At the investor analyst conference call following the release of its Q3 financial report, Interactive Brokers was asked about the future of commissions and how companies, namely Robinhood, that provide commission-less trading are going to affect things for the future. The question comes up as Robinhood has been able to draw strong numbers of new account holders to its mobile app-based trading brokerage.

Answering, Interactive Brokers' CEO Thomas Peterffy stated that he didn’t believe Robinhood’s model was sustainable. He explained that its model is based on providing inferior Execution quality. As such, despite offering commission-free trading, he alleged that it derives revenues from how they execute orders, stating:

They don't charge any commission, but they must make the money somewhere, right?

With any business you have to have income in order to service your customers, right? You make that income some way. You either unbundle like we do, where we say this is the commission and this is the interest rate and this is so-and-so, or you just send us the money and send us your order and we will let you know how you do. Right? That's what Robinhood does. They don't charge any commission, but they must make the money somewhere, right? They must pay for the people in the office and the computers, et cetera, right? So how do you think they do that?

Overall, he didn’t view Robinhood as a serious competitor and believed once his customers look at the executions they wouldn’t want to trade with them.

Robin Hood Stands by Its Pricing

Similar to Peterffy, execution quality has also been debated among forums for retail traders and whether Robin Hood marks up orders to compensate for its lack of commissions.

The company does not markup orders, which is strictly prohibited

In in a conversation with Robinhood, a company spokesperson rejected the notion that they markup prices of orders. The representative explained to Finance Magnates: “The company does not markup orders, which is strictly prohibited, and that SEC's Regulation NMS requires that brokerages guarantee the National Best Bid and Offer (NBBO)." Part of Regulation NMS rules that went into effect in 2007, execution at NBBO prices were established to ‘level the trading field’ to help ensure that retail customers had access to the best pricing available on all trading markets. The statement was similar to one that they publicly state within its FAQ that overviews execution.

Not Just New Investors

Worth noting is that according to statistics made public by Robinhood, 75% of its customers aren’t first time investors. This reveals that the broker has been able to grow its market share at the expense of commission charging competitors like Interactive Brokers. While Robinhood doesn’t publicly break down with whom its clients have traded before, the fact that it is attracting existing investors relates that its pricing model provides them with a competitive edge. As a result, despite Peterffy’s claims to the contrary, a portion of Interactive Brokers' customers would be expected to fall among the 75% existing segment at Robinhood.

Beyond its pricing, Robin Hood believes that part of its appeal to investors is that accounts don’t have a minimum deposit side for opening new accounts. While the no-minimums is an appealing condition for new investors, it also makes it easier for existing investors to try out Robin Hood’s execution and platform. This contrasts to other US brokers which typically have minimum deposit sizes starting in the thousands of dollars.

Less Is More

In comparing Robin Hood and Interactive Brokers, commissions aren’t the only main differentiator between the two brokers. Perhaps more important are their models on serving customers.

Hands down, Interactive Brokers offers the most diverse offering of securities on the market. Customers are able to trade multiple asset types as well as products from numerous countries. The result is that there is very little that account holders can’t trade with them. On the downside, by offering tens of thousands of products on one account,its platform isn’t the easiest to use. In previous analyst calls, Peterffy himself has stated the need to modernize its platforms and make more efficient for customer use.

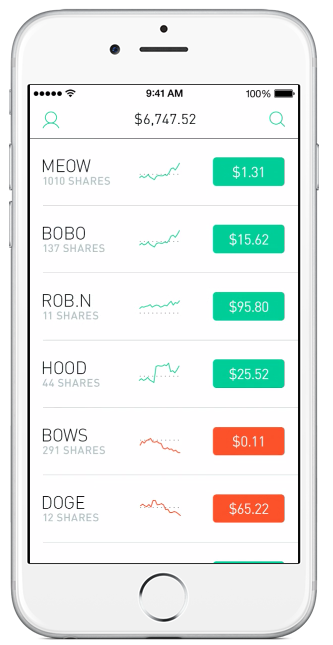

Taking an opposite approach of ‘less is more’, Robinhood accounts are only available on mobile devices. (While no official plans have been created, the firm stated on social media that they plan to release an API in the future and have begun to register interest from developers on its site.) By being mobile only, Robin Hood is simplifying the trading experience to make investing more accessible to new investors. Part of this approach includes a focus on app design to take advantage of how best to serve mobile-based investors.

Looking ahead, it will be interesting to see how commission free brokers affect the future of pricing in the brokerage industry. With its deep discount commission, Interactive Brokers itself was responsible for driving prices lower within the industry. As such, while Interactive Brokers’ CEO Thomas Peterffy may not be concerned about the future trends of commissions, Robinhood may simply be the industry’s next iteration of brokerage pricing models and appealing to changing customer trading habits.