Although artificial intelligence (AI) technology has made a striking entrance into the finance and trading industry, it also brings a series of potential dangers, including the increasingly common deepfakes that are difficult-to-identify.

Finance Magnates discussed the latest trends in AI and deepfakes with Michael Lashlee, the Chief Security Officer (CSO) at Mastercard, who commented on the findings of the company's latest report on this year's technology trends.

AI Trends and Their Impact on Finance and Trading

In its 2024 issue of Mastercard Signals, Mastercard explores the emerging tech trends poised to reshape commerce over the next three to five years. The report highlighted how advances in artificial intelligence, computational power, and data technology are converging to drive innovation across various sectors, including finance and retail trading.

One of the key AI trends discussed in the report is the rise of generative AI assistants, or "personal copilots.”

These advanced digital assistants, powered by natural language processing and machine learning, could revolutionize how financial professionals work. For traders, AI copilots could provide personalized market insights, risk assessments, and even automate certain trading strategies.

“Service industry trainees could practice customer relations with AI-generated avatars. In finance, both bank trainees and retail investors could use gen AI-created environments to practice complex trading functions,” Mastercard commented in its report.

The 4 stages of Artificial Intelligence:

— World of Statistics (@stats_feed) April 8, 2024

0. Systemic AI responds to prompts based on probabilities established during training: i.e. current state-of-the-art AI.

1. Sentient AI is quintessentially curious and uses experience to refine beliefs about the world.

2. Sophisticated…

These AI assistants could help traders make more informed decisions and optimize their portfolios by leveraging vast amounts of financial data and real-time market information.

Another AI trend with significant financial implications is using artificial intelligence to enhance software development. AI-powered tools can assist developers in writing code, designing software architecture, and testing applications.

This could lead to the creation of more sophisticated financial software and trading platforms, enabling traders to access advanced analytics and execute complex strategies more easily.

In a conversation in February with Finance Magnates, Dr. George Theocharides, the Head of the Cypriot regulator CySEC, argued that: "AI remains uncharted" in most of the EU's securities markets.

The Threat of AI-Generated Deepfakes for Traders

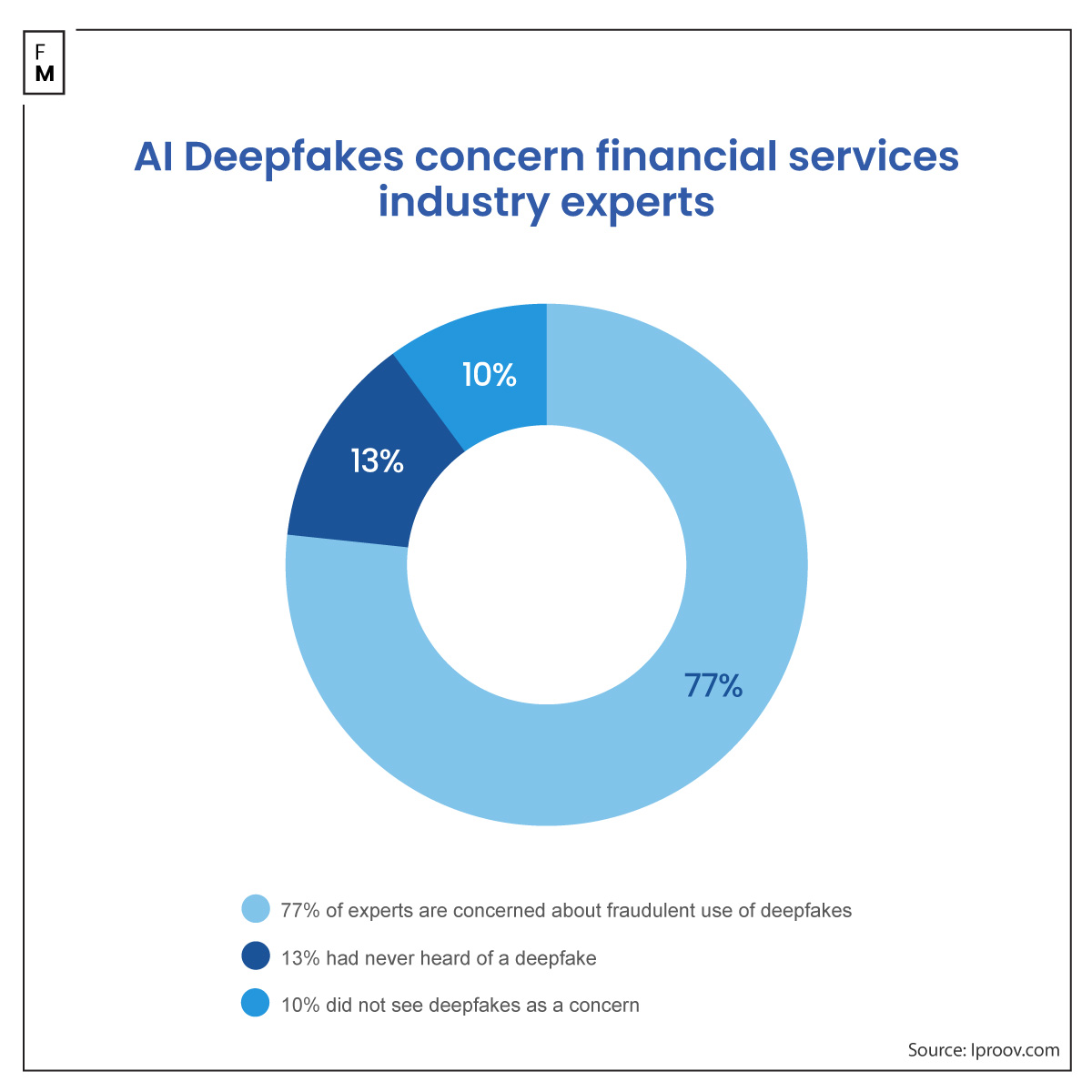

While AI presents numerous opportunities for the finance industry, it poses certain risks. One such risk is the rise of AI-generated deepfakes, Deepfakes are highly realistic media content, such as videos or images, created using AI to manipulate or deceive viewers.

“46% of businesses have been targeted by identity fraud using deepfakes,” Mastercard revealed. “37% of them were targeted by deepfake voice fraud and 29% by deepfake videos. The deepfake detection market is expected to grow 42% annually through 2026.”

For retail traders, deepfakes could be particularly problematic. Malicious actors could use deepfakes to spread false information about companies or markets, leading to market manipulation and financial losses for unsuspecting investors.

We're all familiar with the stories of a fake Elon Musk encouraging investment or a fictitious Taylor Swift urging the use of financial services.

A verified YouTube account was impersonating SpaceX and livestreaming an Elon Musk deepfake crypto scam.

— DogeDesigner (@cb_doge) April 9, 2024

The number of scams on YouTube has skyrocketed. YouTube should just change its name to ScamTube. pic.twitter.com/5z6c0w0jft

According to Michael Lashlee, the Chief Security Officer (CSO) at Mastercard, the troubling trend presents a significant risk to businesses across all sectors. It will only become more pressing as the technology evolves.

“This heightened risk, coupled with the lack of broad public awareness on the issue, will make it easier for bad actors to exploit this technology,” Lashlee commented for Finance Magnates. “Organizations need to educate their employees about this risk and train them to question and confirm through trusted channels any out of the ordinary transactions or funds transfers."

The Mastercard’s CSO concluded that companies must implement processes and procedures to protect themselves and their assets from being compromised.

As scammers use AI for nefarious purposes, Mastercard utilizes this technology to protect consumers from fraud, especially since the annual cost of cybercrime will reach $10.5 trillion next year.

The Role of Computing Power and Data Technology

The Mastercard report additionally highlights the crucial role of computing power and data technology in enabling these emerging tech trends. Advances in chip technology, cloud computing, and quantum computing are providing the computational resources necessary to train and run sophisticated AI models.

The report discusses the growing importance of data tokenization in the realm of data technology. Tokenization allows for the secure and efficient sharing of sensitive data, such as financial information, across different platforms and applications.

“The horizon for tokenization is expanding, with emerging applications across healthcare, finance and cybersecurity. By enabling different types of data tokenization, this technology enhances security and opens new avenues for data use,” Mastercard report added.

This could enable more seamless and secure data exchange between financial institutions, traders, and other market participants. Financial firms that can effectively leverage their data assets while ensuring data privacy and security will be well-positioned to capitalize on emerging tech trends.