In a shift for the retail industry, the largest losses suffered by brokers after the SNB removed its 1.20 price floor on the EUR/CHF exchange rate were suffered by those using non-dealing desk agency models, as opposed to market makers. The most notable were FXCM and InteractiveBrokers, each announcing losses above $100 million. Their losses are notable as non-dealing desk brokers pass all client risk to Liquidity providing counter-parties, as opposed to market makers who warehouse customer trades internally and minimize external hedging.

Affecting non-dealing desk operators this time around was the sharp CHF volatility, which triggered scores of clients to lose more money in their accounts than they had, and resulted in negative balances. For the most part, these negative balances are noncollectable from retail clients, even though brokers themselves are on the hook for similar sized deficits with their Liquidity Providers .

Non-dealing desk firms also suffered from poor executions from their bank liquidity partners during the move. This ultimately caused client losses and negative balances to be exacerbated compared to prices. As related last Thursday, client notes sent from UBS to their customers explained that pricing during the move wasn’t final and could be restated. This turned out to be the case as several technology providers told Forex Magnates that their execution monitoring software revealed numerous price corrections.

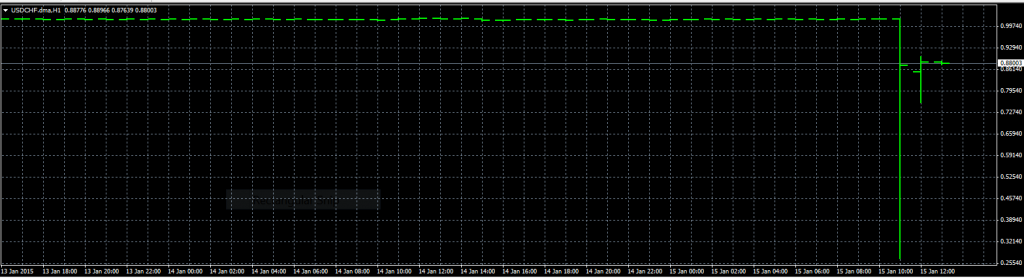

In an extreme example (that affected at least two brokers), Barclays had filled EUR/CHF sell orders at 0.065 (no extra zero) while at the same time EBS was quoting its session low of 0.85. Technology providers that Forex Magnates spoke to corroborated with similar examples of their clients. Firms did state that Barclays and other banks ultimately did provide some price improvement, but often to levels below that of EBS's low of the day.

USD/CHF Bids at 0.26 (click to enlarge)

Market maker risks

Market makers, on the other hand, benefited as counter-parties to customers with Swiss franc short positions. Prior to Thursday's news, many brokers reported trader short positions to be above 90%. Market makers suffered when the profits of their CHF traders (amounting to less-than-10% of traders) were greater than the client balances of the +90% of losers. As such, if losers lost $10 million with client balances of $500,000, and winners profited $750,000, a broker would come out with a net loss of $250,000.

Market makers were also vulnerable to customers executing Swiss franc buy orders as the currency rose following the SNB’s announcement. Unlike no-dealing desk brokers where client executions are dependent on orders being simultaneously transacted with liquidity providers, market makers are able to (not that all of them do) fill customer orders quicker. However, some brokers have also expressed that CHF executions aren’t final and can be altered after verifying rates with liquidity providers.

Lastly, market making brokers also absorbed losses on hedged positions they took on the Swiss franc. Due to the EUR/CHF holding above its 1.20 price floor for over three years, it attracted scores of traders who bought the forex pair near the floor and profited on small moves higher. As the trade had been performing well for many traders, it led to some brokers hedging a portion of their client’s exposure. While the hedge limited their risk to their customers' short term profits against them, it ultimately led to losses as the EUR/CHF crashed.

Even attributing losses to internal hedges and customers that were on the right side of the franc’s move, on the whole, market makers performed better than their non-dealing desk brethren who absorbed client negative balances. Initial analysis also appears to show that losses were regional as brokers with higher APAC-region customer bases were less exposed to the franc. As mentioned above, among market makers, there was a variance of results that was dependent on various factors such as EUR/CHF hedging. As such, several large brokers that use market maker models like GAIN Capital and Plus500 reported profits from the move, while CMC Markets, OANDA and IG Group lost funds.

Who are the biggest bucketshops?

The retail forex market is often quoted as having "bucketshop" operators (market makers are called such because they warehouse client trades, or bucket them together and act as the counter-party). The bucketshop description is used to explain why brokers have a conflict of interest with their clients and will often be accused of affecting their customers negatively by playing around with rates and executions. Ultimately, in the zero sum game of the forex markets, many have long believed it’s the banks that are the ultimate bucketeers of the market, as witnessed by the FX fix rates scandal and last week’s subpar executions provided to broker clients that they have a "relationship" with.

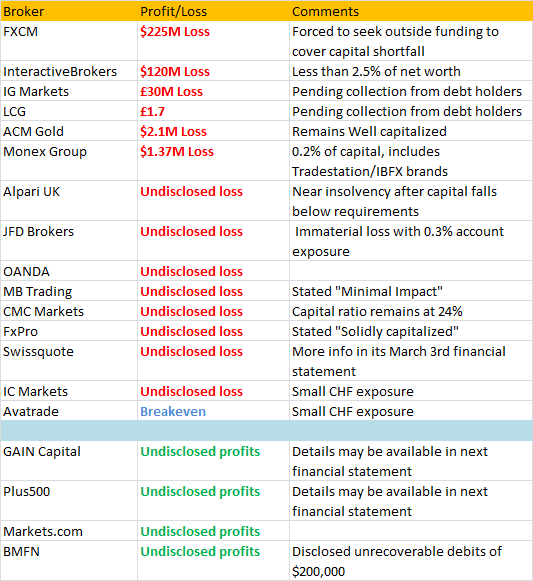

Winner and losers

Following our initial broker estimates which were published on Friday, Forex Magnates has gained a clearer picture of how well firms performed due to the Swiss franc move. Focusing on brokers that have publically made statements, below is an aggregated list of retail winners and losers who have come forward to verify that they in fact did have losses and, when available, their estimates. In addition are firms that have publicly stated that they were profitable from Thursday. Data will be updated as more information becomes available.