Business, described by the FCA in the press release including: "It failed to treat its customers fairly; it failed to communicate with clients in a way that was clear, fair and not misleading; and it failed to take reasonable care to organise and control its affairs responsibly, with adequate risk systems." The FCA noted that once State Street UK's senior management became aware of the issue State Street UK took action to investigate the misconduct and to implement a comprehensive programme to improve the UK TM business controls and bolster control functions, governance and culture across its UK businesses. State Street recently received its Swap Dealer registration in December with the CFTC, as it prepares to build out that business line and following its joining of SwapClear, as reported by Forex Magnates. Shares of State Street (STT) on the NYSE traded down 1.89% today, around the time of publication by Forex Magnates.