Japanese financial regulators have been exercising their global strength in the world of currency trading, as their latest decree plans to forbid Australian financial services providers from dealing with Japanese resident clients.

Forex Magnates has learnt that the regulator is pushing brokers to abandon Japanese-based traders.

The latest act of bureaucracy impacting the world’s most liquid asset class is expected to cause mayhem to some of the largest players operating in Australia. Under the proposed terms, Australian brokers will be held responsible if they deal with and onboard Japanese clients, the United States currently enforces the same rules with international regulators.

The exact reason of the decree is unknown, however a large number of Japanese residents trade with Australian firms and the Japanese Financial Services Agency (JFSA) leveraged restrictions which were implemented in 2010 and 2011 are now being breached by residents trading with overseas firms.

Behind the Scenes

The ordeal recently took place mid Q1 of 2014, during this period the Japanese regulator sent a letter to an FX & CFD broker which requested the firm to stop dealing with Japanese residents. The unnamed broker’s lawyer replied back stating that the firm has not actively or directly solicited clients and these traders have chosen the said firm. The regulator consequently sent a follow-up email requesting the broker to remove Japan from its list of countries in the account opening form. Following this, the Australian Securities and Investments Commission (ASIC) contacted several firms about their dealings with international clients.

In another incident, an unnamed broker commented to Forex Magnates about a recent communication with the Australian watchdog, he explained: “ASIC said they are concerned about brokers misleading international clients ...and (they) require a disclaimer at the bottom of each page stating that non-Australian residents are not covered by ASIC.“

The JFSA’s actions were described to Forex Magnates by Japanese traders as showing how the regulatory organization is using its powers to clamp down on traders, who by their own free will and choice are optimizing the services offered by regulated brokerage firms.

JFSA’s Onslaught on FX

Japan along with the United States introduced a number of reforms after the formidable 2009 G20 meeting of world leaders which labelled OTC derivatives as a culprit behind the 2008 global recession. The financial watchdog tried to curb the over speculative nature of currency trading, a practice taken up by a large number of investors, including the infamous housewives or Mrs. Watanabes.

FX as an Asset Class

FX trading has grown substantially among retail investors since the turn of the century, primarily driven by financial freedom as investors look beyond traditional brokers who were under-delivering returns. In addition, the rise of the internet and access to information has been a pivotal driver of growth in the sector. A key advantage for traders when transacting in currency derivatives is the Leverage or gearing element, with a small amount of margin traders can open sizable positions which provide additional profit and loss opportunities from traditional cash instruments.

The restriction on leverage in Japan has been forcing traders to amend their trading strategies. “The new rules are a misuse of power," explained one Tokyo-based trader who commented on the basis of anonymity.

“We can't run certain strategies on the pitiful margin levels, the UK and Australia-based brokers are both regulated, but why are they allowed to offer greater leverage,” he added.

Japan, the world’s largest FX market, according to Forex Magnates' research, has a developed brokerage and investor trading environment. The market has evolved in line with technological advancements and traders have taken heed of the prominence of automated and algorithmic trading, where higher leverage is a must.

“A lot of the EAs (automated systems) run on Martingale or Anti- Martingale strategies, you need to build up your position using small orders. With low leverage you need a lot of cash? Why trade margin products if it beats the purpose,” explained Cecil Francis a Karachi-based technical trader.

Australia’s Stronger Regulation

Australia's financial regulator has recently embarked on a number of measures that aim to clean up the financial services sector. Particularly for margin derivatives brokers, a number of new initiatives included; minimum capital adequacy and rules about the use and management of client money have strengthened the broking environment.

Australian brokers have seen an influx of traders applying for both demo and live accounts since the last quarter of last year.

A major factor behind the rush in the number of Japanese traders migrating their accounts to Australia has been the high leverage, with some brokers offering up to 400:1 and the segregated accounts of client funds practice.

Japan Net Benefactor

The compulsion to trade with a Japanese regulated broker is a tactic to bring traders back home. Furthermore, brokers who are searching for new markets will look to target Japan due to the sheer size of the investor base.

Immediately after the regulator determined the leverage changes, the market contracted with a large number of providers closing down or being acquired. Client numbers and trading activity was directly affected with a considerable decline in volumes, however the last eighteen months have been a blessing in disguise for Japanese brokers as the recent turmoil in the Japanese yen has reignited the passion to trade and domestic traders have ramped up trading volumes, Japanese giants DMM and GMO Click both having posted plus $1 trillion in total monthly volumes.

A JFSA ASIC Collaboration?

Forex Magnates anticipates new rules to be deployed over the coming months by both regulators which will prevent Australian brokers from dealing with Japanese residents, similar to the steps taken by US regulators. The US’s commitment on safeguarding its flock took a new turn last Friday when the regulator received a legal injunction against Australian regulated, Halifax Investment Services.

Australian Brokers and Japan

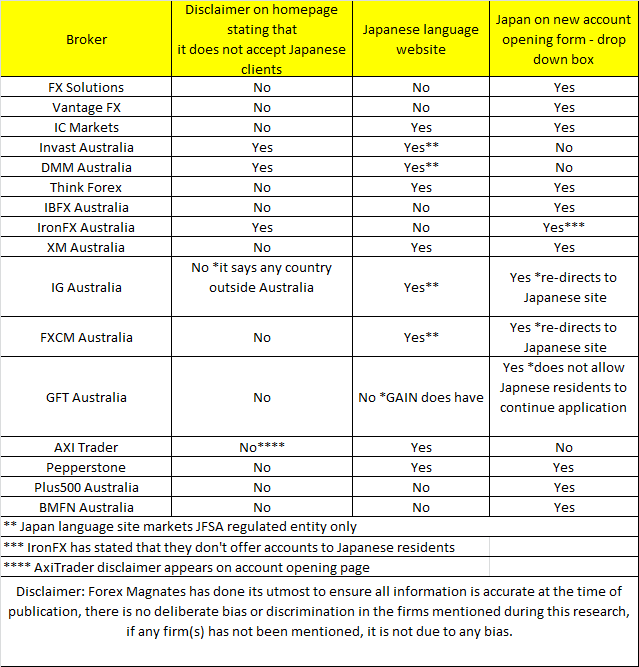

The following table gives a snapshot of how brokers are currently operating in Australia.

The first column specifically looks at the firm's homepage, most non-regulated US firms will have a disclaimer directly on the homepage which states that they do not accept US residents. Although AxiTrader does not have a disclaimer on its homepage it has a specific page on the new accounts page which states that it does not accept Japanese residents.

The data shows that tier-1 providers and recently established Japanese firms regulated in Australia are not dealing with Japanese clients in Australia but redirecting them to their Japanese subsidiaries.

However, of the tier-2 and tier-3 brokers, Cyprus-based IronFX, which holds an ASIC license, is quite an interesting case where the broker states on its homepage that it does not accept Japanese residents, however on its application form the country can be chosen, although there is a disclaimer which states that it does not offer any products to Japanese residents and users can not proceed on that particular page.

This is important because of the firms that state that they do not accept Japanese residents on the homepage, all have excluded the country from the account opening form, a notion the JFSA raised with one of the brokers they contacted, as stated above.

Brokers who do not allow Japanese traders have physically removed (Japan) the country from the list.

More to Come..

Cooperation between regulators is the new norm. The G20 leaders have had consequent meetings post 2009 with new laws and directives taking shape in the US and Europe. A document dated March 2014 which summarizes the G20’s developments on the supervision of OTC derivatives by the OTC Regulators Group (ODGR) stated an interesting development: “The G20 Leaders agreed, and the G20 Finance Ministers and Central Bank Governors later reaffirmed, that jurisdictions and regulators should be able to defer to each other when it is justified by the quality of their respective regulatory and enforcement regimes, based on similar outcomes, in a non-discriminatory way, paying due respect to home country regulatory regimes."

Scratch My Back I’ll Scratch Yours!

The true intent behind the new proposals is unclear, however it could be a case of both regulators joining forces to achieve their own objectives. On the one hand, Japan will benefit from repatriating client funds and potentially signing-up new registered brokers. On the other hand, Australia shows the world that it isn't a soft player and is serious in the way it deals with financial services.

The latter has its implications, if Sydney is keen to position itself as a regional global hub whilst competing with Hong Kong and Singapore then its needs to be more business friendly. A significant number of Chinese owned broker dealers operate in the country and any miscalculated rules could have a detrimental impact on Australia being the preferred destination for Asian brokerages setting up shop.

Forex Magnates wrote an extensive research analysis on the Australian regulatory environment in the recent QIR report.

The new rulings have their pros and cons, however with the industry hitting a glass ceiling in terms of new participants investing in the currency markets, brokers need to service traders by offering them a number of solutions, low leverage trading isn't one of them!

*This article has been updated since initial publication.