All FX brokers, spread betters, stock-focused platforms have seen a significant uptick in trading activity following the coronavirus-inspired market volatility. Indeed, they all said volumes had already been good since the start of 2020, and, as a result, they expect to deliver solid financials for the first quarter and the full fiscal 2020.

What's more, many listed brokers saw a decent share price growth over the last few weeks as the brokerage business wasn't one of the many sectors that were massively affected by the COVID-19 outbreak and subsequent lockdown.

While we could assume that solid operational metrics are already priced in, one might wonder if the positive outlook is warranted and if trading brokers' stocks are still a bargain?

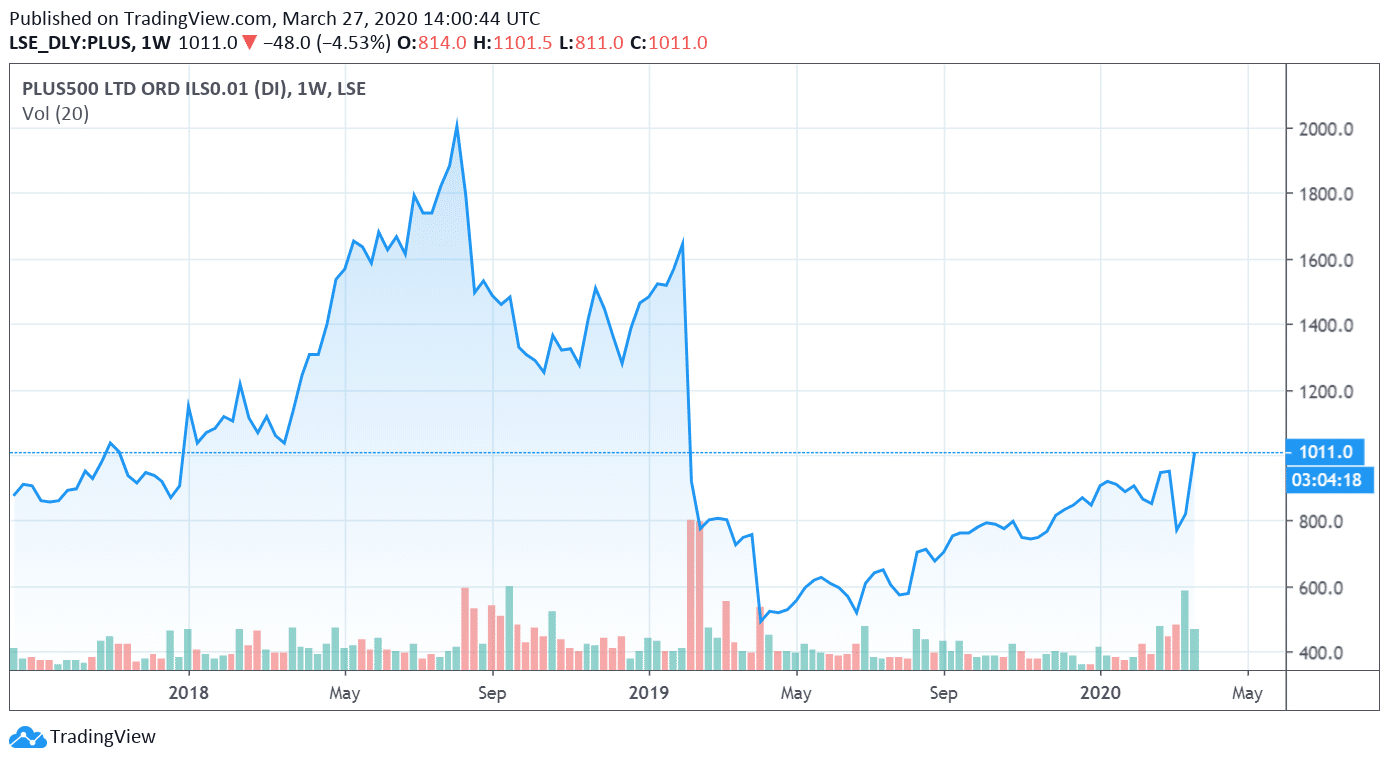

Plus500 stock: Tradingview

Take a breath. While the toll the infection ultimately takes on the world is disastrous, the economic upheaval caused by the coronavirus will likely not be as damaging or long-lasting as similar historic downturns. As such, the uncertain growth outlook warrants much caution and also raises serious questions about how deep a possible pullback in volumes and brokers' fortunes will be, though it should not cause panic.

Changes in risk sentiment and Volatility

On one part, the historical precedents, most recently the 2008 crisis, show that FX market Liquidity falls during periods of market stress; and that the impact of post-crisis regulatory change often brings adverse consequences on FX traders' activity.

If the history tells anything at all, the increase in FX volatility, reflected by sharp swings, makes traders tend to pare back the size of their positions in order to avoid the sizeable risks on the downside.

According to conclusions made by one of the BIS reports, there was a marked increase in the amount of FX turnover during the lead-up to the financial crisis, aided by low volatility and a high appetite for risk. These factors reversed a few months later when traders became increasingly risk-averse, and market volatility spiked higher.

Interestingly, the current pattern mimics what happened during the crisis period, which initially saw an increased FX turnover that was attributed to a 'hot potato' effect, where traders were keen to pass on any risk as quickly as possible. This was seen recently when investors liquidated nearly everything for cash, including the traditional safe havens like gold and yen, only driving up the US dollar.

On the regulatory front as well, the triggers for a more stringent reaction from regulators have already begun to emerge. ABN Amro Bank said this Thursday that it would incur a significant "incidental" loss on one of its US clients amid the new coronavirus scenario. The Dutch lender became the first major bank hurt by a major loss stemming from the COVID-19 crisis after its clearing division could not meet a margin call on a loan. Similar announcements are expected to follow suit shortly.

Furthermore, most of the popular online platforms experienced major outages, sparking anxiety from investors who were unable to trade on some of the market's biggest rallies and drops. Customers of the popular trading app Robinhood, whose service faced a massive downtime several times, quickly lashed out on social networks, and some clients have even grouped to file a lawsuit.

Partly as a result, both incidents will certainly draw the regulators' attention, which most likely would translate into more restrictions. The cost imposed by the corona crisis may take the form of a legislative reaction to further rein in risky products and speculative behavior.

Combined with a number of slowdown factors that have been affecting a pre-corona environment, which was characterized by regulation creep in the OTC space, currency rigging scandals, increased cost of market-making, the attitudes may only skew towards aversion.

As such, excluding the one-off effect triggered by the global spread of the coronavirus, the idea that markets may become less active is hardly controversial.

Uncertain fundamental outlook also warrants caution

The prospects of higher volumes, at least in the few months ahead, are also in check. Despite concerns about the virus' effects on economic growth, policymakers are telling investors that they expect the downturn to be short-lived. This is even though a plunging stock market, widening prospects of a global recession, interest rate cuts by almost all central banks are reviving memories of the 2008 financial crisis.

For one thing, the 2008 meltdown resulted from years of deeply rooted housing problems. That's not the case now. What we're seeing is caused by something external to the economy, and it's closer to a natural disaster.

Activity in the post-corona world could also be muted by the fundamental factors, including central banks acting in tandem and policies moving more or less in lockstep, as well as a wait-and-see approach in relation to how global economy would recover. This would make it tricky for FX traders to find compelling reasons to bet on or against any single currency.

So taking aside coronavirus-driven rout, the spotlight will be soon back on long-term trends in the FX markets where volatility has hovered around its lowest level in several years. Just before the disease outbreak, the trading range in the world's most traded currency pair, EURUSD, has been bumping along at multi-year lows as stimulus policies flooded financial markets with liquidity, a scenario that could be replicated in the months ahead, particularly with the Fed joining the party as well.

On the regulatory front, this assumption also brings the focus back to tighter regulation of the speculative trading instruments that brokers sell to retail investors. So although their mood may have been improved by higher trading volumes in recent weeks, the upcoming months may reverse the course, and such performance may be unlikely to continue under rules such as ESMA's restrictions that have already had a more severe impact than most CFDs brokers anticipated.