In almost exactly two months, the doors of the Old Billingsgate will be thrown open for the London Summit 2018. As the event draws near, we are proud to present our extensive crypto agenda, featuring the CEOs of Coinbase UK, Coinfloor, eToro, DX.Exchange, and Swissquote, to name only a few.

Below you can consult relevant sessions, and on the agenda page you can contact the speaker and pose your questions early on.

Crypto Believers Unite

Crypto prices are currently plummeting, making investors frustrated (and meme creators flourish), however, Cryptocurrencies remain a key concern for the financial services industry.

Virtually every broker is offering crypto pairs, and a considerable number of industry participants launched or considered launching their own token.

Therefore, the agenda is addressing the full scope and challenges that this not-so-new asset and technology currently presents. From the visionary to the rank and file, from market opportunities to payment solutions, if it matters to the industry, you can hear about it at the London Summit 2018.

“I’m personally a crypto believer, what you might call hodler,” says Finance Magnates’ CEO, Michael Greenberg, “but regardless of that, since crypto and the Blockchain changes the way we transfer value, it bears a fundamental impact on financial services. Anyone in the industry should keep a close eye on market developments, and it is a top priority for us that the Summit’s agenda will allow it.”

Coindesk

Coindesk

Industry-leading CEOs Talk Crypto’s Future

As is customary, every year of the London Summit features one of the most important discussions, i.e., the CEOs panel. Featuring a hand-picked panel of some of the industry’s top talent in a roundtable discussion, cryptocurrencies will once again be a marquee topic.

Attendees can expect multiple different topics to be included during the panel, with this year emphasizing the role of cryptocurrencies in OTC trading. The topic is of particular note as demand for these instruments has grown throughout the year – this is one panel you do not want to miss.

Opportunities in Crypto in 2019

The cryptocurrency industry is a forward-thinking one. Though its rise has been touched on and analyzed at length, the most important implications are yet to come. More than twelve months since its meteoric rise, it’s time to look ahead to 2019 for cryptocurrencies and what the future may hold for the nascent industry.

A panel of veteran specialists will delve into this discussion during the London Summit, attempting to chart a course forward in what could very well be one of the most key segments in 2019. Be sure to stay ahead of any regulatory headwinds or surprises and attend this panel.

Cryptocurrency Trading: Breaking down Retail and Institutional Models

Crypto trading is no longer just a retail phenomenon, with leading institutional venues such as CME Group and CBOE embracing Bitcoin futures at the tail end of 2017. This year’s panel will touch on the specifics of cryptos in both the retail and institutional space, as well as the impact of regulations.

As recently as last week, for example, CME Group’s CEO has gone on record saying they will no longer be introducing more crypto futures. Does this represent a changing perception around these instruments or just a corner case?

The Cryptocurrency Survival Kit for Brokers

Few spaces have been through more upheaval during the past 12 months than the cryptocurrency industry. Following its rise to prominence, the industry has transformed, rather quickly, into a fully-fledged segment. However, 2018 presents its own unique challenges, many of which have threatened to extinguish many an exchange or broker.

Indeed, as a fundamental component of many retail brokers’ offerings, cryptos are here to stay. In this seminar, attendees will learn from three leading experts about the most critical components surrounding the successful integration of cryptocurrencies. This includes tips and tricks for proper risk management and a step-by-step guide to smoothing out the payment process as well as linking up with exchanges.

Impact of Regulating ICOs: A Global View

Initial coin offerings (ICOs) have managed to eclipse 2017 already and are only increasing in frequency and worth. For these reasons, regulators and global authorities have moved to police this segment perhaps more so than any other, given the large swaths of cash changing hands.

Will ICOs continue to flourish moving forward in a more regulated manner? This year’s seminar will address this and other concerns, such as the large percentage of projects that have resulted in disaster for investors. With ICOs now firmly on the radar of regulators, new projects and startups have had to adapt to a newly defined playing field.

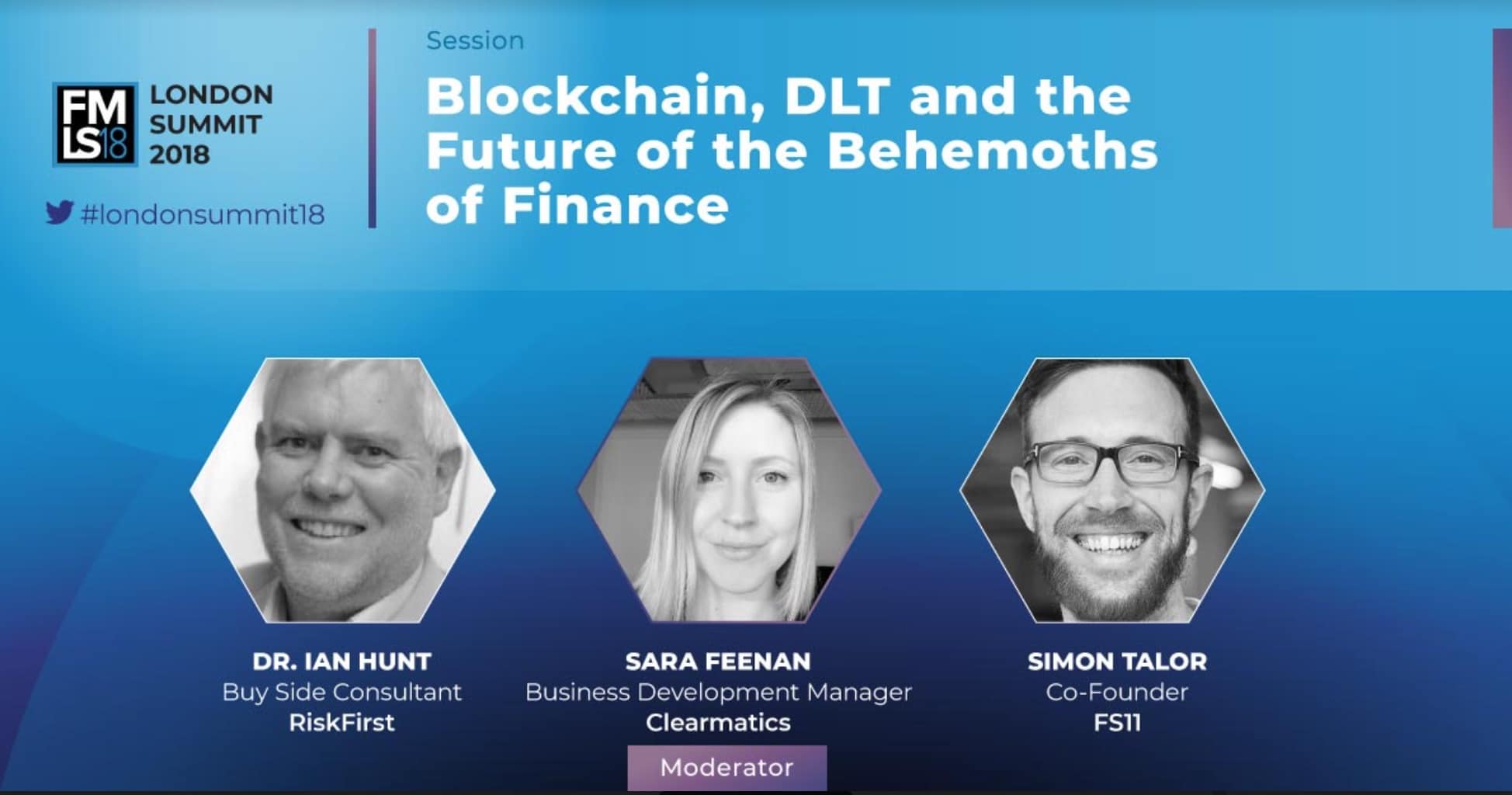

Blockchain, DLT, and the Future of the Behemoths of Finance

Emerging technology has always changed the way humans transfer value. Blockchain is at the forefront of innovation today, transforming the machinery of the existing financial system, as well as offering new mind-boggling possibilities.

This panel will explore some of the questions brought about in this brave new world. What’s the impact of the adoption of distributed ledger technology on the financial sector to date? What challenges await the buy-side in keeping up to speed with innovation? What will the short- and long-term future of financial services look like, and how should it look?

Attendees can expect a review of the current state of major DLT projects and a forward-thinking discussion about blockchain and the future of financial services.

Blockchain Innovation Stage

As the buzz around blockchain technology remains at an all-time high, cutting through the noise to find the products and concepts that will take your business to the next level can be difficult. In this session, you will meet startups and firms that harness blockchain technology to drive innovation in the finance system.

They will showcase their wares, and battle for your vote for the Most Outstanding Blockchain Product Award. Industry participants and crypto enthusiasts alike are welcome to join the Blockchain Innovation Stage and have a glimpse at tomorrow’s economy today.

Cryptocurrency: Creating an Open Financial System for the World

Cryptocurrencies and blockchain technology are paving the way for the most open and transparent financial system ever created. This session will delve into what goes into open finance and what role cryptocurrencies has to play in what may very well be the future of the industry.