NinjaTrader Group, now owned by Kraken, has entered the prop trading business with the launch of two new platforms: NinjaTrader Prop and Tradovate Prop, giving prop traders a complete toolkit for every stage.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Two New Platforms for Prop Trading

The new prop-specific platforms extend NinjaTrader’s existing futures trading services.

Announced today (Wednesday), NinjaTrader Prop and Tradovate Prop have been launched under NT Technologies, an affiliate of NinjaTrader Group.

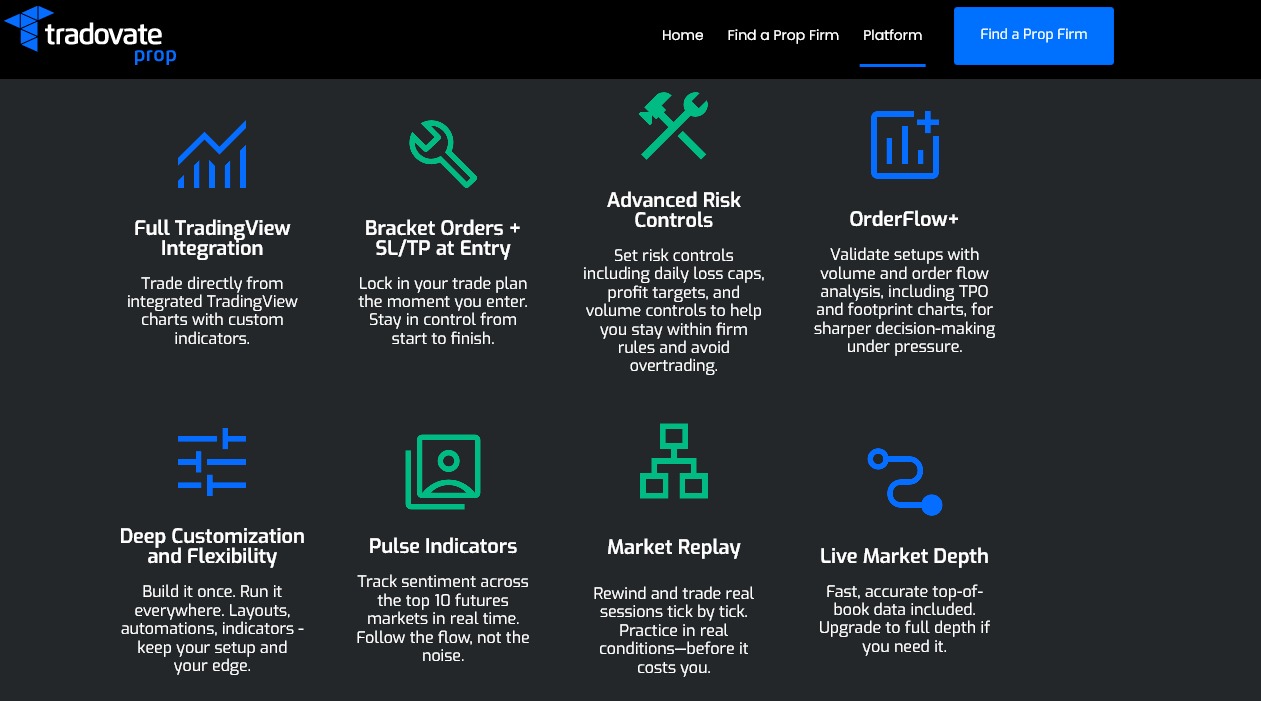

According to the company, the new platforms will support evaluations for funding. They will offer advanced risk controls and seamless integration with popular third-party platforms such as TradingView. They will also provide charting and order flow tools.

You may also like: Brokers Are Leaving MetaTrader Behind When Integrating TradingView

Furthermore, the new platforms will have cross-platform support, meaning they can be accessed from mobile, web, or desktop.

“We have always been committed to making professional-grade trading technology more accessible,” said Martin Franchi, CEO of NinjaTrader Group. “As prop trading continues to grow, NT Technologies meets prop traders and prop firms where they are, supporting both groups with purpose-built tools and reliable, institutional-grade technology.”

Already Attracting Prop Firm Interest

Several US-based prop firms, including Take Profit Trader, Apex Trader Funding, and MyFunded Futures, will be the first to adopt NinjaTrader’s two new platforms.

The launch comes as many prop firms are re-entering the US market after more than a year of disruption due to the MetaQuotes crackdown. While most firms, including The5ers, relaunched US services on non-MetaTrader platforms, FTMO became the only major prop firm to reintroduce MetaTrader in the US.

The US also remains one of the most important markets for prop firms.

“By investing in the technology and tools traders rely on, we’re giving them the confidence to scale faster, manage risk smarter, and grow without limits,” said John O’Neil, General Manager of NT Technologies.

FinanceMagnates.com earlier reported on Kraken’s acquisition of NinjaTrader for $1.5 billion, a deal closed last May. Kraken also recently acquired Breakout, a crypto-focused prop firm.

Read more about NinjaTrader: