Hi. Retention has become such a buzzword lately that I started thinking that this industry is like a bubble where we all talk the same language and have similar experiences. My guess is that for us (brokers, suppliers, account managers) to understand ourselves better, we should take a look at other online segments and see what retention is like for them.

I apologize in advance for taking such a huge concept and squeezing it into a short article. Limitation of the media.

Retention in the Online Trading Industry

In online financial trading, clients make a deposit to an account in order to make high returns through buy and sell transactions of financial instruments. Correct? According to our data, in FX, traders would make an average of roughly several dozens or several hundreds of transactions (consecutive).

Let’s assume that a “Trading Cycle” is when a given client places consecutive trades, makes additional deposits and withdrawals until he decides to cease trading for a long period (e.g., several months). If he returns back to trade then he is a returning client.

Binary options traders on average make many less trades and many of them do it within days or weeks. So they are highly engaged but disappear off the broker’s radar very rapidly.

Needless to say, many traders have several accounts spread around at several brokers.

In most cases, account managers are responsible for a portfolio of accounts. Most brokers have several hundreds or several thousands of active accounts monthly. As opposed to global retail vendors such as Nike – it is considered a small amount of clients. For this reason, the relationship between the broker and the traders is based on personal connection and familiarity.

I think the interesting issue here is that financial trading involves engagement of clients that is expressed in several hundreds of activities (e.g. buy, sell, deposit, withdrawal).

This is quite an involvement. Adding to this the high tension that traders experience when it involves winning or losing money, so brokers need to handle a variety of emotional states (from euphoria to anger) as part of their daily routines.

Retention in Other Online Retail Segments

What happens in other retail (non-financial) segments such as online shopping, or traveling? It seems that classic retail activities consist of one time deals or a few deals in a row by masses of clients. This is the opposite of financial trading: low engagement by clients and lack of personal relationships. Firms that undertake “retention” in these fields actually aim for clients to return to them for shopping and not move away to the competition. They work to brand themselves and are available whenever a client wants to buy a particular product. Retail firms are more focused on good, efficient and reliable service on the spot to make sure the purchase experience is as pleasant, easy and simple as possible.

Examples:

Here is an example of the difference between 2 types of retention:

If I want to order a vacation and go to booking.com, I can do it on my own without any human help if everything goes well. The site will even give me comments in bubbles along the process to show how many other people have shown interest in a particular hotel and what the best rates are. I pay, get a confirmation and log out. They know that if I get frustrated I may quit and move to another site.

In financial trading you all know it is very different. If I am a newbie, I create an account and need to send documents for compliance. I then make a deposit and start figuring out how to place trades. Sometimes my account manager assists me and sometimes I am able to watch videos on how to trade.

From time to time I will get a call to place more funds and check up on how I am doing, and if I am really hooked on trading I will log in and out every day even from my mobile phone to check the status of my trades. If I lose, I will call my account manager to tell him how angry I am.

I think it is easy to see how 2 different types of engagement require a completely different retention approach.

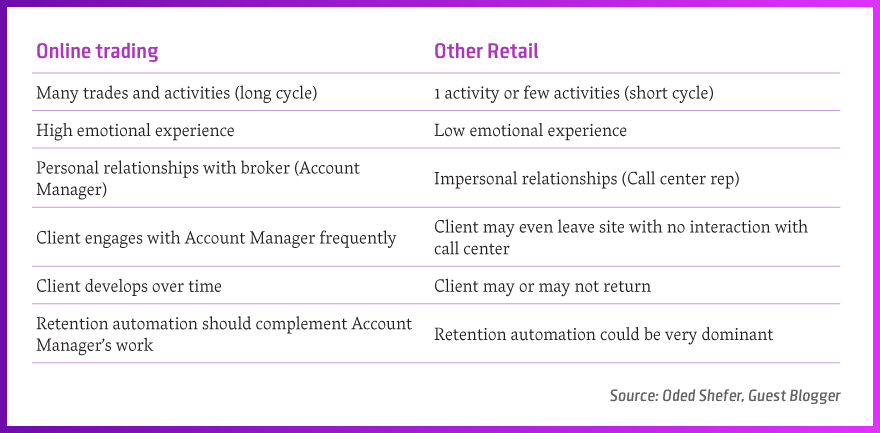

Comparing Retention in Two Different Worlds

Financial trading, being more engaging in terms of activities and emotions and more personal in nature – requires a different skill set of account managers. They need to work with their clients on the ups and down of their trading cycle, provide ongoing support and ongoing offers according to each client’s behavior.

They need to have patience and identify their client’s mood and need to make quick decisions on how to work with him. In other retail segments, as there is no particular account manager, a call center phone rep needs to be able to provide the necessary care or technical support in one or very few engagements. Sometimes even with no engagement at all when a client buys online and moves on.

Here Is a Quick Summary:

Now it is time for you to ask – why did I waste your time with this comparison? Well, I think that you have now increased your understanding of the unique characteristics of online trading and traders' needs so that you can deduce what is required in terms of retaining clients.

One Last Word about Automation

It makes sense that automation is what everybody is looking for in all online businesses. It helps reduce manpower and response time and increases efficiency and reduces costs. But how does this relate to the personal connection in the online trading industry? If you ask me, then automation can help brokers focus machine work on the “black labor” of retention (e.g. increase self-deposits, automate communications to traders and as a result reduce needs for phone calls).

Automation in our industry can help brokers devote human attention to cases where human interaction is required (e.g. personal care, support, encouragement, troubleshoot). Account managers can and should become “controllers”: allowing machines to do routine tasks and engage clients where their intervention is most required.