The financial services sector has spent years blaming a confidence problem for keeping women out of investing. Research from eToro suggests that explanation is not only wrong, it's making things worse.

Financial Industry's “Confidence Gap” Messaging Backfires on Female Investors

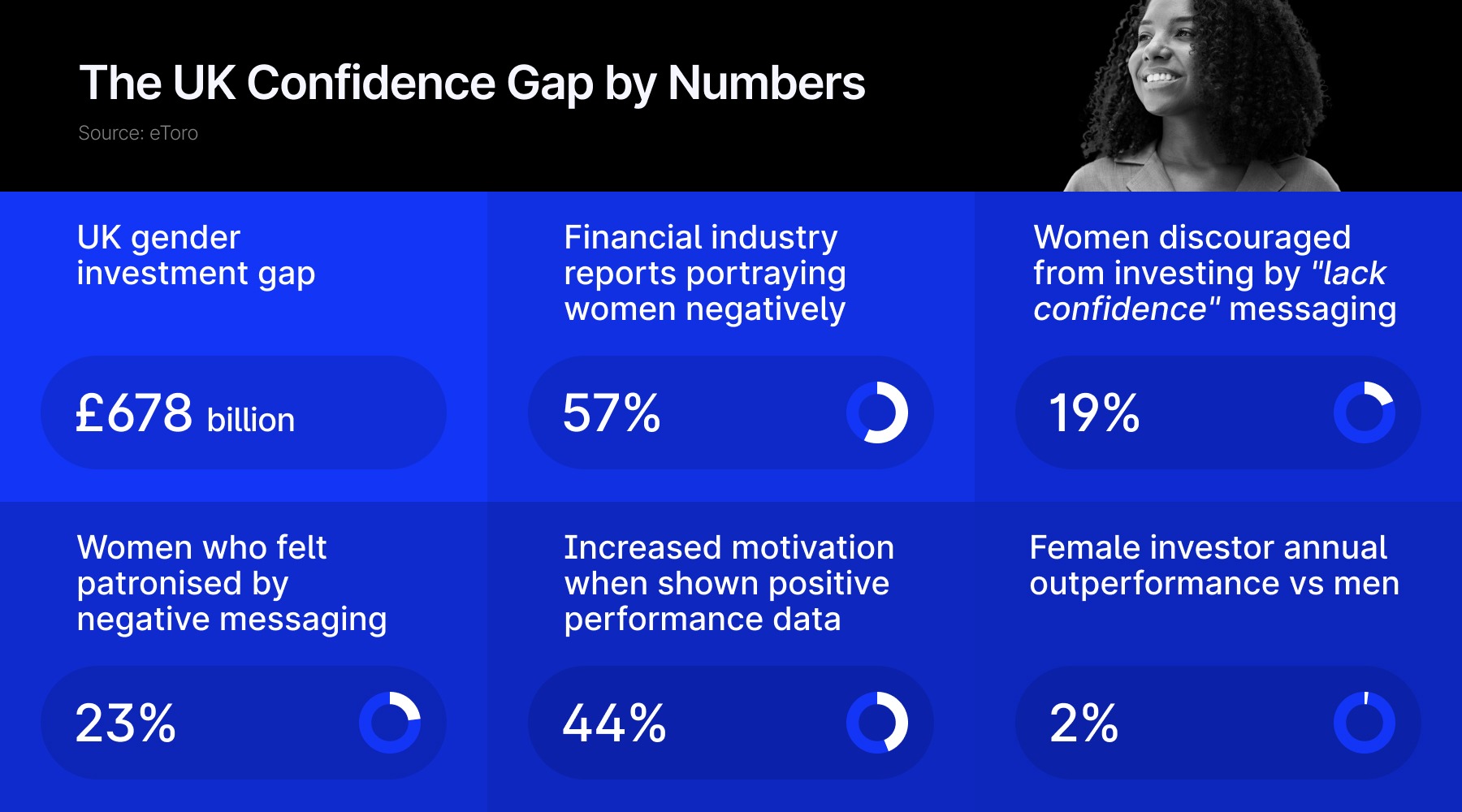

An analysis of more than 80 UK reports and campaigns published by financial companies between 2020 and 2025 found that 57% portrayed women's confidence around investing in negative terms.

The reports recycled familiar phrases: women are “too nervous to invest,” “unsure where to start,” or “too scared of losing money.” Only 21% took a different angle, highlighting qualities like patience and long-term focus that female investors bring to the table.

The language matters. When eToro and research firm Appinio tested these messages on 2,000 UK women, nearly one in five said being told they lack confidence made them less likely to invest. Almost a quarter felt patronised. Another 17% said it drained their motivation.

“This constant negative framing is not harmless commentary, it's damaging,” said Dan Moczulski, UK Managing Director at eToro. “You could argue it's an unintentional act of collective self-harm by the very industry that claims to want to support women and close the gender investment gap.”

- eToro Goes Local in Australia with AUD Accounts, Will Offer Spaceship Access In-App

- eToro UK Profit Jumps 144% as Trading Activity Rebounds in 2024

- eToro Shares Drop Widens to 40% Since May IPO

Performance Data Contradicts Stereotype

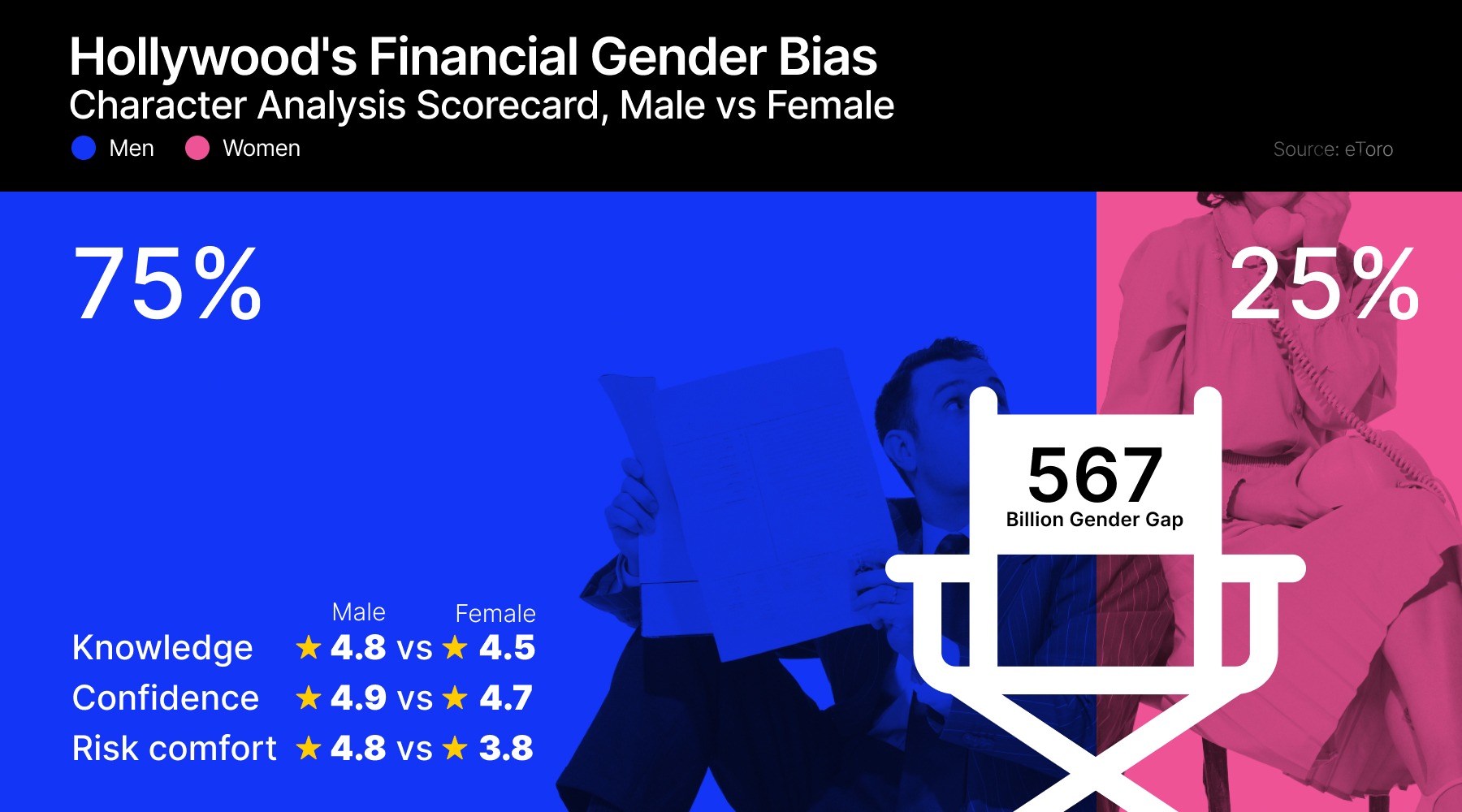

Multiple studies show female investors actually deliver stronger returns than men. Warwick Business School research from 2018 found women outperformed men by nearly 2% annually. Their tendency to ask questions, weigh options carefully and avoid unnecessary risks drives better outcomes, not worse ones.

“We don't need women to invest like men; we need them to invest like themselves,” Moczulski said. “What really sets them apart is a natural reluctance to be overconfident.”

Women trade less frequently than men and take longer-term views, both behaviors that contribute to superior performance. What the industry labels as hesitation is often just better judgment.

Positive Framing Shows Different Response

When the research flipped the script, results changed. Women shown the headline “Women investors outperform men by 4%” reacted differently. Among current non-investors, 26% said they wanted to learn more about investing. Overall motivation to invest jumped 44%.

But the problem extends beyond messaging to representation. In the eToro research, 41% of women said they don't relate to people who talk publicly about investing. More than half said the conversation is dominated by men, and 54% said it's mostly finance professionals.

An earlier study conducted this year by eToro examined this issue: men account for 75 percent of screen time in financial media, while women are often shown in subordinate roles.

Dr. Ylva Baeckström, Senior Lecturer in Finance at King's Business School, said the industry needs to change its approach. “Branding women as underconfident undermines women's excellent investment abilities,” she said. “Negative gender stereotypes are both powerful and destructive, contributing to the gender investment gap.”

Jill Scott Joins Push to Close Gap

The gender investment gap in the UK now stands at £678 billion, roughly equivalent to Switzerland's economy, according to Boring Money data published with eToro. About 3.3 million more men invest than women, and that gap widened by 200,000 people in the past year.

eToro brought on Jill Scott MBE, the former England footballer, as ambassador for its Loud Investing campaign. Scott sees parallels between elite sports and investing success.

“In football, discipline and patience are everything,” Scott said. “You don't win tournaments overnight, you build towards them over years. It's the same with investing. The industry has been too quick to focus on what women supposedly lack, when the truth is our approach is a strength.”

The Loud Investing initiative aims to change how the industry talks about female investors and push more women to start investing. The campaign argues that shared knowledge and open conversation about money can help close the gap, rather than recycling stereotypes that have failed to move the needle.