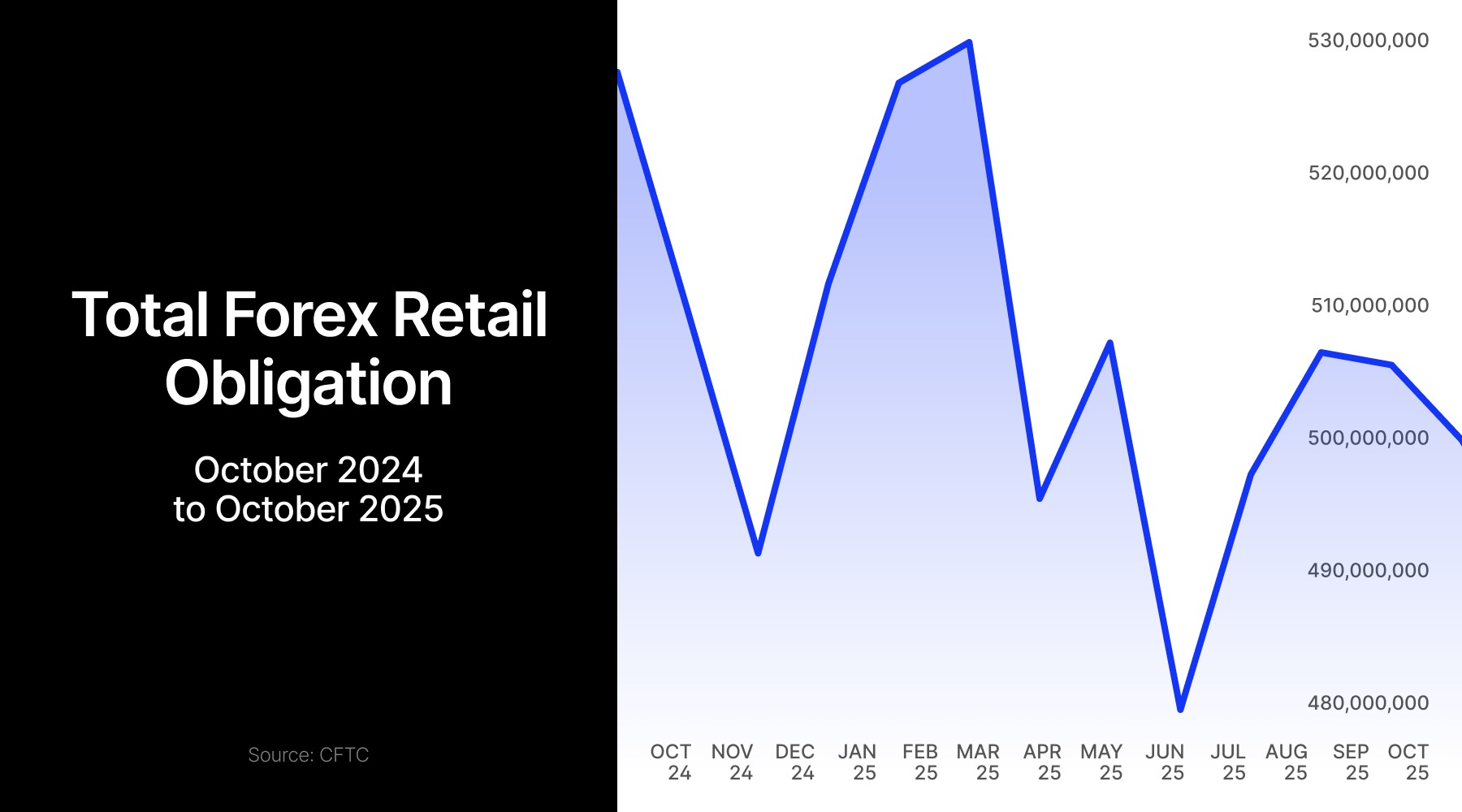

Retail forex deposits across major US platforms declined 1.1% in October 2025, dropping to $499.9 million from September's $505.6 million as the industry extended its losing streak into a second consecutive month.

The decline reflected continued headwinds facing currency traders despite varied performance among individual brokers.

Divergent Results Among Major FX Players

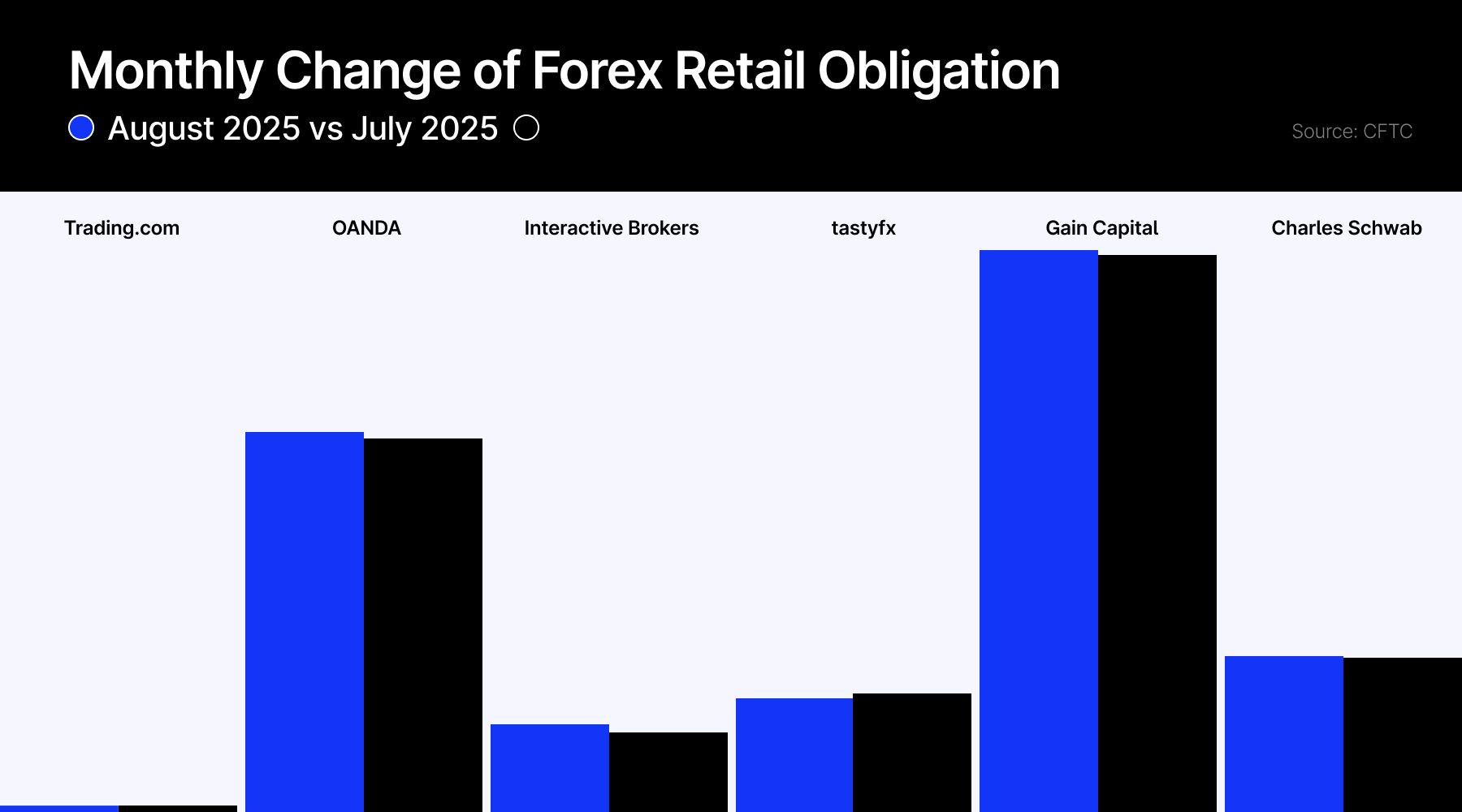

GAIN Capital maintained its position as the largest platform with $215.4 million in October, down 1.0% from September's $217.6 million. The company shed $2.2 million during the month as clients pulled back from currency positions.

Year-over-year, GAIN Capital showed resilience with deposits up 5.0% from October 2024's $204.6 million, making it one of the few platforms posting annual growth.

- Forex Deposits in the U.S. Rise for the First Time in Months as Dollar Stabilizes

- Mastering the Battle for Deposits: Actionable Insights for Retail Banks in 2024

Interactive Brokers recorded the steepest monthly decline among major platforms, plunging 10.5% to $30.9 million from September's $34.2 million. The $3.2 million outflow represented the broker's sharpest single-month drop in recent periods.

Despite the October setback, Interactive Brokers posted a 11.4% year-over-year gain from October 2024's $25.6 million, suggesting longer-term client acquisition success.

tastyfx Defies Industry Weakness

tastyfx emerged as October's standout performer, jumping 5.3% to $46.2 million from $43.7 million in September. The $2.4 million monthly gain bucked the broader industry trend as the platform attracted new forex flows.

The strong monthly performance couldn't offset longer-term weakness, with tastyfx deposits down 19.2% from October 2024's $42.8 million.

Trading.com posted modest gains with a 3.1% monthly increase to $2.5 million from $2.5 million, adding $78,720 in new deposits. The platform showed impressive year-over-year momentum with deposits up 28.0% from October 2024's $1.9 million, marking the strongest annual growth rate among tracked brokers.

Market Leaders Face Pressure

Charles Schwab reported $59.9 million in October forex obligations , down 0.7% from September's $60.3 million. The institutional broker shed $395,164 during the month as retail currency trading remained subdued. Schwab's deposits fell 8.1% year-over-year from October 2024's $64.4 million, reflecting persistent challenges in attracting retail forex clients.

OANDA saw deposits decline 1.7% to $144.9 million from September's $147.3 million, losing $2.4 million in client funds. The platform faced steeper annual headwinds with deposits down 20.2% from October 2024's $170.4 million, marking one of the largest year-over-year declines in the industry.

FTMO has just completed its acquisition of OANDA after ten months. At the same time, Paweł Łatocha, a former IG Group risk executive, has joined the broker’s management board in Poland.