The London-based provider of market data and trading infrastructure services, MarketPrizm, has today announced that it will offer data and order entry services to the Dubai Gold & Commodities Exchange (DGCX), one of the fast- growing electronic commodity and currency derivatives exchanges in the Middle East and North Africa (MENA) regions, with 267 members from across the globe.

According to the official press release, these services will provide European investors with improved access to the DGCX, with benefits that are expected to result from MarketPrizm’s low latency data and managed trading services that will enable investors to connect to DGCX and send orders directly into the exchange for trade execution, and receive data from anywhere in Europe without the added costs of establishing connectivity into Dubai, and thus reducing costs and providing a faster time to market

Jay Hibbin, MarketPrizm’s Commercial Director

Commenting in the official corporate annoucement, Jay Hibbin, Commercial Director of MarketPrizm said, “Extending our offering to provide market data in the UAE is an exciting step for MarketPrizm.”

Mr. Hibbin further added in the release regarding the importance of cross-border connectivity, “The increasing number of international trading houses in Europe who want to trade commodities and FX in the UAE will now have easier access to this highly sought after market. And the DGCX will benefit from expanded foreign trading volumes by global investors. This move is in-line with our focus on enabling customers to deploy increasingly complex multi-venue trading strategies across the derivatives, FX and commodities markets.”

Currencies, as noted previously by Forex Magnates, have played a pivotal role for the exchange's growth with the DGCX’s Indian rupee contract being the superstar at the regulated trading venue.

DGCX has attracted considerable volumes in some of its products as the exchange continues to build its offering, the announcement with MarketPrizm is aimed to facilitate ease of access along with the above mentioned benefits, and thus provide foreign connectivity into the exchange to be more streamlined. The exchange has also recently joined Euroclear as covered by Forex Magnates in early September.

DGCX Continues to Build Out Offering to Attract Global Volumes

Gary Anderson, CEO of DGCX

Gary Anderson, CEO of DGCX said in the corporate announcement, “We are very happy to welcome MarketPrizm, a leading provider of market data and trading infrastructure services, to the DGCX community. As DGCX widens its global footprint, enhanced access and connectivity to the Exchange will be a critical enabler for our growth. We look forward to working with MarketPrizm to make it easier and more cost effective for traders in Europe to connect and trade on DGCX.”

As the need for cross-border connectivity continues to play a major role in enabling brokerages to access international markets without undue latency, the importance of a reliable and fast connection across various mediums is just as important as local brokerages look to international markets to diversify their product offerings.

A challenge for such firms has been the lack of ease in accessing foreign markets and exchanges from their home turf. Over recent years, there have been a number of efforts to solve this dilemma, such as the announcement from MarketPrizm today.

Connectivity and Market Efficiency Go 'Hand-in-Hand'

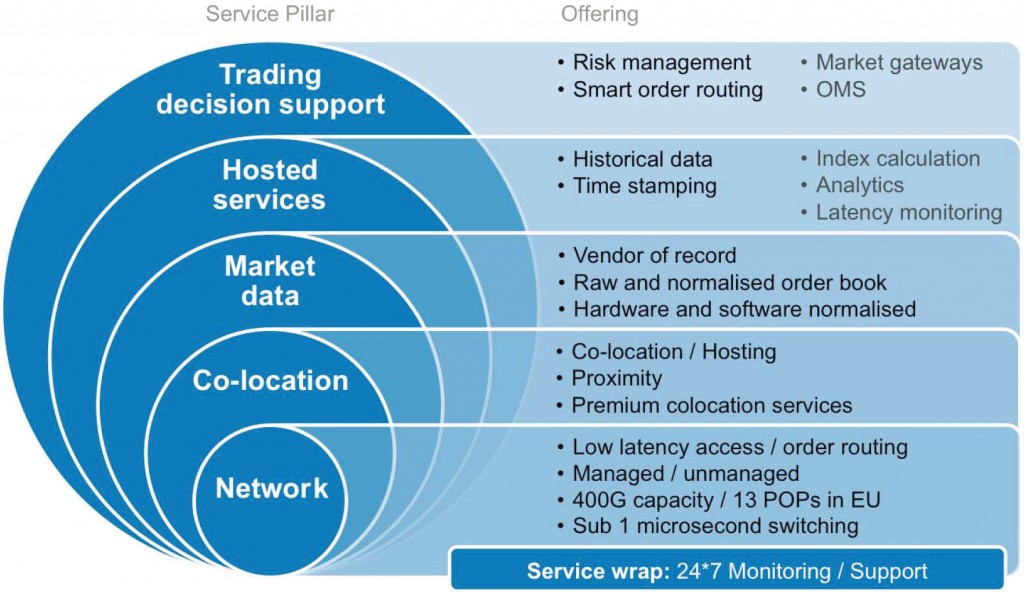

According to information on its corporate website, MarketPrizm operates what they refer to as the only 'entirely-dedicated' infrastructure for financial trading industry through its PrizmNet. More specifically, PrizmNet enables clients access to more than 5,500km of optical or ethernet connectivity designed with the fewest number of ‘hops’ and the most technologically advanced latency-reducing switches and routers. The company launched a service for FX last year.

![PrizmNet [Source: MarketPrizm]](https://www.financemagnates.com/wp-content/uploads/fxmag/2013/11/PrizmNet.jpg)

PrizmNet [Source: MarketPrizm]

Such a network entirely dedicated to trading means that 'trading data' is the only data that courses through PrizmNet, which is a 10Gbps physical optical fibre infrastructure designed as a full ‘mesh’. This mesh design ensures resilience to fibre cuts in an ‘any-to-any’ distributed model, as per the MarketPrizm website description. This solution is also described by the company as the fastest multi-venue connectivity infrastructure available in EMEA, with routes constantly optimized to reduce latency.

Looking into the MarketPrizm's Parent company, Colt S.A, it appears to have substantial coverage across industries as disparate as insurance to media or Telco & IT, in addition to legal, financial services, business and other enterprises.

Source: Colt

This includes, operating a 21 country, 33,000km network that includes metropolitan area networks in 38 major European cities with direct fibre connections into 17,000 buildings and 19 Colt data centres.

Its customers include the world’s largest 25 institutions, and connects 20 of Europe’s stock exchanges and hosts 7 of them, including servicing the top five providers of market data and providing the Payments infrastructure for 13 central European banks. On this basis, the announcement today appears to have been of the best choices available for DGCX to more easily connect with investors from Europe.

Source: MarketPrizm