Nearly all price gains in major technology stocks on Wall Street have occurred outside regular trading hours over the past year, according to new market data released today (Monday). It prompted CFD broker Pepperstone to more than triple its after-hours trading offerings to over 100 U.S. stocks.

Tech Giants Made Nearly All Gains After Hours, New Data Shows

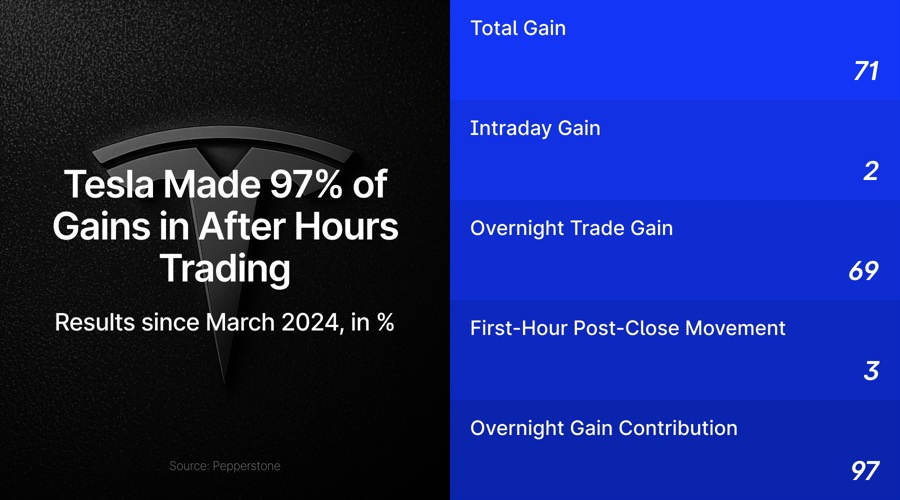

Analysis of trading patterns shows that Tesla recorded 97% of its price appreciation during after-hours trading since March 2024, while Alphabet saw 91% of its gains outside regular market hours. Nvidia, currently the market's third-most valuable company, generated 82% of its returns when traditional exchanges were closed.

These statistics emerge as institutional investors and algorithmic trading systems increasingly react to market-moving events such as earnings releases and global developments during overnight hours, leaving traditional day traders potentially missing the market's biggest moves.

“The data trends we’ve observed suggest that, for traders whose strategy holds the edge in periods of trend and heightened movement, it’s the overnight session that has generated the best returns for the NAS100 and many of the marquee US equity plays,” said Chris Weston, Head of Research at Pepperstone.

Finance Magnates wrote about this a year ago when Robinhood shared statistics showing that $10 billion in volume was traded after hours.

The findings highlight a fundamental shift in global market dynamics, where Asian trading hours and pre-market responses to earnings releases can drive significant price movements before U.S. exchanges open. This trend has accelerated with the rise of 24-hour cryptocurrency markets and increased retail trading participation across time zones.

Pepperstone Expands 24-Hour Stock CFDs as After-Hours Trading Surges

In response to these patterns, trading platforms are racing to provide round-the-clock access. Pepperstone is one of them, expanding its 24-hour trading service to include an additional 79 US share CFDs, bringing its total offering to more than 100 continuously traded instruments.

The expansion follows the broker's initial launch of 24-hour US share CFD trading in March 2024. The new offering encompasses technology companies such as ASML and Palantir, transportation service provider Uber, entertainment company Netflix, and financial services firms Mastercard and Visa.

This development enables traders to respond to market-moving events such as earnings announcements and economic data releases that occur outside standard trading hours.

“Aside from the complete ability to react at a time of the trader's choosing, this relative performance is perhaps another reason why 24-hour US equity pricing may be the default position for equity traders in the future. One to watch with Nvidia’s earnings report coming up,” added Weston.

Pepperstone is not the only one that has expanded its clients' access to round-the-clock trading. A similar move was made this month by Charles Schwab and Firstrade, although the latter offers 20/5 trading.

Overnight Trading Drives US Equity Gains

Pepperstone examined price movements for US 24-hour share CFDs since March 2024, when the company introduced the offering. The analysis divided the trading day into two key periods: US cash equity trade (09:30 to 16:00 EST) and the ‘overnight’ session (16:01 to 09:29 EST). The team assessed cumulative percentage changes in various assets, including the NAS100 index and several prominent individual stocks.

The study also investigated performance within the first hour after the US stock market closed, a period known for heightened activity due to corporate earnings releases and other key developments.

Key Findings: NAS100 Index Gains from Overnight Trading

Since March 2024, the NAS100 index has registered a 20.1% total gain. However, a detailed breakdown of performance reveals a striking contrast:

- If a trader had engaged in intraday trading only—buying at market open and selling at close—they would have recorded a cumulative 1% loss.

- In contrast, executing trades in the ‘overnight’ session—buying after the US close and selling just before the next market open—would have resulted in a cumulative 21.1% gain.

This discrepancy suggests that market-moving events and momentum are favoring extended-hour sessions, a trend that also holds for individual equities.

Applying the same methodology to select high-profile stocks, the analysis showed that overnight trading accounted for the majority of gains in some of the most actively traded US equities.

Stock | Total Gain (%) | Intraday Trade Gain (%) | Overnight Trade Gain (%) | First-Hour Post-Close Movement (%) | Overnight Gain Contribution (%) |

Nvidia (NVDA) | 64.8 | 11.7 | 53.1 | 0.9 | 82.0 |

Tesla (TSLA) | 70.7 | 1.6 | 69.1 | 3.2 | 97.0 |

Alphabet (GOOGL) | 34.9 | 3.1 | 31.8 | -6.2 | 91.1 |

These results indicate that traders focusing only on regular market hours might be missing significant profit opportunities.

One contributing factor to overnight outperformance is the release of earnings reports, which often occur shortly after market close. The analysis highlighted that in the past eight quarterly earnings reports, major stocks experienced significant one-day price movements:

- Nvidia: 9.2%

- Microsoft: 4%

- Meta: 7.9%

- Amazon: 6%

- Alphabet: 6%

- Tesla: 11.3%

While earnings-driven moves play a role, the data suggests that overnight trading extends beyond just post-earnings volatility. For traders with strategies favoring trending markets and higher volatility, extended-hour trading provides additional opportunities to capture meaningful price shifts.