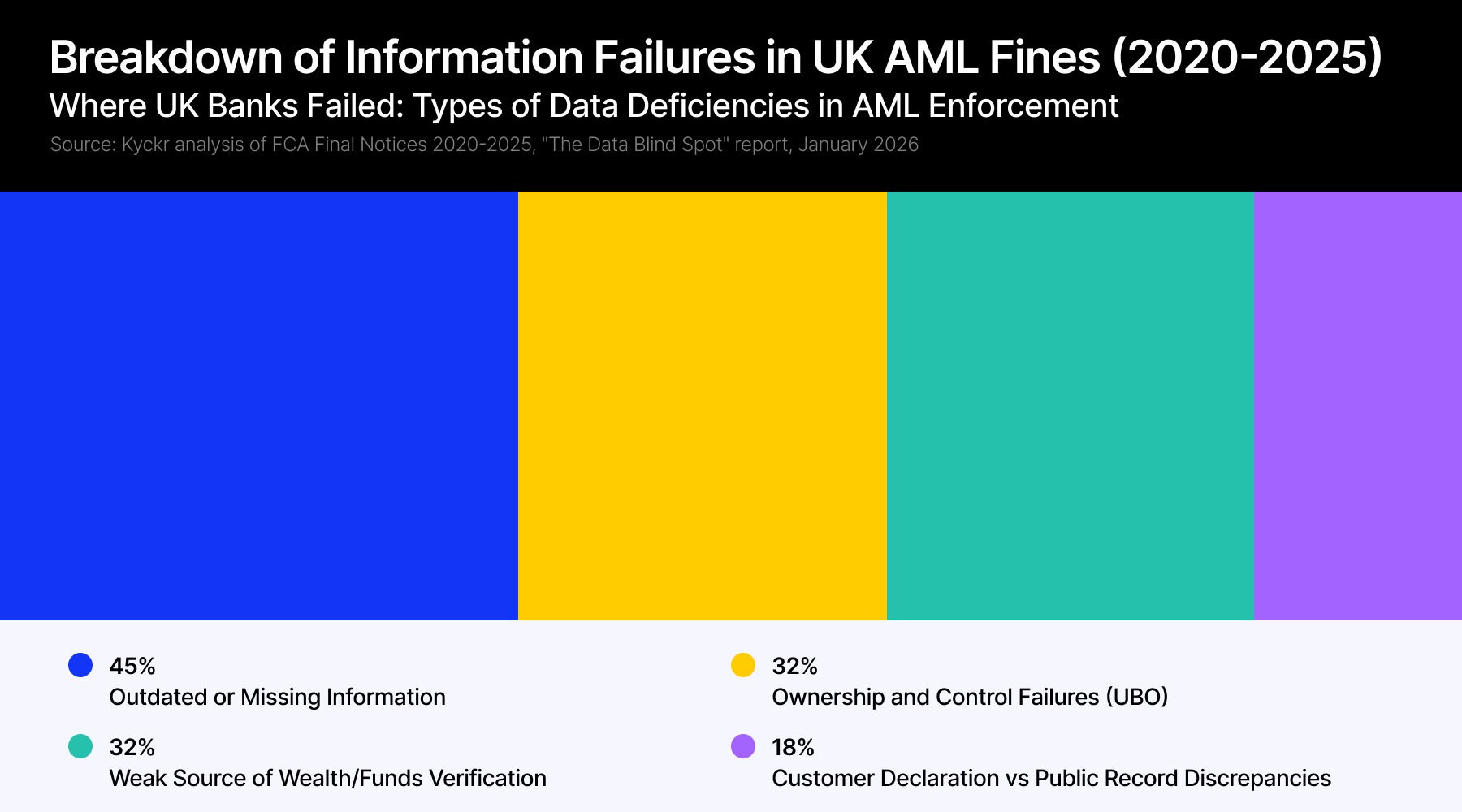

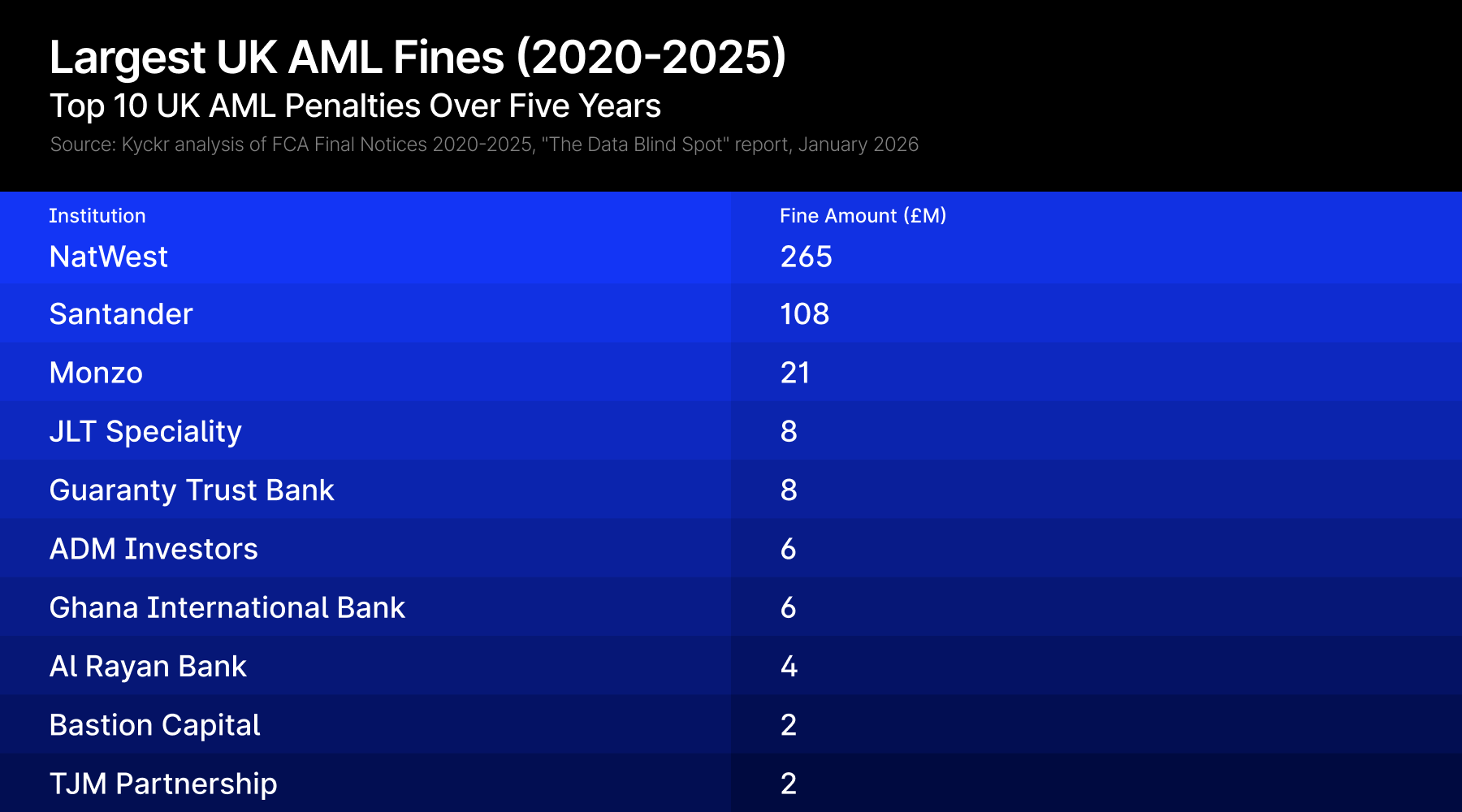

Data deficiencies contributed to 68% of anti-money laundering fines imposed on UK financial institutions over the past five years, with total penalties exceeding 430 million pounds, according to an analysis of 22 FCA enforcement cases released by compliance technology firm Kyckr.

The report found that "outdated records, missing customer information, or reliance on self-disclosures without independent verification" repeatedly appeared in enforcement actions, even when governance failures and weak controls were the primary causes.

The findings point to what Kyckr calls a "clear regulatory shift" where "the FCA is no longer satisfied with firms having policies 'on paper.'"

Missing and Outdated Records Drive Enforcement

Forty-five percent of the reviewed fines involved outdated or incomplete data. Gatehouse Bank screened shareholders of a high-risk special purpose vehicle in December 2014 against an outdated investor list, only discovering during 2016 remediation work that several recent investors were politically exposed persons.

The FCA stated the bank "failed to properly assess the money laundering risk" because it relied on stale information.

- UK Watchdog Extends Consumer Duty Lens from CFDs to “Complex” Exchange Traded Products

- 7 Million Britons Sit on Cash as FCA Moves to Nudge Them into Investing

Ghana International Bank failed to detect for five years that a business client had ceased trading in 2011.

Monzo prioritized transaction monitoring over gathering customer information during onboarding, but the FCA noted this "made it challenging for the financial crime team to contextualise subsequent account activity." The digital bank couldn't verify ultimate beneficial owners for 19,198 entities it onboarded, and some customers listed addresses as Buckingham Palace and 10 Downing Street.

Using automated compliance without adequate human oversight has proven insufficient, as recent cases show how technology missed red flags including executives previously fined millions.

Customer Claims Go Unchecked Against Public Records

NatWest's case illustrates the cost of failing to verify customer information. A high-risk gold bullion merchant later convicted of money laundering mysteriously had its industry classification changed from "precious metals" to "wholesale of metals and metal ores" in December 2013.

The bank was "unable to say definitively how this happened," but the change didn't match Companies House records. The account's risk rating dropped from high to low, removing it from a 2014 remediation program and allowing millions in illicit funds to flow through without scrutiny.

Santander opened an account in May 2013 for a company claiming to operate as a translation service with 5,000 pounds in estimated monthly turnover. Companies House listed it as financial intermediation. By March 2014, some 26 million pounds had passed through the account. The pattern repeated with three other money services businesses.

Source of Wealth Verification Failures

Al Rayan Bank failed to verify 82% of customers' source of funds and 96% of source of wealth in a sample of 50 files. The bank onboarded a wealthy Qatari businessman allegedly deriving wealth from a property portfolio but "wasn't able to obtain 'independent' information, including 'evidence of ownership or income,'" the report states.

Another customer deposited 580,000 pounds in cash despite claiming it would make monthly 2,000-pound installments.

In the meantime, nearly 9 in 10 crypto registration applications failed UK AML standards in recent years, with only four applications approved out of 35 reviewed.

The analysis notes most violations occurred over a decade before final notices were issued, and "do not necessarily reflect the practices in place today." The study excluded Starling Bank and Credit Suisse cases because their failures weren't data-related.