Overall, 2019 was a rather lackluster year for foreign exchange (forex) and contracts for difference (CFD) brokers, with low market volatility and a tightening regulatory environment resulting in low client activity. 2020, however, has so far proven to be a much different story, and while the rest of the world is feeling the pressure of the coronavirus pandemic, the crisis has brought volatility back into the markets.

Are brokers one of the biggest winners of coronavirus?

So, is it fair to say that brokers are one of the biggest benefactors of the current crisis? And if so, is this sustainable? Earlier this week, Finance Magnates reached out to a number of Australian brokers, such as Vantage FX, GO Markets, ACY Securities, and Pepperstone, who all gave a resounding yes - coronavirus has provided a boost for operations and has left brokers significantly up in terms of volumes year-on-year.

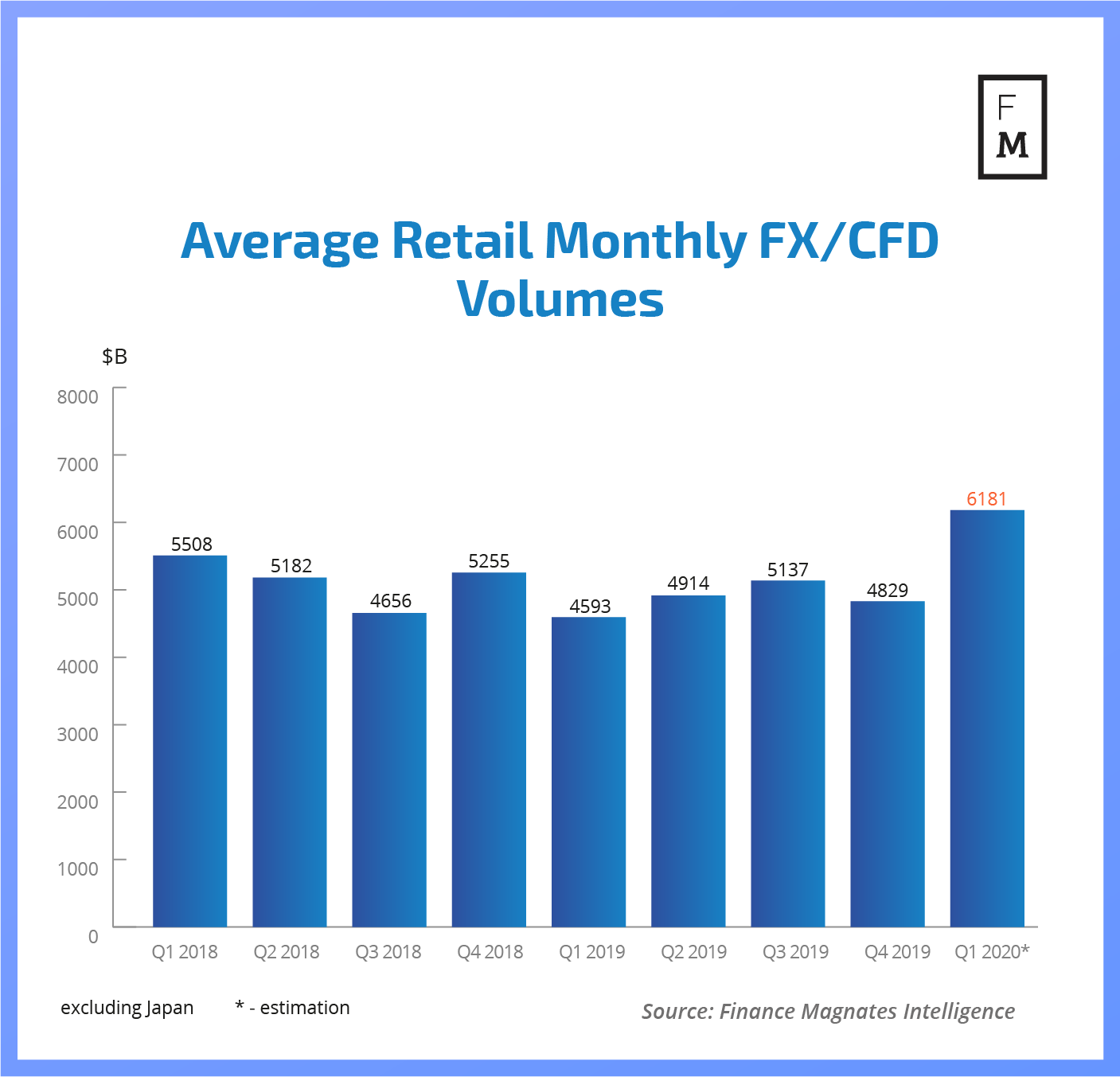

However, can the same thing be said for brokers outside of Australia? Such as in Europe or the Middle East? According to data compiled by Finance Magnates Intelligence and estimations drawn from that data, the first quarter of 2020 is set to deliver a sizeable boost for FX and CFD trading volumes.

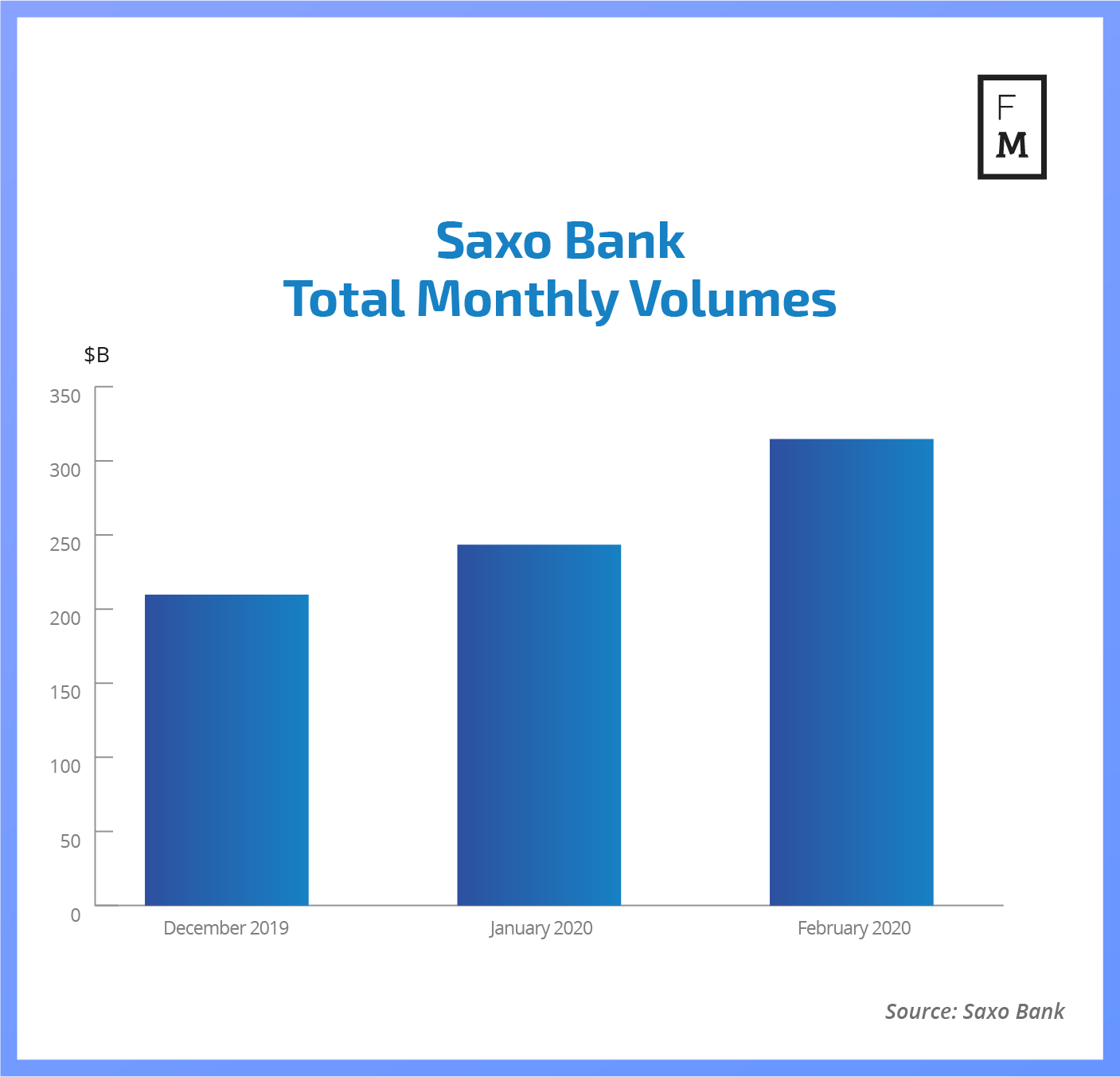

Many brokers started to feel the impact of coronavirus related volatility in the month of February, with many brokers reporting that the final week of the month, in particular, saw a significant uptick in trading volumes.

Therefore, many trading providers managed to report strong volumes during the month of February, with some brokers even managing to hit record volumes, as the coronavirus pandemic continued to boost trading activity. This is clearly illustrated in Saxo Bank's trading volumes.

So that's what the data is saying at the moment, but what are the brokers themselves saying? To find out what the global situation is, Finance Magnates spoke to a further selection of brokers, operating throughout the world, to get a complete picture.

Volumes grow as COVID-19 worsens

Jeffrey Siu, ATFX Group COO, told Finance Magnates that as the outbreak continues to worsen, clients have become more active on all of the broker's trading platforms.

Jeffrey Siu, Chief Operating Officer of ATFX Group

"The financial markets have been very volatile for the last three months, which has created lots more trading opportunities for short-term traders. Many of our clients have taken advantage of the large price swings in major financial markets including FX, indices, commodities and more," Siu said.

Fabian Chui, Head of Brokerage Risk, ADSS

Fabian Chui, Global Head of Front Office and Global Head of Risk at ADSS, highlighted that the levels of volatility we see in the markets had not been witnessed by some traders across their entire careers.

"The surge in volatility in the financial markets has been unprecedented due to the combined demand and supply shocks. The escalating situation and the severity of Covid-19 caught the market off guard, which has led to a major increase in client trading activity," Chui explained.

"We have seen a lot of intraday trading as clients attempt to call the bottom and profit from the volatility. At the same time, clients are adjusting their positioning and risk management for volatility in a way that is comparable to the financial crisis in 2008."

Over at eToro, a social trading and multi-asset brokerage company, the current climate has brought a welcome uptick in website traffic as the topic of investing has been brought front and center amid all of the activity.

Coronavirus is bringing investing front and center

eToro CEO Yoni Assia

Yoni Assia, the CEO of eToro, highlighted: "Due to increased market volatility, we are seeing a greater interest in financial markets and in trading and investing from retail investors. Stock markets have plunged, ending a long rally and we are also seeing increased volatility in commodities notably oil."

"This is creating a lot of noise in the media and consequently has brought the topic of investing increasingly onto people's radars. We have seen an uplift in website traffic by roughly 20% globally as people want to find a simple and transparent way of accessing information as well as the opportunity to trade and invest."

Jens Chrzanowski, Member of the Management Board of Admiral Markets Group AS

Source: LinkedIn

Jens Chrzanowski, Member of the Management Board of Admiral Markets Group AS, said that its clients have been capitalizing on the moving markets.

"Admiral Markets is a broker whose main focus is on active traders who do not trade with the aim to do long-term investments. They trade short-term market movements. So, with these big market movements, our clients have been trading a lot, leading to a significant increase in trading volumes when compared to January and February 2019," stated Chrzanowski.

How do volumes compare YoY?

Whilst it is important to keep in mind that although coronavirus has led to a definite surge in trading volumes, there have been other factors in play. The oil price war between Russia and Saudi Arabia also provided a boost in volatility, as well as 2019 ending on a high, with December volumes being higher than normal due to the Federal Reserve tightening and the China/US trade war.

Nonetheless, it can't be argued that coronavirus hasn't delivered a boost to volumes. So how do these volumes measure on a yearly comparison? For ATFX, the broker has managed to record double the trading volumes it had last year across all of the regions it operates in globally.

"The year began with volatility in the Asian markets as COVID-19 hit those areas and forced them into lockdown measures. The situation worsened after January as more countries began to lockdown their citizens in an attempt to stop the spread of the virus. ATFX is still implementing its business continuity plan on a global scale during this challenging period to ensure we continue to provide high-quality services," Siu outlined.

"It's clear the spread of COVID-19 has increased market volatility and activity during this period. However, this is not the sole reason for our increased trading volumes. Since the beginning of 2019, we've launched several new products and our client base has been growing organically thanks to our ever-rising reputation."

For eToro, the yearly increase is even more pronounced. "Globally, we have seen trading volume increase over 200% in 2020 compared to the same period last year. We have seen those depositing for the first time on eToro grow over 300% this year and stocks investment quadruple, compared to Q1 2019," Assia highlighted.

How are brokers dealing with increased volatility?

As Finance Magnates analyzed, large swings in the price of major currencies can be problematic for brokers and traders alike. Back in June of 2016, following the big Brexit vote, many brokers struggled to meet their customers' demand as there was a squeeze on Liquidity .

Now, there is a squeeze on gold, as the pandemic has created a surge in demand, whilst at the same time, is inhibiting supply. Furthermore, the more volatile markets become, the more chance there is for investors to lose more money. So how are brokers preparing for this?

At ADSS, Chui said the broker has put in place the following measures: "Primarily we have focused on readjusting our margin and collateral requirements to protect both the clients and the business from adverse outcomes and losses.

"We invest heavily in our systems, which has allowed us to cope very well with the extra load and capacity. We maintain healthy buffers with our counterparties. We continually monitor and adjust for trading conditions to ensure we provide optimal liquidity and pricing to our clients."

Is volatility here to stay?

Whilst the global crisis has provided a boost to brokers currently, can we count on this for the long term? Speaking to Finance Magnates earlier in the week, Christopher Gore, the Chief Executive Officer (CEO) of GO Markets pointed out that the future remains unclear.

Christopher Gore, CEO of GO Markets

Source: GO Markets

"At this stage most of our business metrics are broadly stronger. Still, we're in uncharted waters – we may well see a lull in volumes as time wears on. There are so many variants to consider."

Professionals from Polish broker XTB, JFD Group, ATFX, and RoboForex all provided their own opinions on whether we can expect volatility to stick around in our previous analysis here.