Despite being a nation of savers, Italians remain largely absent from the financial markets. The average Italian investor would prefer a low-risk, low-return investment with a short- to medium-term holding period. This is mainly due to liquidity needs related to unexpected expenses, lifestyle choices, and family support rather than long-term retirement planning.

Italian Investors' Habits

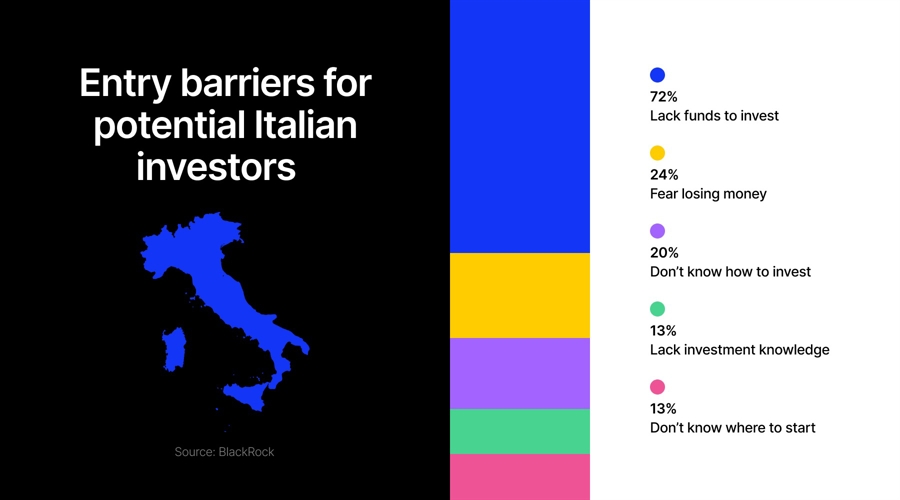

These behavioral patterns and investment preferences were clearly illustrated in BlackRock’s October 2024 “People and Money” report, which analyzed investment trends across 14 European markets. Focusing on the Italian market, BlackRock surveyed nearly 5,000 investors and identified nine key barriers preventing potential Italian investors from entering the market.

The survey revealed that 72% of respondents do not have enough money to invest, while 24% are worried about losing money. Additionally, 20% do not know how to invest, and 13% lack sufficient knowledge about what to invest in. Another 13% do not know where to start, while 7% are unaware of the benefits of investing. Furthermore, 6% find it difficult to control their expenses, 5% do not have enough time to invest, and 3% struggle to select the best investment from different alternatives.

The result? Only 29% of Italian adults invest—one of the lowest percentages in Western Europe, ahead of only Spain and Portugal, where the figure is 28%.

Also, read the first part of this three-part series: Italy’s Underrated Trading Market: High Value, Low Participation

When it comes to investing, the gap between Europe and the United States is striking. While 58% of American households have some exposure to the stock market, only 7% of European families do. Nowhere is this contrast more evident than in Italy, where retail investors have long been known for their cautious approach, favoring stability over risk.

A 2022 survey by the Commissione Nazionale per le Società e la Borsa (CONSOB), Italy’s financial regulator, sheds light on the reasons behind this conservative mindset. It reveals that a combination of low financial literacy, limited budgeting habits, and cultural influences continues to shape the investment choices of the average Italian household.

From this survey, it emerged that the main reasons behind the average Italian household’s portfolio composition—and the stereotype, rooted in tradition, of preferring stable assets—mainly derive from two factors: low perceived financial knowledge and poor financial planning and budgeting skills.

Risk-Averse Italians

Among the surveyed population of Italian retail investors, in most cases, fewer than 50% stated that they had heard of and understood basic financial concepts such as the risk-return relationship, compound interest, inflation, mortgages, and diversification. Consequently, many Italian retail investors might feel completely unprepared when considering an investment in a more complex financial product such as a CFD.

To compare perceived and actual financial knowledge, CONSOB’s survey also included a brief questionnaire that investors had to answer to assess their understanding of basic financial concepts. In every category, at least one-fifth of the investors underestimated their knowledge. Netting out the downward and upward mismatch, the results suggest that, on average, Italian investors underestimate their financial understanding. This phenomenon is particularly evident in topics such as the risk-return relationship and compound interest, where only one-third of Italians stated that they had “heard of and understood” the concepts.

Because of this, along with other tradition-based factors, Italian investors can generally be considered risk-averse. Around 70% of investors in Italy prefer to invest in moderate-and low-return assets to limit their exposure. Moreover, almost 70% of investors agreed with the statement, “I feel anxious if there is even the possibility of losing any portion of the invested capital,” further reinforcing the risk aversion of the average household.

Turning to CFDs, the risk aversion survey revealed that only 9% of surveyed investors agreed that they would invest significantly in a high-risk security, indicating the likely portfolio weight of CFDs and other derivatives in the average Italian portfolio.

Despite Italians being considered a nation of savers, recent polls show that one of the main barriers to entering the financial markets is the lack of disposable income. In the CONSOB report, investors were asked about their financial planning and budgeting habits. The findings revealed that 43% of Italians had never had a financial plan in their lives, and only 18% had a budget that they always adhered to. As a result, only 12.4% of Italians were considered savvy planners.

Italian Investors Are Left Behind

A key factor limiting Italians’ ability to invest is the primary reason they save in the first place. Italy ranks second only to Spain and Portugal for having the lowest percentage of adults investing in Western Europe. Beyond the reasons already discussed, a major factor is that only 31% of savers have retirement as their goal. Instead, most households save to enjoy life, support their families, prepare for unexpected events, and for other personal reasons.

Given the risk aversion of Italian investors and the barriers to entry faced by potential ones, it is unsurprising that the composition of the average Italian portfolio leans towards safe assets. According to CONSOB’s report, in 2022, the average investor allocated 50% of their portfolio to bank and postal savings, 29% to mutual funds, and 18% to Italian government bonds. Meanwhile, only 2% of the average portfolio was allocated to derivatives, and 3% fell into the “other” category, which includes CFDs, Alternative Investment Funds (AIFs), and other financial instruments.

However, it is important to view this data with caution, as 2021 and 2022 were unique years following the pandemic crisis. The uncertain market conditions and high-yielding bonds may have further pushed Italian investors towards safer investment options during this period.

The next part of this Italy-centric series will dive deep into how the investment trends in the country are changing among young investors.