The United States financial regulatory landscape stands at a critical juncture. With the recent passage of key stablecoin legislation, the GENIUS Act in July 2025, and the ongoing, highly anticipated debate over comprehensive market structure bills like the CLARITY Act in early 2026, the nation is opening up to the crypto economy.

This momentum, coupled with a discernible shift in administrative posture from enforcement-heavy to innovation-friendly, signals a new era for digital assets.

Why the Howey Test No Longer Fits Crypto

The cornerstone of U.S. securities law, the 1946 Howey test, remains an anachronistic and ill-suited tool for the nuances of a rapidly evolving, often decentralized technological paradigm.

- Why Crypto Is Going Down Today? XRP, Bitcoin, Ethereum and Dogecoin Prices Fall as $1.7B Gets Rekt

- After Two Years Without Banks, Australian Traders Can Move Fiat on Binance Again

- KBC Becomes “First Belgian Bank” to Launch Crypto Trading for Retail Investors

It is my firm opinion that relying solely on this decades-old precedent for a modern, multi-trillion-dollar global market is a fool’s errand that stifles innovation while failing to provide genuine investor protection. A new, crypto-centric framework is not just a regulatory desire; it is an economic necessity.

An Orange Grove Test Meets Decentralized Finance

The original Howey test, born from a dispute over orange groves in Florida, determines a security if there is an investment of money in a common enterprise with a reasonable expectation of profits derived solely from the efforts of others.

This framework, while flexible in its time, struggles to capture the essence of decentralized finance (DeFi), where the efforts of others are often distributed among countless, sometimes anonymous, participants, governed by immutable code rather than a central corporation.

The Securities and Exchange Commission (SEC) has attempted to modernize its application, most notably with 2025 guidance emphasizing the expectation of profit and issuer influence criteria. This still leaves a gaping chasm of uncertainty, particularly for projects aiming for true decentralization.

Legal Uncertainty and the Cost to Institutional Adoption

The current approach fosters an environment where an asset may be considered a security at launch but a commodity later. This legal gray area is what most institutional investors fear to tread, thus hindering mainstream adoption and keeping the U.S. from cementing its crypto capital status.

We need a bespoke instrument, a DeFi Howey, that provides the clear token taxonomy that regulators and builders alike desperately need. This new test must be built on the reality of distributed ledger technology (DLT ), not shoehorned into an outdated agricultural precedent.

Toward a Crypto-Centric Regulatory Framework

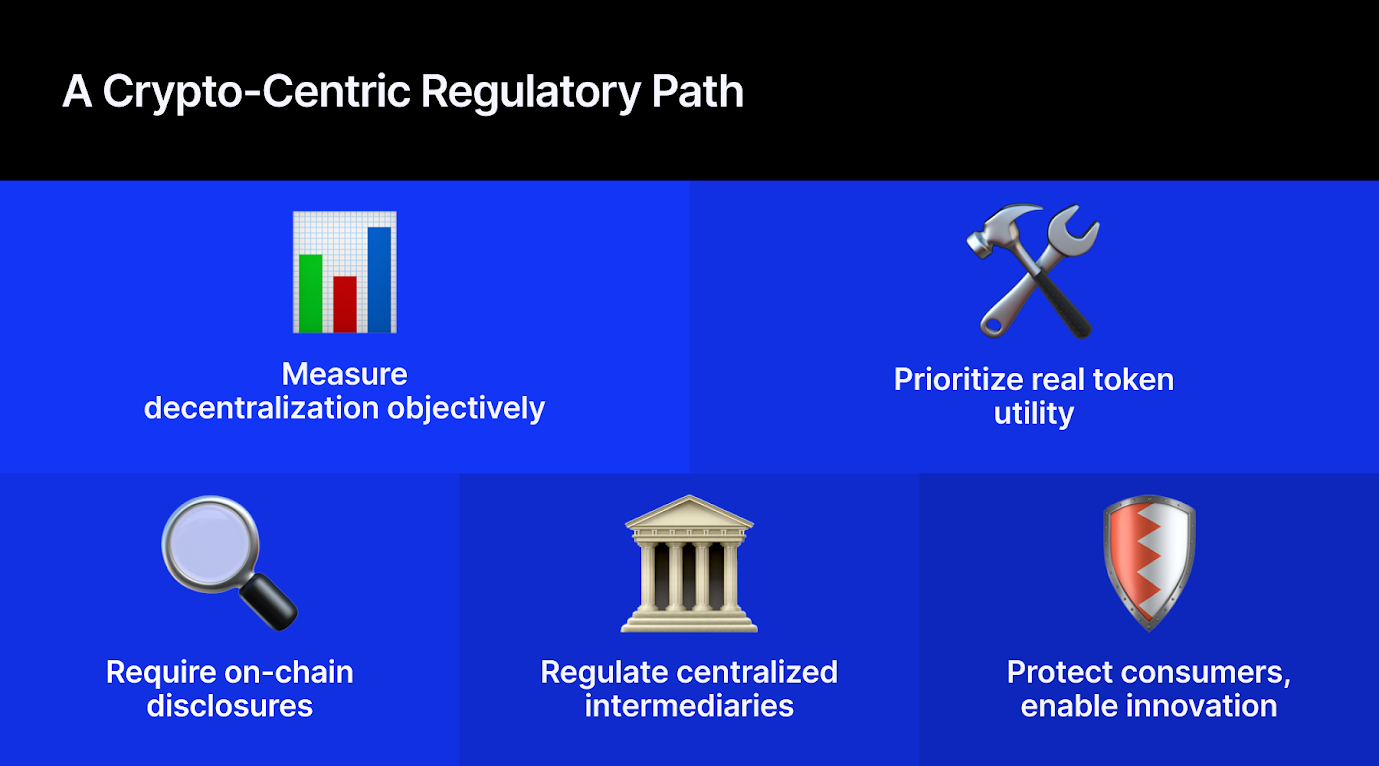

Drawing on proposals such as Commissioner Hester Peirce’s safe harbor and the functional token taxonomy advanced by industry leaders, I propose a crypto-centric regulatory framework built around four core rules. The goal is to promote U.S. innovation while preserving investor protection.

Rule One: The Decentralization Threshold

A modern framework must establish a clear, verifiable standard for decentralization. Once a network or protocol meets this threshold, it should exit securities law oversight and fall under a commodity framework, likely overseen by the Commodity Futures Trading Commission (CFTC).

Rather than relying on vague claims of “no central party,” regulators should assess measurable factors such as token ownership dispersion, the number of independent validators, and the immutability of smart contracts.

For example, if no single entity, including the founding team, controls more than a defined share—such as 20%—of governance tokens or validation power, the project would qualify. This provides a predictable path from launch to decentralization, addressing one of the industry’s most persistent legal uncertainties.

Does the Howey test still apply to crypto in 2025?

— CoinFund (@coinfund_io) January 29, 2025

Hear @jito_labs Chief Legal Officer @RebeccaRettig1's take on Mined with CoinFundhttps://t.co/BC86JI5xMphttps://t.co/mPWjRdnr2c pic.twitter.com/mkCFwoxr1Z

Rule Two: Functional Utility Versus Speculative Intent

The framework should prioritize a token’s actual use within a live network over speculative expectations. Tokens that serve clear, consumptive purposes—such as paying network fees, accessing services, or participating in on-chain governance—should be treated differently from passive investment instruments.

This functional approach better reflects how crypto networks operate and reduces the risk of utility tokens being swept into securities litigation solely due to secondary-market trading behavior.

Rule Three: Transparency and On-Chain Disclosure

Investor protection should be achieved through standardized, on-chain disclosures rather than traditional prospectuses. Projects should provide machine-readable information on audits, token supply and distribution, governance structures, and material risks.

This “code is law, disclosure is compliance” model aligns with the transparency of public blockchains and builds on disclosure principles embedded in the CLARITY Act.

JUST IN: Senator Cynthia Lummis says "most digital assets are not legally securities under the Howey test. The US is behind other countries in creating laws for digital assets. Stablecoins will bring our payment system into the 21st century." 🇺🇸 #Cardano $ADA pic.twitter.com/YrfKY9G1Os

— Angry Crypto Show (@angrycryptoshow) February 28, 2025

Rule Four: Intermediary Liability and Consumer Safeguards

Regulation should focus on centralized intermediaries where most retail users interact. The GENIUS Act sets a useful precedent through reserve requirements and AML obligations. Strong oversight of exchanges and service providers can protect consumers without constraining decentralized innovation.

A Narrow Window to Get Crypto Regulation Right

The U.S. is at a pivotal moment. The current legislative momentum offers a rare chance to get this right. By moving beyond the archaic limitations of the Howey test and embracing a bespoke, forward-thinking framework, we can provide the regulatory clarity the market craves, protect investors, and ensure America remains a global leader in the digital financial revolution.

Sticking to the old ways in a new world is a path to irrelevance, and that is a price the U.S. economy cannot afford to pay.