The dedicated spot crypto exchange of contracts for differences (CFDs) broker Pepperstone went live today (Thursday), but only for users in Australia, as FinanceMagnates.com had the first look at the new website.

The launch came after Pepperstone’s CEO, Tamas Szabo, publicly announced his company’s plan to launch the crypto exchange last November while speaking at the AusCryptoCon convention.

Tapping Crypto Traders

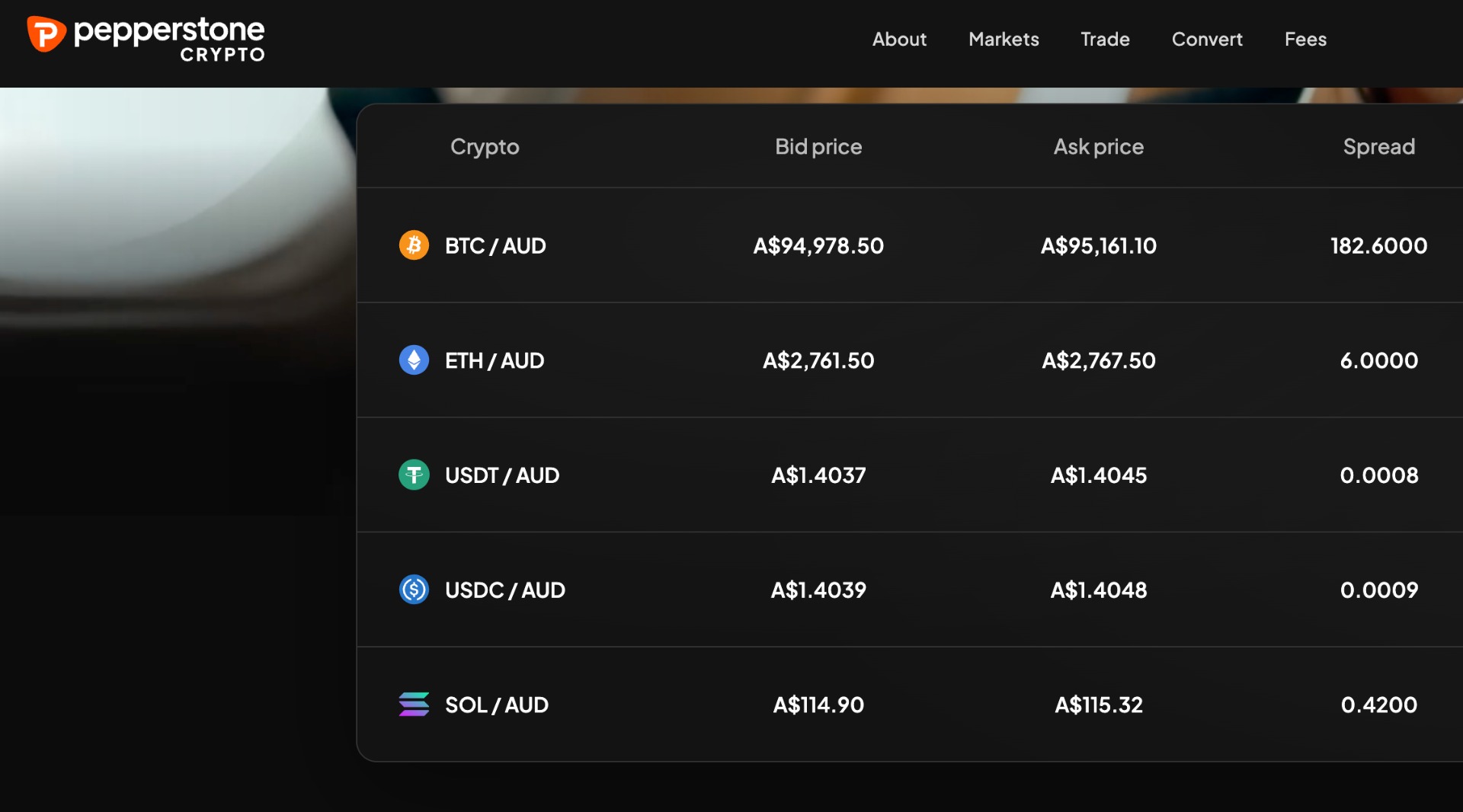

At launch, the Pepperstone Crypto website lists five cryptocurrencies, including Bitcoin, Ethereum and Solana, along with two stablecoins, USDC and USDT. All pairs are listed against the Australian dollar. It will add more cryptocurrencies in the future.

It's also offering crypto trades at a flat fee of 0.1 per cent.

“The key focus areas have been ensuring deep liquidity, maintaining platform stability during peak trading, and supporting secure deposit and withdrawal processes,” Szabo told FinanceMagnates.com. “The team has worked carefully to address these considerations, allowing the launch to proceed as planned.”

- Pepperstone Hunts for CTO to Spearhead “Imminent Crypto Expansion”

- Pepperstone Takes Aim at Crypto Exchanges, Citing ‘Fat on the Bone’ in New Market Push

- Pepperstone CEO: “We’re Taking Down Scam Sites Almost Every Day”

Pepperstone has already been offering crypto CFDs for years. Although the brand remains the same, it is keeping its legacy CFDs and spot crypto offerings separate.

“Leveraging the scale of our broader CFD business, which processes over USD 6 billion in crypto CFD volume each month, we are able to support robust liquidity and reliable execution for our clients,” Szabo added.

The company has also built its crypto infrastructure in-house. Despite being resource-heavy, in-house infrastructure “provides full oversight of execution quality, deep liquidity, pricing and system security.”

CFD Brokers’ New Target: Launching Crypto Exchanges

Meanwhile, Pepperstone is not the only CFD broker to move towards crypto offerings. In the United Kingdom, IG Group last year partnered with Uphold to offer spot crypto and later became the first UK-listed firm to obtain its own cryptoasset licence from the FCA. It then acquired an Australia- and Singapore-regulated crypto exchange and is now expecting to launch “crypto propositions” in the Asia-Pacific and Middle East regions.

CMC Markets is also planning to add decentralised finance (DeFi) products to its platform, which was part of its broader plan to become a “super app.” It also established an office in Bermuda with a licence to conduct digital asset business, creating an offshore hub to expand its crypto services to international clients.

Other players in the industry that are also exploring crypto product launches include XTB and Capital.com.