The doors have officially opened for London Summit 2019! Following last night’s Networking Blitz, today will feature a full slate of panels, seminars, and workshops covering all elements of the industry.

If you have not already done so, make sure to familiarize yourself with the event’s agenda. Upwards of 3,000 attendees are expected this year, making London Summit 2019 the largest to date.

All of the industry’s leading executives, thought leaders, and companies are filtering in to come together under one roof.vHosted by Finance Magnates at the Old Billingsgate, the summit has something for all attendees, whether this is your first time, or you are a veteran.

Are you the market for a shoeshine, perhaps a trip to the coffee bar? Feel free to explore these and over well over 100 different exhibitor booths and everything else the summit has to offer.

Live Feed

9:00 - Doors Open

Swim in the Deep End: Optimising Payments for Success

10:00 - A look into the payments space

- David Kimberley, Senior Editor at Finance Magnates

- Jasper Goeman, EMEA Business Development Director at Worldpay

- David Backshall, Senior Business Development Manager at Cardpay

- Raphael Tetro, Senior Vice President Merchant Services at SafeCharge

- Sherwin Quiambao, CEO at AloGateway

With the payments eco-system more complex and diverse than ever before, thought leaders were on and to discuss the latest occurrences in this vibrant industry.

Following a year of significant news & developments, the discussion focused on a wide range of topics from regulatory effects on the processes, to what you should be looking for in a PSP from a mass pool of options.

CEO Roundtable: Straight from the Industry Core

10:45 - Actionable insight from the industry's leading players

- Michael Pearl, Director of Content at Finance Magnates

- Andrew Ralich, Founder & CEO, oneZero

- Andrew Edwards, CEO at Saxo Markets UK

- Muhammad Rasoul, Director at TradeTech Group

- Harpal Sandhu, CEO at Integral

- Richard Elston, Group Head of Institutional at CMC Markets UK

As an FMLS tradition, top execs from leading businesses in the industry took center stage to discuss and debate some of the most pressing topics today. This included an interesting perspective on 2020 and what’s to come as well as a bird’s eye view of the latest industry developments.

The panel also touched on insight on the business implications from regulation while addressing growth, revenue & development. Of note, the panel also discussed the flow of brokers looking to gravitate towards less regulated jurisdictions.

Andrew Edwards, the CEO at Saxo Markets UK, gave the bluntest assessment of the situation, stating that “companies need to make a decision, if they want to play in a regulated market, then they need to play by the rules.”

Additionally, Harpal Sandu, CEO at Integral, also noted the importance of re-engineering operations for scale as one of the most pressing issues moving forward.

After the Hype, Ahead of Mass Adoption: The State of the Cryptocurrency Industry

11:45: A mature market

- Abdul Haseeb Basit, Board Member at Global Digital Finance

- Michael Coletta, Head of Blockchain Technology and Business Development at LSEG

- Sophie Winwood, Associate at Anthemis Group

- Max Boonen, Founder & CEO at B2C2

The crypto space originally took the industry by storm, creating a fresh hype in efficiency, innovation, and financial inclusion.

However, we have now reached a new era in the crypto world as mass adoption comes to the horizon — panelists engaged in an insightful session that focused on the vast complexities of the cryptocurrency industry.

This included an analysis of the current state of the crypto sphere and the aftermath of the 'crypto winter.' Clearly, many were in agreement that 'bad' actors were weeded out, offering a new start for mature institutions. The panel was upbeat about the future, with many positive signs spotlighting a bright future.

Additionally, other panelists pointed towards the existing maturity of the crypto industry and how it finally arrived as a viable market.

Reinventing the Retail Broker Business Model

13:45 - Brave new world

- Steven Hatzakis, Global Director of Research, Forex & Crypto at Forexbrokers.com

- Nima Siar, Chief Sales Officer at FXPRIMUS

- Albina Zhdanova, Chief Operational Officer at Tools for Brokers

- Nikolai Isayev, Chief Operating Officer at Financial Commission

- Shay Benhamou, CEO at AIRSOFT

As brokers face a constantly shifting regulatory environment, a look into overcoming challenges and reinventing the business model is now more important than ever. Industry thought leaders laid out the most important tools in the business model that can be harnessed to your advantage.

Sometimes it's not always about reinventing the wheel but rather optimizing your model to stay ahead of the competition. The panelists focused on a number of different execution methods as well, leaving no stone unturned in one of the more informative sessions of the event.

The Evolution of Money: Digital Markets and Asset-Backed Tokens

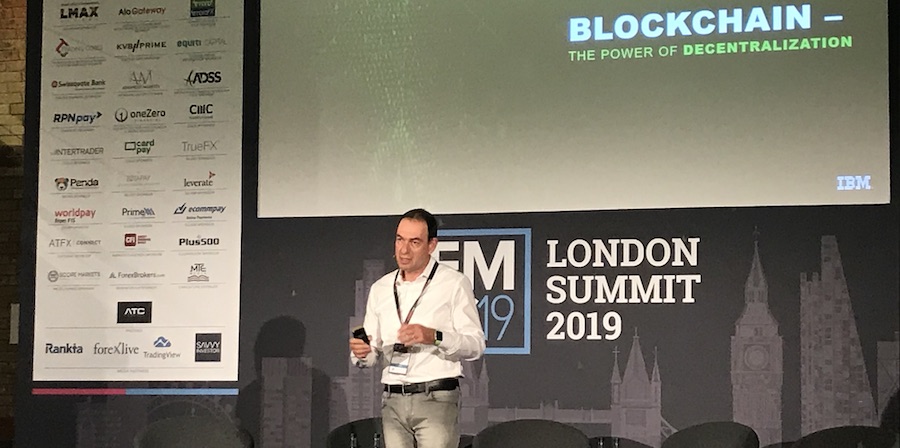

14:30 - The many benefits of blockchain

- Gabi Zodik, Director, Blockchain and IoT Platforms at IBM Research

Gabi Zodik discussed the evolution of money and its intersection with Blockchain, IoT, and other disruptive technologies that have taken the FX and finance industries by storm. Indeed, blockchain, like the new operating system of trust, has become a power of decentralization, creating markets for the future with a new trust model.

This phenomenon was on full display, providing new economic and business models based on joint value, identity, and digitalization.

Beyond Liquidity: The Good, the Bad & The Must-Know

16:45 - Talking profits and liquidity

- Hormoz Faryar, Global Head of Institutional Business at Equiti Group

- Ian Daniels, Head of eFX Distribution EMEA & Americas at Nomura

- Alexei Jiltsov, Co-Founder at Tradefeedr

- Jeremy Smart, Global Head of Distribution at XTX Markets

- Andrew Biggs, Head of Liquidity at CFH (TradeTech Group)

- Conor Daly, EMEA Head of eFX Sales at Goldman Sachs

FX Liquidity is a landscape that never stops changing, providing endless opportunities and pitfalls for market participants. One of the most informative panels of the summit was saved for the last, with some of the biggest names.

The panel discussed both ‘the good and the bad’ news and touched on significant progress areas as well as pressing issues in the FX markets and the outlook for liquidity consumers.

Furthermore, panelists grappled several ‘must-know’ topics, which are crucial in what the future will bring.