The Financial Conduct Authority (FCA) is taking a novel approach to consumer education by premiering a cinema advertisement to raise awareness about the dangers of investment hype. The ad, which is part of the FCA's InvestSmart campaign, will be shown during the premium ‘Gold Spot’ just before the feature film ‘Dumb Money’, a cinematic take on the GameStop investment frenzy of early 2021.

FCA Debuts Unique Cinema Ad to Caution against Investment Hype

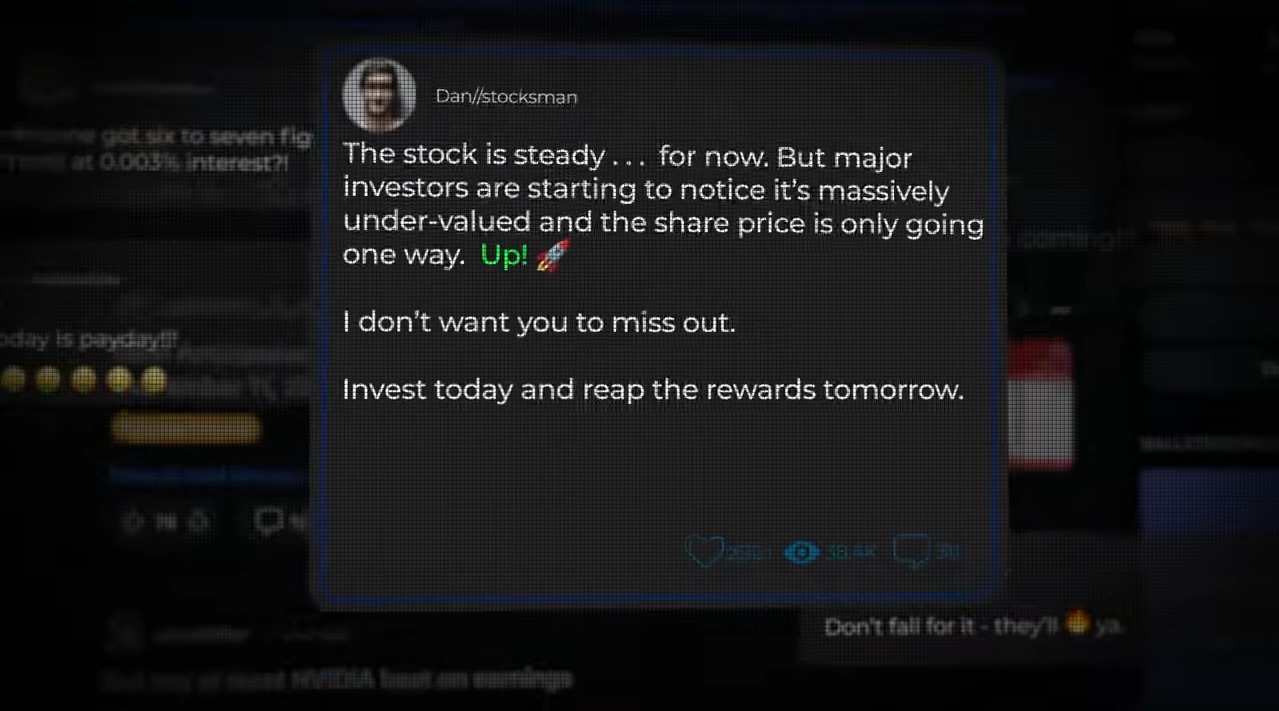

The FCA's cinema ad employs sensory techniques to captivate the audience, initially presenting what appears to be a "once-in-a-lifetime investment opportunity." As the ad unfolds, it becomes clear that the anonymous tipster offering this golden chance is merely typing in an online forum. The ad concludes with the FCA's cautionary message: "Don't Get Played."

GameStop is an American video game retailer. The publicly-listed company stocks saw a surge in trading app accounts in the UK, with over 1 million new accounts opened in the first few months of 2021, half of which were in January alone.

Digital screens in cinema lobbies and geo-targeted online display ads further amplify the campaign. These additional touchpoints remind cinema-goers before and after the film about the importance of diligent research before making any investment decisions.

The InvestSmart initiative aims to empower consumers to make investment choices that align with their financial situation and risk tolerance. Emma Stranack, the Head of Content and Channels at the FCA, claims that GameStop saga serves as a textbook case of speculative investment fueled by hype.

“This new film gives us the perfect opportunity to encourage less experienced investors to understand the risks, avoid hype and do the necessary research before they invest. This is the first time we’ve created a cinema advert tied-in with a specific film. The subject-matter is directly aligned to our target audience’s interests and the cinema provides a unique environment to capture their attention,” added Stranack.

You can watch the FCA's ad below:

From Regulating Ads to Making Them

The FCA released the advertisement warning about investment risks just days before new national regulations on cryptocurrency market advertising take effect.

The British government has recently passed laws to oversee the advertising of cryptoassets to the public. This initiative is designed to shield UK residents from entering high-risk investments without sufficient knowledge. The updated financial promotion framework will be applicable to all entities promoting cryptoassets in the UK, even those headquartered abroad.

As the deadline for the new rules takes shape, and given that crypto companies are grappling with 'significant challenges' in preparation for these rules, the FCA has issued a conclusive alert, which advises companies anticipating non-compliance with the new rules should promptly reevaluate their stance.

The FCA emphatically suggests that these companies consult legal experts to sidestep criminal liability and potential regulatory repercussions. The updated framework is not designed to limit consumer access to existing assets but rather to curb additional high-risk investment behavior.