The Australian Securities and Investments Commission (ASIC) has today released its sixth market supervision report, highlighting specific areas of investigation and enforcement which the regulatory authority has concentrated its efforts on, and statistics relating to its activities and resolutions.

The Big Brother Effect

George Orwell envisaged a world in which automated surveillance would pervade every corner of daily life, and in today’s highly computer-reliant financial markets structures, such systems are beginning to make their presence felt.

ASIC has made a significant effort to switch toward automated surveillance in order to root out transgressors of its rules, using the First Derivatives Delta Stream system, which conducts real-time surveillance on OTC trading activities in Australia’s financial markets. This system will be fully implemented in the third quarter of this year.

In a wider scope, ASIC utilizes the SMARTS trade surveillance system, internally developed market monitoring tools, and information provided by the market and other ASIC stakeholder groups to identify possible market misconduct matters across all other financial markets businesses.

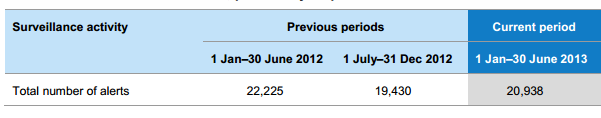

Trade surveillance alerts are indicators of unusual trading activity. During the reporting period, there were 20,938 alerts compared to 19,430 alerts generated during the previous reporting period.

The number of alerts has increased slightly from the previous period (1 July–31 December 2012), although it number remains within acceptable volume parameters and is not indicative of any significant changes to calibration.

The number of alerts is affected by factors including general market volatility, the level of corporate transactions and trading conditions generally. ASIC expects that its new enhanced market surveillance system will provide the further refinement and calibration of alerts, and lead to greater efficiencies.

Speaking on behalf of ASIC, Greg Yanco, senior executive leader of the market and participant supervision team, noted that through ongoing engagement with stakeholders, surveillance of markets and market participants, education and guidance, and enforcement activities, ASIC has been able to achieve rapid changes in the behaviour of market participants.

‘We encourage market participants and securities dealers to continue to work with us at an early stage to address any trading issues or concerns,’ Mr Yanco said.

In the next six months ASIC will focus on technology governance processes in participant firms to ensure appropriate diligence at all levels.

In total, the regulator has completed surveillance on 88 firms which conduct financial markets business during this period.

ASIC Cracks Down On Insider Trading

Insider trading has been a strong focus for ASIC during the relevant period. The regulator achieved five enforcement outcomes against individuals for insider trading activity. The report confirms that ASIC will continue to dedicate significant resources and energy to fighting this crime.

Shedding Light On Dark Pools

The findings of ASIC’s taskforces into the impact of dark Liquidity and high frequency trading on the quality and integrity of our financial markets were published in March 2013, and subsequently ASIC announced that it welcomed high frequency trading and the use of dark pools.

During this reporting period, ASIC implemented a number of important market integrity rules to address issues stemming from structural and behavioral changes in Australian financial markets over recent years, including increased automation and technological innovation.

The new rules led to changes in the behavior of market participants in some instances. For example, there has been a decline in the volume of dark liquidity as a result of the meaningful price improvement rule introduced in May 2013.

The Future – Client Money Protection

Looking ahead, ASIC has confirmed that there will be a heavy focus, particularly with the introduction of the new surveillance system, on participants’ contribution to high order-to-trade ratios, small and fleeting orders, and generally market noise generated by participants and/or their clients.

In the past, ASIC has adopted a facilitative approach to the implementation of key reforms. The regulator will continue to apply this approach to the implementation of new reforms, such as the Future of Financial Advice reforms.

However, once market participants and securities dealers have had sufficient time to familiarize themselves with new obligations, ASIC will take a more enforcement-oriented approach to breaches of the law.

For example, ASIC previously took a facilitative approach to client money handling obligations in order to improve industry standards in this area. The regulator is now taking a more enforcement-oriented approach toward penalizing market participants who fail to meet their client money handling obligations.

Speaking on behalf of ASIC, Greg Yanco, Senior Executive Leader of the Market and Participant Supervision Team, made a public statement that through ongoing engagement with stakeholders, surveillance of markets and market participants, education and guidance, and enforcement activities, ASIC has been able to achieve rapid changes in the behavior of market participants.

"We encourage market participants and securities dealers to continue to work with us at an early stage to address any trading issues or concerns" Mr. Yanco said.

In the next six months ASIC will focus on technology governance processes in participant firms to ensure appropriate diligence at all levels.

For a full and concise insight into the use of surveillance systems by regulators in the Asia-Pacific region, the Forex Magnates Quarterly Industry Report for Q2 of 2013 can be purchased here.

https://www.scribd.com/doc/161877609/Rep366-Published-21-August-2013