Equity exchanges worldwide are grappling with mounting pressure to extend trading hours as investors demand near-constant market access, according to a new analysis from the World Federation of Exchanges (WFE).

The global industry body released a comprehensive study examining the shift toward extended trading hours, particularly the move to 22-hour or 23-hour trading weeks that several major exchanges are considering.

The analysis doesn't advocate for 24/7 trading but instead provides a roadmap for exchanges considering the transition. Extended trading hours present significant operational challenges that require careful coordination across the entire financial ecosystem, the WFE warns.

Growing Investor Appetite Drives Market Changes

Three main factors are pushing exchanges toward longer trading sessions, according to the WFE analysis. Local retail investors increasingly expect the same around-the-clock access they get from digital services and cryptocurrency markets. International retail traders, particularly in Asia, want to trade U.S. stocks during their local business hours. Meanwhile, overseas institutional investors seek continuous access to manage global portfolios and respond quickly to market-moving events.

The demand is already reshaping parts of the market. Several Alternative Trading Systems in the United States now operate overnight hours, capturing trading activity that traditional exchanges currently miss. Some retail brokers offer 24/7 trading through internal order matching, though these arrangements often lack the transparency of exchange-based trading.

Major U.S. equity exchanges have announced plans to move toward continuous trading, while the Depository Trust & Clearing Corporation plans to transition to 24/5 clearing by the second quarter of 2026. The moves follow similar developments in derivatives markets, where CME's Globex platform already operates 23 hours a day, five days a week.

Moreover, 24X National Exchange has already secured a key partnership with Transaction Network Services (TNS) that will provide market data connectivity for its upcoming round-the-clock US stock trading platform.

Operational Hurdles Require Coordinated Response

Extended trading hours create complex challenges that go far beyond keeping computer systems running longer. Market participants will need to adapt risk management systems, surveillance programs, and staffing models to handle round-the-clock activity.

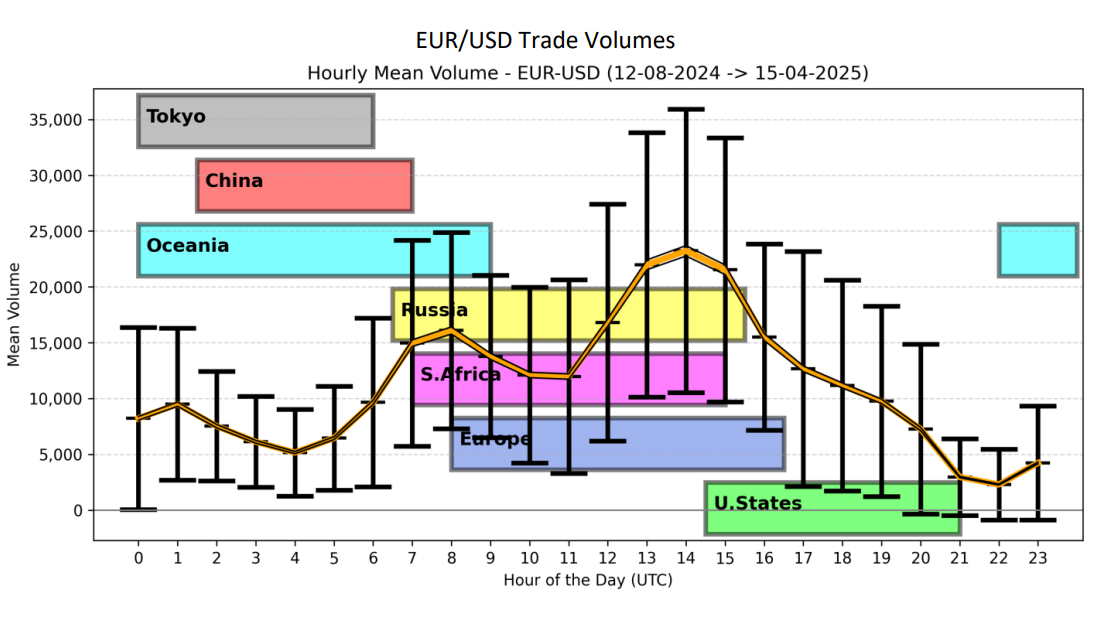

Liquidity patterns observed in foreign exchange and cryptocurrency markets suggest trading volumes won't remain constant throughout extended hours. Instead, activity will likely peak during traditional business hours, with thinner participation overnight potentially leading to wider bid-ask spreads and increased volatility.

“Lower participation at these times may lead to wider spreads, price slippage, and volatility,” the WFE notes, adding that brokers should clearly disclose these risks to retail investors who may be less familiar with overnight trading dynamics.

Exchanges will need to maintain circuit breakers and other risk controls during extended hours, while ensuring proper surveillance to prevent market manipulation during periods of thin liquidity. The infrastructure demands are substantial – systems must achieve near-zero downtime and support continuous operation without traditional maintenance windows.

Post-Trade Systems Face Major Overhaul

The shift to extended trading creates particular challenges for clearing and settlement operations. Traditional clearing environments often align risk assessments with business-day cycles, but extended hours require constant price formation and real-time margin calculations.

One major concern involves margin calls and funding requirements during periods when banking and payment systems are offline. Some exchanges have addressed this by requiring prefunded margin buffers or arranging with foreign banks to facilitate after-hours margin movements.

Payment system operators are responding to the demand. The Federal Reserve is considering expanding Fedwire operating hours to 22 hours per day, seven days a week by 2027. The European Central Bank is similarly consulting on extending its payment system hours.

Markets will also need to maintain designated closing prices for benchmarks, fund valuations, and corporate actions. Potential solutions include “virtual closes” or brief scheduled closures to handle these essential functions.

Regulatory Flexibility Key to Market Evolution

The WFE emphasizes that extended trading isn't suitable for all markets and shouldn't be viewed as inevitable. Different exchanges will adopt different models based on their participant base, liquidity profiles, and local market conditions.

“Extended trading is not inevitable nor universally desirable,” WFE CEO Nandini Sukumar said. “The shift to extended trading is technologically feasible and already aligned with investor behaviour in other asset classes. The real question is how markets evolve in a way that protects investors, supports integrity, and strengthens global competitiveness.”

The WFE has recently also highlighted the growing popularity of tokenized stocks in retail trading. In an email sent to FinanceMagnates.com, it explained that while it is not generally opposed to tokenization, it has “called for a crackdown on mimicked tokens.” The institution argues that the term “stock tokens” may mislead investors, as these instruments often do not provide the same rights and protections as traditional shares.

“What Nasdaq is doing is best practice. If tokenized securities are to be traded, this is how it should work,” Sukumar added. “The emergence of unregulated platforms offering mimicked tokens raises serious concerns. These offerings often bypass established safeguards, creating risks for investors, undermining market integrity, and enabling regulatory arbitrage. In contrast, Nasdaq’s approach ensures that tokenized securities are treated like traditional securities, meaning investor rights remain protected.

The organization warns that regulatory inaction could push trading activity toward less transparent, unregulated venues. Several major exchanges have already announced extended trading initiatives, joining a growing trend across global markets.

The Biggest Players Wants to Join the Trend

The London Stock Exchange has explored 24-hour trading options, while Nasdaq seeks approval for extended operations. The crypto exchange Kraken has applied for SEC approval of a 24/7 tokenized stock trading platform, and the CFTC recently sought public comment on round-the-clock derivatives trading.

Richard Metcalfe, the WFE's head of regulatory affairs, emphasized that trading hours should remain the responsibility of individual market operators rather than being mandated by regulators.

“Flexibility and diversity in trading models should be encouraged, with trading hours remaining the responsibility of market infrastructures,” Metcalfe said. “Regulators should focus on enabling innovation while maintaining the fundamental principles of fairness, transparency, and systemic stability.”

The WFE study suggests that 22/5 or 23/5 trading models offer a pragmatic stepping stone toward eventual 24/7 markets, allowing exchanges to test operational readiness while managing risks incrementally. True continuous trading would require more extensive system-wide changes across the entire financial ecosystem.

This story was updated on Sept. 14, 2025, at 20:15 CET to include comments from the WFE and to clarify the organization's position on extended trading hours and tokenization.