As the approach to financial markets regulation in Indonesia had been in question with regards to recent Forex efforts, its central bank, Bank Indonesia, has handed over certain market-regulating and supervisory powers to its financial services authority OJK (Otoritas Jasa Keuangan) according to the latest press release from the two governing bodyies.

According to the joint announcement from Bank Indonesia, the Central Bank in charge of governing its country's financial markets regulatory matters, in addition to its monetary authority obligations, the change in its power was made by transferring certain functions of bank supervision to the OJK on December 31, 2013.

Twin Peak Regulatory Structure Strengthened

The jointly issued statement made on New Year's Eve, said how the signing of a record of transfer (BAST-Berita Acara Serah Terima) on the function of Banks' supervision and regulation from Bank Indonesia to OJK - was signed directly by the Governor of Bank Indonesia, Agus D.W. Martowardojo, and the Chairman of Board of Commissioners of OJK, Muliaman D. Hadad.

Bank Indonesia said it would handover the Book of Bank Indonesia Function Implementation Report in the Sector of Regulation, Licensing and Supervision of Banks as an overview of the implementation of the function and supervision duties of banks by the central bank to date.

As of the date of the deal, December 31, 2013, micro-prudential supervision to individual banks shall be conducted by OJK, whereas Bank Indonesia said it would retain the conduction of its macro-prudential functions, in coordination with OJK.

Transfer Authorized Under 2011 Act 21, Effective Dec 31, 2013

The new authority was bestowed to OJK in accordance with Act 21 of 2011 and made , effective as of 31 December, 2013 based on the above-mentioned signing of BAST between Bank Indonesia and OJK.

Agus D.W. Martowardojo, Governor of Bank Indonesia

Commenting in the official press release, Agus D.W. Martowardojo, the Governor of Bank Indonesia, said that Bank Indonesia is transferring the function of banking supervision to OJK in a sound banking condition under the right regulation.

Mr. Martowardojo added,“In the future, Bank Indonesia and the Financial Service Authority will continue to work together so that the right balance related to the policy mix between macro- prudential and micro-prudential can be expected in order to maintain financial system stability.”

Various Staff Transferred to OJK from Bank Indonesia

The transfer of the banking supervision and regulation to OJK - had gone through a year long process, as per the press release which noted the forming of a OJK Task Force Team in Bank Indonesia, and a Banks’ Supervision Function Transfer Transition Team in OJK as of the beginning of 2013.

The press release said both teams had excellent cooperation with its human resources transitions as well as the transfer of documents, data, and information systems, as well as the utilization of Bank Indonesia buildings as OJK offices are shared both by the Head Office and regional locations.

Muliaman D. Hadad, Chairman and Board of Commissioners of OJK

OJK Chairman and Board of Commissioners, Muliaman D. Hadad, commenting in the jointly issued announcement regarding the ease of the transition said, “With the smooth operations in the process of transferring banks’ supervision and regulation function from Bank Indonesia to OJK, banks’ business processes are still running as they should and the public especially customers can make banking transaction activities as when the supervision was still conducted by Bank Indonesia.”

With YoY CPI Inflation at 8.38% in December, Target of Stability is the Goal

Mr. Hadad concluded, “Through this transfer of function of banks’ supervision and regulation to OJK, it is to be expected that in the future supervisory function toward financial institutions is conducted in a more integrated manner in order to support the creation of a more stable and solid financial system,” added Muliaman.

With nearly $100 billion in reserves (M1 money) at the end of November 2013, and its central bank BI rate at 7.5%, with an inflation target of 4.5% as of 2013, the nation's currency - the IDR - has steadily depreciated to 12,226 IDR per USD, up from 9,760 last May (for the USD/IDR pair), and just back up above 2009 levels.

![USD/IDR 5 YEAR [Source: Yahoo Finance]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/01/USDIDR-5-YEAR.jpg)

USD/IDR 5 YEAR [Source: Yahoo Finance]

Although inflation during that time has been steadily lowered (and far below the start of the last decade), it still remains a concern. Inflation targets established by the Government for 2013, 2014 and 2015 are 4.5%, 4.5% and 4%, respectively and with ±1% margin of error, according to the central bank's website.

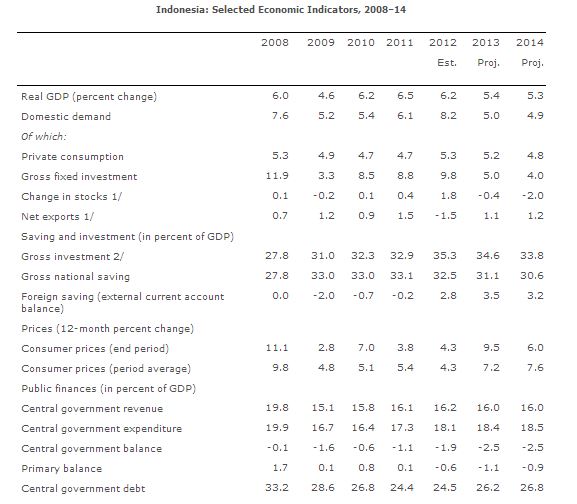

Stabilizing Economic Indicators but 2014 Could be Rocky

Unemployment was reported near 6% in August 2013, according to data updated as of January 2, 2014 on the Central Bank's website. GDP is expected to inch up two-tenths of a percent from 5.3% in 2013 to 5.5% in 2014, according to the latest IMF projections, and inflation is expected to moderate in 2014, and the latest data by the central bank for December 2013 (released yesterday) showed that inflation was recorded at 0.55% (mtm), lower compared to its historical pattern in the last five years.

With emerging markets, such as Indonesia, more sensitive to global macro-economic events, Volatility in the Indonesian Rupiah could follow further tapering by the US Fed, and any cuts to other nations monetary easing programs in 2014.

Changes Underway In Indonesia, Still an Attractive Destination for Finance

According to a December 15th IMF Executive Board Conclusion for its 2013 Article IV Consultation with Indonesia, banks in its country were noted as remaining well capitalized and highly profitable, after having been supported in recent years by strong economic growth and wide interest margins. Asset quality was referenced as continuing to be strong, as reiterated by recent Fitch Ratings for the country. As per the IMF consultation, along with monetary policy actions, macro-prudential measures have been taken to slow credit growth, but loan-to-deposit ratios have continued to rise.

Sources: Data provided by the Indonesian authorities to IMF; and IMF staff estimates and projections.

The transition of bank supervision and regulation from Bank Indonesia to OJK - just concluded - was also noted as planned by the IMF. At the same time, gaps remain in the crisis management framework, which are expected to be filled by a financial sector safety net law when approved by parliament, as per the IMF consultation.

The announcements follow Forex Magnates' previously reported covering of the government operated website TRUST+ blocking over 100 Forex related websites in Indonesia, under the Ministry of Communications and Information of Republic of Indonesia and General Directorate of Telematics Applications.

Indonesia has been a country that many Forex Brokers maintain customers from, and an attractive target audience of traders/investors as it is the fourth most populous country according to 2013 rankings. However, it's unclear what the fate of FX will be for retail brokerages in the region, if further changes are underway as a result of the new regulatory shift of powers.