“The two-step evaluation has no chance of being A-book. It simply cannot be done,” said Gil Ben Hur, founder and CEO of The5ers, a leading prop trading platform rivaling the likes of FTMO.

He spoke to FinanceMagnates.com in the wake of the collapse of Funded Unicorn – a prop firm that had promised to bring transparency to the industry by adopting an A-book model – only to shut down shortly after. “The popular two-step evaluation model is fundamentally incompatible with true A-book execution,” he added.

Although prop firms do not explicitly reveal their risk management models, other props might also be running A-book models – most likely a hybrid of A-book and B-book.

Related: Funded Unicorn Wanted to Ride on A-Book Trust, but Its Failure Exposed Prop Trading Limits

A-Book Is “Unsustainable”

Ben Hur explained the mathematics behind this claim: “If a trader makes a profit and gets to keep 80 per cent, the company retains only 20 per cent. But when the trader loses 10, the company absorbs the full 100 per cent loss. To break even, a firm would need eight winners for every losing trader. It’s unsustainable.”

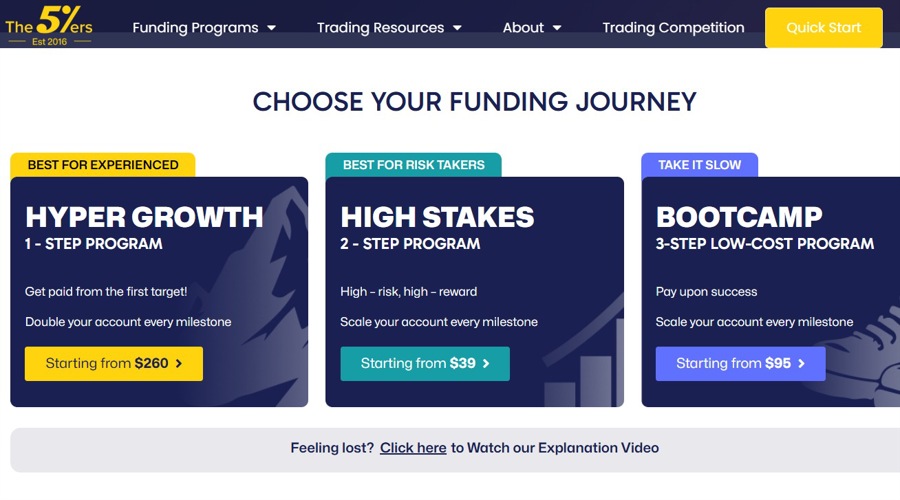

Instead, The5ers advocates a different path: one-step and three-step evaluation processes that can viably operate on an A-book model. “We resisted the two-step evaluation for many years because of this fundamental flaw,” the CEO added.

Managing risk in prop trading can make or break firms overnight. Ben Hur described it as “rocket science,” requiring sophisticated data analytics and constant monitoring: “Without proper risk management, even successful firms can collapse quickly.”

According to Ben Hur's estimations, there are almost 1,000 prop firms now. “In many industries, only the top 20 to 50 companies are expected to be able to sustain their operations and the rest are likely to fall away,” he said, hinting that the prop trading industry is no exception to this.

The5ers’ risk team constantly analyses market fluctuations, behavioural risks, and emerging threats. “We’ve invested significantly in analytics. It saved us multiple times by flagging trends and suspicious activities early,” Ben Hur revealed.

Read more: 80–100 Prop Firms Shut Down in 2024's Industry Reshuffle

“Very Few Put In the Effort to Build Trust”

Israeli-based The5ers is one of the oldest prop trading platforms still operational – from 2016. Three years ago it also launched another prop trading brand, Trade The Pool, which is targeted only to stock traders.

Ben Hur recalled early scepticism from potential clients: “Initially, the market was sparse. We had clients reading our website for weeks, sending hundreds of questions. It seemed too good to be true.”

Nearly a decade later, he believes the defining factor in their growth is trust and authenticity: “We don’t sell dreams. We don’t drive Lamborghinis. We wear T-shirts, and we understand our clients’ positions. Traders can see who we are.”

However, building trust is demanding. “Anyone can use this approach,” Ben Hur emphasised, “but very few are willing to put in the sustained effort required to build genuine trust over time.”

When The5ers started, its goal was clear – to recruit skilled traders. However, the firm soon realised most participants lacked the professional trading background he initially sought.

“The majority of our clients weren’t professionals and didn’t match the talent profile I was originally targeting. Around 2018, that insight prompted a major shift in our business model – we pivoted to focus more heavily on education,” he said.

Ben Hur added: “Today, prop trading is our vehicle for teaching traders how to manage risk and trade professionally. Our mission is to help traders become better at what they do. It's not just about trading – it's about a holistic approach”.

However, that does not mean they are not pushing prop offerings to retail traders. In fact, The5ers runs extensive advertisements across social media channels, just like other prop firms.

The differentiator, according to Ben Hur, is that The5ers don’t allow users to upgrade their accounts once they’re funded. “We never take additional money after the evaluation fee,” he says, while taking a clear jab at the competitors. “Once a trader is funded, they will never be asked to pay anything more. We believe doing otherwise risks creating a dishonest relationship and fuelling FOMO.”

“Proud of what We’ve Accomplished in India”

The5ers now hosts global concurrent users "between 100,000 and 200,000", with India as its largest market. “We’re very proud of what we’ve accomplished there,” said Ben Hur.

Other major markets are Nigeria and Vietnam. Ben Hur attributes the rapid expansion in developing markets to the economic incentives of prop trading: “For someone in Nigeria or India, earning $2,000 is far more significant than for someone in the UK. Our platform provides tangible value for their time.”

He admits, however, that the company needs to better address linguistic diversity. “We’re preparing a rebranded, multilingual website,” he disclosed, “to better serve local markets, especially in Southeast Asia.”

The growth of the sector has inevitably drawn attention from organised groups looking to exploit firms. “There are communities specialising in gaming the two-step evaluation,” Ben Hur noted. “But we quickly identify these bad actors through their trading patterns. Our mission isn't compatible with dishonest traders trying to game the system.”

“The Industry Is Heading Towards Hybrid Models”

Despite the growing popularity of prop trading, the regulatory oversight on the industry remains elusive. Ben Hur revealed prior conversations with regulators: “They didn’t show any interest yet because clients don't invest their own funds, and we don't expose them to direct financial risk.”

It's more than likely that since Ben Hur's conversations with regulators, things have evolved. FinanceMagnates.com published exclusively last year that the European Securities and Markets Authority (ESMA) ran an initial check on prop trading firms and also discussed possible regulations. More recent reports suggest that the regulatory landscape remains open to further changes.

“I would be happy if regulators set standards for fairness and customer service, it will only strengthen the industry,” He claims.

Read more: Regulators Conducted Preliminary Reviews on Potential Prop Trading Regulations

Meanwhile, as prop firms mature, many are moving toward brokerage licenses. Ben Hur believes recent trends, such as FTMO agreeing to acquire OANDA, indicate a broader shift driven partly by changes in MetaQuotes’ licensing policies.

“The industry is heading towards hybrid models combining prop trading and brokerage activities,” he concludes.