Morgan Stanley has agreed to pay a $2.6 billion Settlement to the US Department of Justice over the firm’s creation and sale of residential mortgage-backed securities, leading to the 2008 financial crisis.

The settlement is another one in a long string of regulatory steps taken against the company over similar allegations. Last year the firm settled with the Federal Housing Finance Agency for $1.25 billion over accusations that the bank sold faulty mortgage-backed securities to Fannie Mae and Freddie Mac.

The company reached a similar settlement in July for $275 million with the Securities and Exchange Commission over accusations that the company understated the number of delinquent loans backing subprime mortgage securities.

But what exactly did the bank do to warrant these enormous settlements? Highlights of internal documents revealed in legal proceedings show a frightening level of negligence.

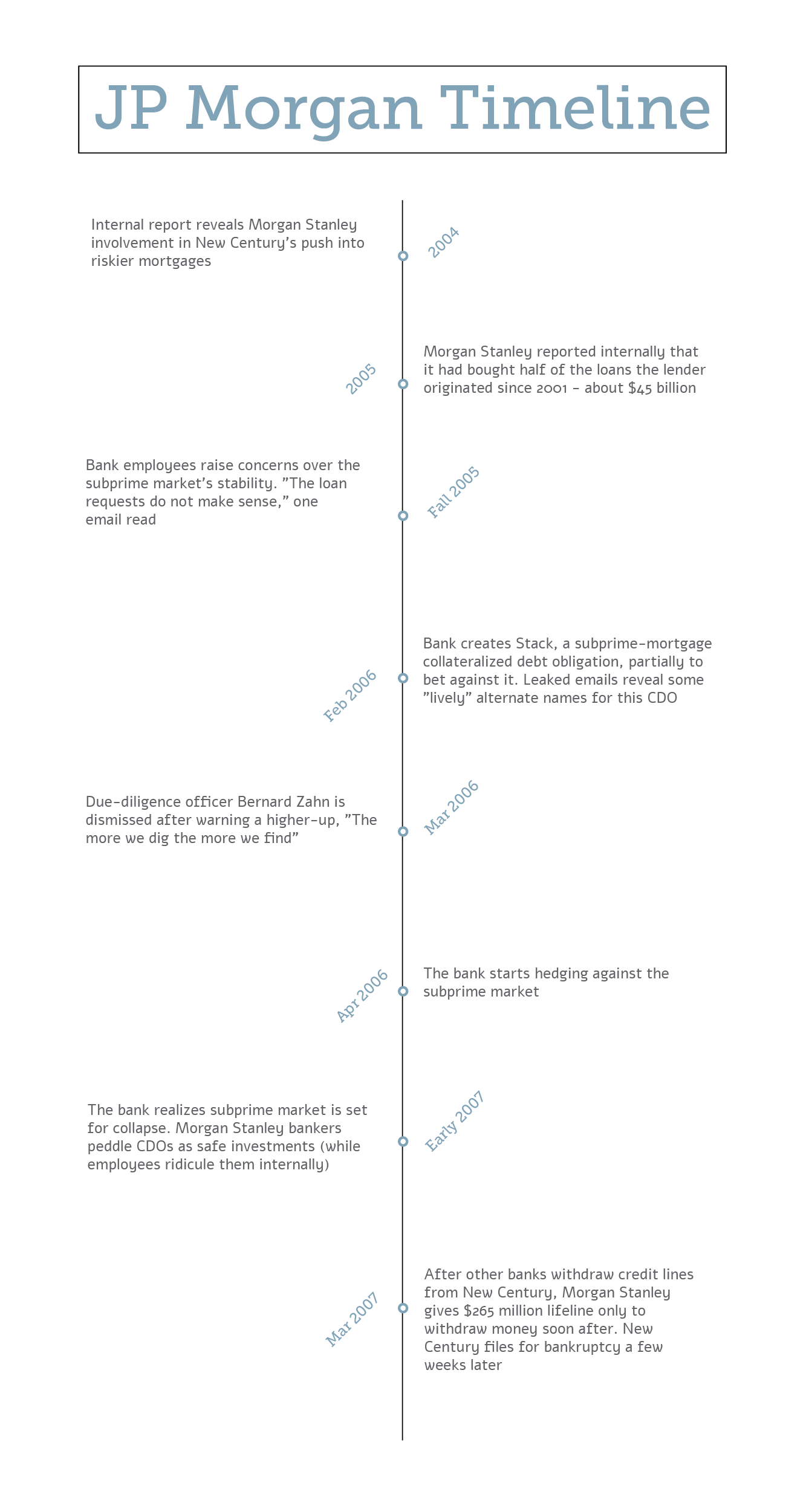

For instance, one due-diligence email read, "The real issue is that the loan requests do not make sense." It cited an example of one borrower listing his salary as $12,ooo a month while working at a tarot reading parlour. Another email pointed out that "deteriorating appraisal quality is very flagrant."

Not only did higher-ups pay no heed to these concerns, the situation was made light of by Pamela Barrow, top due diligence executive. Some choice quotes of hers mocking home buyers include, "First payment defaulting straw buyin' house-swappin first time wanna be home buyers," and, "We should call all their mommas." She continues, "Betcha that would get some of them good old boys to pay that house bill."

In direct response to an email from a due-diligence officer, Bernard Zahn, where he voiced concern that the problem was very widespread, she wrote, "Good find on the fraud :)" but continued with a frank, "Unfortunately, I don't think we will be able to utilize you or any other third party individual in the valuation department any longer."

To paint readers a clearer picture we’ve put together a timeline of Morgan Stanley’s role in the years leading to the subprime mortgage crisis.

For reference, New Century Financial Corporation was a real estate investment trust that originated mortgage loans in the United States. As of January 1, 2007, New Century was the second-largest subprime mortgage lender in the US.

This marks the fourth time over the past five years that the company has been forced to reduce earnings in the weeks following an earnings announcement as the company has now cut 2014 income from continuing operations by $2.7 billion due to the increase in legal reserves related to mortgages.