As the world continues to wait for the US SEC’s decision on the Bitcoin ETF applications that are still being processed months after a decision was expected, some investors may find themselves seeking alternative methods of entering into the Bitcoin market without actually having to do the dirty deed of investing in Bitcoin itself.

What will happen first brexit or bitcoin-ETF? ? $btc #bitcoin #etf #brexit https://t.co/DPsrnxpnCs

— coinflipper AT (@CoinflipperA) April 10, 2019

After all, there are still a number of risks associated with holding Bitcoin. There’s the issue of ‘tainted’ coins--coins that may have been used in illicit transactions, and therefore may still carry a numerical associated with those transactions. There’s also the issue of custody--securely storing coins can be a risky business, and hiring an external custody service can be costly.

On the other hand, time is money. As long as investing in a Bitcoin ETF isn’t an immediate possibility, investors are coming up with increasingly creative ways to profit off of BTC and other crypto assets. Crypto lending services have recently reported record profits; crypto futures exchanges are also reporting higher-than-ever trading volumes.

Some good news for #Bitcoin. I think we're about to start seeing more Institutions enter the market. #BitcoinNews #CME #Futures #Markets #Investors #Trading #BTC #Volume $BTCUSD #Crypto #bullish https://t.co/uCGElPSdHw

— Paul J Lowe (@real_PaulL) October 17, 2018

However, there’s another option for investing in crypto that has often gone overlooked in the cryptocurrency space. Despite the fact that they’ve been around for more than five years, crypto tracker stocks have remained a relatively little-known avenue into investing in the cryptocurrency space without actually holding cryptocurrency itself.

Grayscale’s Crypto Tracking Stock Was Created in 2013

Crypto investment firm Grayscale was one of the first companies to successfully establish a cryptocurrency-tracking stock. In 2013, the company established the so-called ‘Bitcoin Investment Trust’ (BIT) as a gateway for accredited investors to gain access to Bitcoin without holding it themselves.

The BIT was designed to operate similarly to products like the SPDR Gold ETF, which allows investors to purchase shares in gold without having to actually buy gold themselves.

Shortly after its creation, the BIT moved into the over-the-counter trading market under the symbol ‘GBTC.’ Investors who had purchased shares in the BIT were now able to sell them in what was essentially a secondary public market.

Similar to Bitcoin itself, purchasing GBTC shares did not require a substantial minimum investment. The shares are technically available to any retail or institutional investor who has a brokerage account.

However, there are some potential drawbacks with this type of investment, depending on your perspective. Bitcoin can still be purchased and used with relative anonymity; using a brokerage account to buy GBTC shares means that one’s investments are very easily trackable. And of course, one can’t use GBTC shares (or similar products) to buy goods and services directly.

One of the major criticisms of the GBTC is that it trades a high premium. However, Daniel Skowronski, Co-Founder & CEO at DX.Exchange, told Finance Magnates that this is a normal part of any new market.

"Premiums are high because [these companies] are still trying to find their way in the institutional space and the crypto space," he said. However, as these kinds of options become more popular among investors, "Liquidity will grow, competition will kick in, and spreads will tighten."

Daniel Skowronski, CEO, DX.Exchange

ETFs vs. ETNs

Another crypto-tracking stock made headlines last August when it was listed against USD shortly following the denial of several high-profile applications for a Bitcoin ETF (exchange traded fund). Bitcoin Tracker One, or CXBTF, had already been trading on the Nasdaq Stockholm exchange since 2015.

At the time of its pairing with USD, Bloomberg described CXBTF as “a soft opening of sorts for a crypto ETF, which has been repeatedly shot down by U.S. regulators in recent months amid concerns about manipulation and liquidity.”

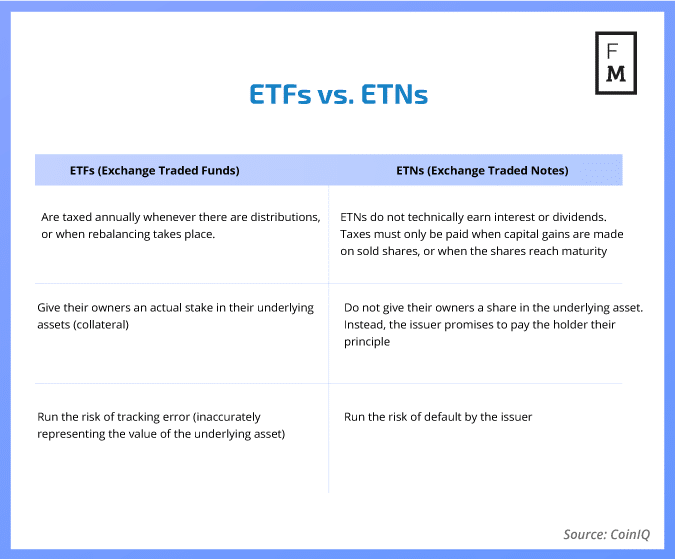

Bitcoin Tracker One was launched as an ETN, or exchange traded note. Investopedia describes an ETN as “more like a bond” than an ETF is--meaning that it’s more of a risk. “It's an unsecured debt note issued by an institution. Just like with a bond, an ETN can be held to maturity or bought or sold at will, and if the underwriter (usually a bank) were to go bankrupt, the investor would risk a total default.” This presents a huge risk--in some respects, perhaps even greater risk than holding Bitcoin itself.

Bitcoin Tracker One may have also been particularly attractive to investors who did not want to trade BTC-based assets at a high premium, like Grayscale’s GBTC. “Our products historically have not traded at a premium and are liquid,” said Ryan Radloff to Bloomberg. Radloff is the chief executive officer of CoinShares Holdings Ltd., the parent of the company that offers Bitcoin Tracker One.

Despite its pairing against USD, most US-based customers are barred from investing in the Bitcoin One Tracker.

Pick Your Poison

Because of the fact that these options don’t offer any leverage on the value of Bitcoin, profiting off of investing in crypto-tracker stocks is basically dependent on Bitcoin’s performance as an asset. Crypto lending and crypto futures trading offer more opportunities for profit when Bitcoin itself may not be doing very well, but if you’re trying to get as close to pure Bitcoin investing without actually purchasing Bitcoin, crypto-tracking stocks may just be your best bet at this moment in time.

The bottom is that “[they provide] exposure to a new asset class in a form familiar to the rest of your investment portfolio,” wrote Moe Adham, Founder and CEO at Bitaccess, in a Forbes report.

Additionally, this method of investing in Bitcoin may save you a major headache when it comes to filing taxes. “You won’t need to set up a new brokerage account or file your taxes any differently than normal, which can be a huge time-savings come year-end,” he said.

However, as more affordable crypto custody options may become available, investors may eventually wish to take the leap into investing in Bitcoin directly.

Kyle Asman, partner at BX3 Capital, argues that actually, investing directly in Bitcoin could be much more efficient than purchasing crypto tracking stocks.

Kyle Asman, partner at BX3 Capital.

“Crypto-tracker stocks are just another gimmicky investment product,” he wrote in an email to Finance Magnates. “I could see an ETF that holds a basket of the top 5, 10, or 50, but if someone is considering investing in a tracker stock, they are much better to invest directly in the asset, such as Bitcoin, and save themselves all the management and performance fees associated with purchasing a tracker.”

Investing in a Crypto Company

If purchasing a crypto-tracker stock seems to closely tie with Bitcoin markets, investors could also consider investing in a company that is part of the cryptocurrency ecosystem without getting anywhere near cryptocurrency assets themselves.

There is some evidence to suggest that as the cryptocurrency ecosystem has continued to grow and mature, crypto companies may benefit from price bumps in cryptocurrency markets. Following the bullish boost that cryptocurrency markets saw at the beginning of the month, some publicly-owned cryptocurrency companies saw boosts in their stock prices.

Bloomberg reported that “crypto-linked stocks in Asia also extended gains, led by Remixpoint Inc. in Japan with a jump of as much as 16 percent during the day Thursday. It’s up 26 percent so far this week. Vidente Co. has climbed almost 20 percent since the weekend, while Omintel Inc. is on a 6.3 percent advance.”

Bitcoin's price surge has also boosted crypto stocks around the world https://t.co/r251l6SpGP pic.twitter.com/xynaBgNfOa

— Bloomberg Crypto (@crypto) April 4, 2019

US-based crypto companies’ stocks also benefitted. Riot Blockchain Inc. saw a 24-percent boost in the first week of April, while DPW Holdings Inc. and Marathon Patent Group Inc. (two smaller crypto firms) saw gains of their own.

Hopefully, a Bitcoin ETF will eventually be approved--this would be a great way for a new group of investors to securely enter into the cryptocurrency markets. But until that day, we just have to continue working with what we've got.