The past few weeks have seen a noticeable rise in both market Volatility and the amount of market sensitive macro developments. The price actions seen in FX, commodity and equity markets last week highlight the ongoing themes prevailing in the market, underlining the fact that several asset classes are now reaching multi-year highs (lows) and causing significant angst amongst investors.

EUR/USD had a rather flat week, with the pair consolidating between 1.24 and 1.25 as traders digested the previous week’s US jobs report and ECB meeting. The longer-term downtrend remains intact.

Against GBP, the US dollar firmed significantly last Wednesday as the Bank of England (BoE) stepped back from its tightening bias and struck a much more accommodative tone in its Quarterly Inflation Report, prompting traders to push back their expectations of rate hikes in the UK.

In the Land of the Rising Sun

USD/JPY extended its escalating uptrend last week, reaching a new 7-year high above 117.00. The almost ‘parabolic’ fall in some JPY pairs over the past few weeks has a good chance of staging a severe correction given that the majority of price moves are speculative. A rather interesting side note is the Nikkei’s tendency to follow USD/JPY higher. Bank of Japan's (BoJ) ultra-loose monetary policy is directly lifting Japanese stock prices.

The BoJ is becoming an increasingly large source of support for the Japanese stock market, hiking up purchases of Exchange -traded funds to bring its equities portfolio to an estimated ¥7 trillion ($60 billion) as of September 2014; while pile-driving inter market lending rates and bond yields lower via ‘Abenomics’.

The BoJ bought ¥124 billion (~$100 billion) worth of ETFs in August, the largest monthly tally so far this year. Japanese core inflation remains stagnant around 1% and the lack of consumer spending is weighing on overall economic growth.

A potential salvation could be export-led demand via a weaker yen, although the contribution from the ‘trade’ element of today’s aggregate demand formula is unlikely to be sufficient to reel in the slack left by all the other components, such as consumption, investment and government spending. Prime Minister Shinzo Abe will bloat the latter in a an attempt to try though.

Several central banks have had the same idea as the BoJ as they attempt to support their respective economies through a weaker exchange rate. The competitive ‘race to the bottom’ in terms of exchange rate devaluations is another factor diminishing the positive effects of a weaker yen for Japan.

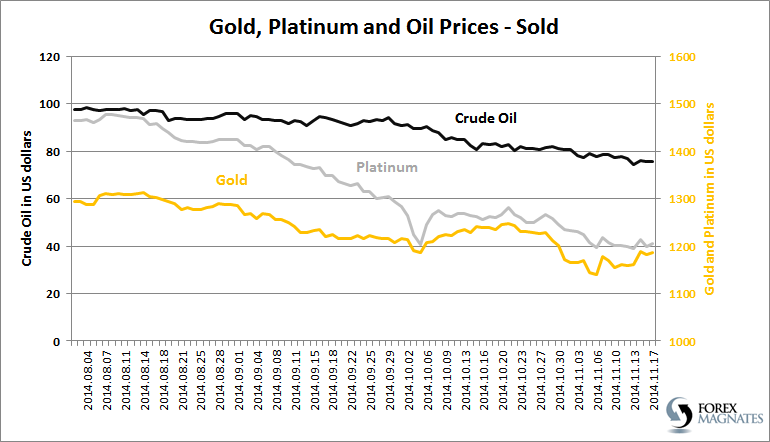

Black Gold, White Gold, Yellow Gold - Sold

The past month has seen prevailing downward trends in oil and metals markets gain further momentum and those trends exacerbated. So much so, that crude oil prices have now fallen 10% in the last 3 weeks alone, breaking below the key $76 support level on Thursday. By Friday, futures prices had reached a low of $73.25 before bouncing back sharply to close the week at $75.91.

Although crude stocks decreased slightly last week, this is unlikely to indicate a strengthening of demand. With aggregate demand falling or flat across most of the G20 and beyond, combined with OPEC continuing to refuse implementing production cuts, bullish oil prices are mired in weak sentiment.

In addition, several OPEC oil ministers have recently dismissed the idea of production limits and the next OPEC meeting is only on November 27th – 10 days could be an eternity for several market players in addition to speculators. The Russian Federation and the Central Bank of Russia (CBR) as prime examples.

The Russian Bear Needs Her Honey

The CBR has a $60 theoretical threshold when factoring in oil prices into its macro forecasts. As recently as September, the CBR announced that it was assuming an “oil price of $60 per barrel in its new stress scenario for monetary policy,” according to CBR’s First Deputy Governor, Ksenia Yudayeva. Adding, “The purpose of this scenario is to prepare a shock scenario to work out an action plan which we would implement to limit negative effects."

Alongside plunging oil prices shrinking Russia’s revenue pockets, the global foreign exchange market is also eroding what’s in their pocket to begin with. The Russian ruble has fallen from 33.14 to 46.75 (at the time of writing) against the US dollar since the start of 2014 - a brutal 41% depreciation. With macroeconomic and geopolitical developments conspiring against and exacerbating each other, Russia’s economic position is ominous.

The ruble currency has been caught in a pincer movement with falling oil prices on one side and risk aversion towards Russian assets on the other, both exacerbating the negative effects on ruble-denominated markets. Oil and gas continue to rule the roost in Russian economics with suppressed oil (and other commodity) prices taking away highly sought-after revenues and foreign currency reserves.

Since the beginning of October, the bank has shifted the ruble’s trading band five times in a bid to stem foreign currency outflows from the beleaguered nation. All of the market interventions implemented to date have done little more than slow down the pace of RUB depreciation at the cost of foreign exchange reserves.

However, on the flip side, Russia is actively investing in physical gold on a central bank level, buying 55 tonnes of gold in Q3 2014 alone. The CBR’s rate of gold acquisition was the highest rate globally in Q3.

Russian authorities are fighting for the economic high ground in their ongoing economic and geopolitical conflict with the U.S.