Having entered the US Presidential race with no political background, Donald Trump’s leading position in GOP polls has been a surprise to many. More surprising has been the rise in polls following seemingly negative headlines after strange comments from Trump.

James Watson from ADS London Highlights Post-SNB Changes to the Industry

January 15th 2015 - A Timeline of Panic

Examples include his attack on John McCain by stating “I like people who weren’t captured” and questioning whether McCain should be viewed as a war hero. Trump also has voiced several comments that can be viewed as condescending towards women, including words towards Presidential Rival Carly Fiorina and Rosie O’Donnell. The personal attacks are in addition to his general ideas such as putting up a wall with Mexico and banning Muslims from travelling to the US which upset large segments of the US population.

Despite these happenings, Trump has experienced positive momentum in his campaign as it nears the Iowa Caucus later this month, the election’s first state primary

Despite these happenings, Trump has experienced positive momentum in his campaign as it nears the Iowa Caucus later this month, the election’s first state primary. Among the explanations for this phenomenon being provided by statisticians is that early polls tend to favor better known candidates. As such, from the time he entered the race, Donald Trump has benefited from his celebrity status which has only gotten stronger as he dominates headlines, both positively and negatively.

SNB Crisis – From Negative to Positive

A similar result appears to have benefited the online retail Forex industry in the wake of the Swiss National Bank (SNB) triggered Swiss franc crisis. Reaching now the one year anniversary of the SNB’s removal of its 1.2000 floor on the EUR/CHF exchange rate, and the subsequent gyrations of the franc, the overall industry appears to currently be as strong as ever.

At the time, headlines were dominated by customer losses, with many receiving notices of owing their brokers thousands of dollars due to negative account balances. On the company side, many brokers and banks alike reported multi-million dollar losses as a result of the volatility and negative customer balances that were deemed unrecoverable.

Among them, FXCM required $300 million emergency financing from outside investors to remain solvent while Saxo Bank and Interactive Brokers reported potential unrecovered losses of above $100 million. Other public firms such as IG Group and Swissquote reported losses in the tens of millions of dollars. In addition, succumbing to client losses, Alpari UK and several smaller brokers went out of business.

By May 2015’s iFX Expo, many brokers, including those that suffered losses, revealed to Finance Magnates that new account openings were back to their highest levels

Nonetheless, after what seemed like endless 24/7 news of the risks of forex trading and client and company losses, the negative atmosphere quickly dissipated. By May 2015’s iFX Expo, many brokers, including those that suffered losses, revealed to Finance Magnates that new account openings were back to their highest levels after dipping in February 2015.

In addition, after 2014 had been a weak year for new product releases, the conference featured the entrance of new technology providers as well as product releases from incumbents. This continued during November’s Finance Magnates London Summit which also saw lots of interest from participants to learn about new products and marketing solutions.

Even FXCM, which has become the ‘poster boy’ for the crisis and the near death experience that followed, has seen their volumes and account numbers stabilize and then grow.

It’s all about awareness

Speaking to industry professionals, the overall consensus is that, like Donald Trump’s advancements in the polls following negative headlines, the forex industry benefited from increased public awareness. For many existing traders, the Swiss franc’s move proved that volatility exists in forex, and meant it was worth their time to investigate its potential.

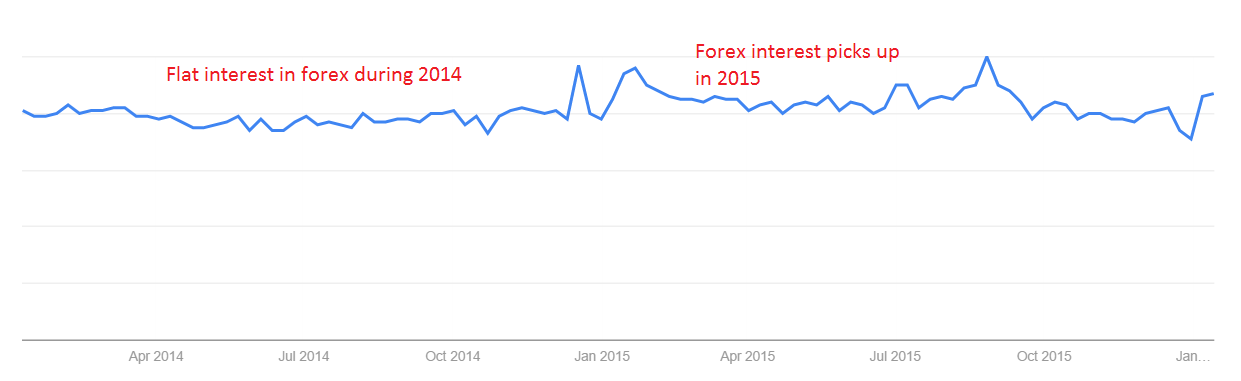

Google Trends Interest in 'Forex' (2014 to present)

Among non-investors, news from the SNB crisis led the general public to have slightly more knowledge that there is such a thing as forex trading. As a result, online advertisements marketing leverage, low spreads, 24/7 trading and access to the world’s most liquid market became slightly more understandable. This in turn had the effect of increasing banner click through rates as well as leading to more online searches about the subject.

This correlation between negative headlines and positive account growth in the forex industry is far from the first time this has occurred for online businesses

This correlation between negative headlines and positive account growth in the forex industry is far from the first time this has occurred for online businesses. In 2014, the Tinder App was at the center of attention, having led to a harassment legal suit, while Uber has been flagged negatively for both driver and company behavior. But, in both cases, the negativity had little to no lasting effects and helped raise product awareness.

The bottom line is that as today marks the one-year anniversary of the SNB crisis, it is important to also remember that in addition to being a financial based sector, forex trading also belongs in the online world. As a result, market forces such as viral activity and online awareness are arguably just as integral to the future of the industry as Risk Management practices.