Bank Hapoalim (TLV: POLI) is Israel’s largest bank and has a significant presence in the global financial markets. Finance Magnates recently visited the bank’s new creative space, an entire floor at the top of a building in central Tel Aviv where its innovation division will be housed. The impressive location gives the feeling of a high-tech development firm rather than the usual setting for a bank. Fintech startups that the bank decides to work with will also be invited to share the space.

Dr. Yoav Intrator

We sat down for a talk with Dr. Yoav Intrator, Hapoalim’s Chief Technology Officer. His main responsibilities include driving the bank’s long term innovation strategy and plans. Prior to his role at the bank, he was a general manager at Microsoft where his team developed and released a new IP that supported 500 enterprise strategists and architects worldwide. Prior to that Yoav filled a series of senior roles in Wall Street. Additionally, Dr. Intrator has worked in such roles as CTO, Chief Enterprise Architect, product manager and leader at companies like Deutsche Bank, AT&T Business, XL Capital and Cap Gemini Consulting.

During this interview, we asked Intrator about bitcoin, ethereum, and how he sees the impact of Blockchain technology on the economy. It was a follow-up to his speech at the Blockchain Summit in Tel-Aviv. Hosted by BNY Mellon (NYSE: BK) and Hapoalim, it was the most impressive institutional blockchain event in Israel so far, with top business executives and regulators from around the world in attendance.

Blockchain is a foundational technology, Intrator explains, which means that businesses including startups can use it to transform almost every business process. He gives examples of how it could be the basis of a new supply chain management in the diamond sector as well as completely changing accounting to a real-time monitoring model. He also called on Israel’s leadership to promote the technology as is done in other countries.

Poalim Innovation Lab overlooking Tel Aviv

Israel

“I think it is an unfortunate situation that unlike some key European countries and the US, Israel is a relatively slow adopter of this technology. But I sense that there is a growing interest that is likely to accelerate in the next year or so. Israel is the leader in the cyber space and we haven’t found the ‘next Cyber’ yet.

As I mentioned in the conference DLT will disrupt not only the financial markets but all markets, including governments and municipalities. The early government adopters recognize that with this technology when combined with others can be used to rebuild the citizens’ trust. Governments and municipalities have a unique opportunity to build more Transparent, Open, Fair, and Efficient (I call it TOFE) government model – this is what I also call Smart Economy.

As the OECD noted – building a trust is one of the key focus of its member countries.

There is a huge opportunity for Israel in blockchain technology, first for Israel and second as a foundation to build the next ‘Cyber’. Using this technology for registration, voting, digital asset management, and transaction processes are a few of the ideas to be explored. I expect that moving into a cashless society supported by financial transactional ledgers is a major long-term goal that needs to be established now.

This is an opportunity however if we don’t act fast we might find ourselves behind the modern world. In Dubai, for example, Blockchain is becoming a mandate in the Financial Industry. As a country, we are just in the learning phase vs. where we should be; exploration and testing phase.

Ethereum

One of the most important changes that the world needs to adapt to is the legal implications of the technology.

The DAO taught us something very interesting, we need to come up with a coding language that can be used by the legal world or closer to.

We need to be able to show a lawyer: here is the contract that I am running. Will we need to teach lawyers to read code? We don’t want to teach lawyers what is recursion – it is a technical concept not a contractual one. We do need to differentiate between the legal and technical functions. This raises a question: ‘Are coders becoming a fiduciary entities now or not?’ – My answer is not, but in the DAO case it ended up exactly that. This has some similarity to the autonomous car world. If something goes wrong – who do you go after? There is a lot of space for startups and legal entities to start addressing these issues. The world is changing quickly and new ideas, rules and solutions are required.

Blockchain can be used to tackle a significant pain in the B2B space especially when more than 60% of the B2B processes are still being executed manually or semi manually.

There is a lot to say about the ability of this technology to gain efficiencies by removing intermediaries so if we can manage to reduce the trade affirmation from T3 to T0 which will translate to significant cost savings and better customer service. But it is also about managing risk: the financial industry is about managing risks – the moment I improve my certainty level it translates to cash.

In the financial crisis, we (the financial industry) had to deal with mortgage-backed securities where we didn’t know what risks we carried – if everything is digitized I can mathematically tell you how much risk I carry at any moment and therefore we can accurately figure out how much cash we need as collateral. With completely digitized instruments that can be fully tracked and monitored at any time, the financial industry will be able to create new financial instruments and even complex ones with more confidence.

The technology that was created to replace the financial industry is now proving to be a gold mine for our industry.

Technology Taking over jobs

Over 60% of all the B2B industry operations are still being conducted manually. The workforce that supports these operations is at risk.

In the next century, I suspect that anyone that works with manual delivery processes, paper-based systems, or conducting their B2B processes via emails, are at risk of losing their jobs to automation. For example, with full B2B automation the international trade cost is likely to come down to 10% of what it is today. This is partially due to automation and removal of many manual and paper based processes – there is a lot of paper shuffling in this industry today.

This will also have a profound impact on the auditing and the legal profession. Automation via a combined set of technology (AI, Blockchain, IoT, etc.) will have a significant impact on the workforce, it does not matter if its autonomous car or an autonomous contract. This is a new world and we must learn how to manage an economy in this new reality.

Additionally, in the music and the publishing industry where you are dealing with digital assets, it doesn’t matter if it is music or books, you can become your own publisher with the ability to protect your digital rights from being distributed illegally and get the royalty you deserve – this will transform the music industry and create new ecosystems.

Bitcoin vs blockchain

If the price of Bitcoin continues to go up, it doesn’t mean that this technology fulfilled its promise. Compared to what Satoshi (Nakamoto) envisioned, one promise that this solution failed to fully deliver is a trust. Bitcoin is filling a market need but it is still with some risks.

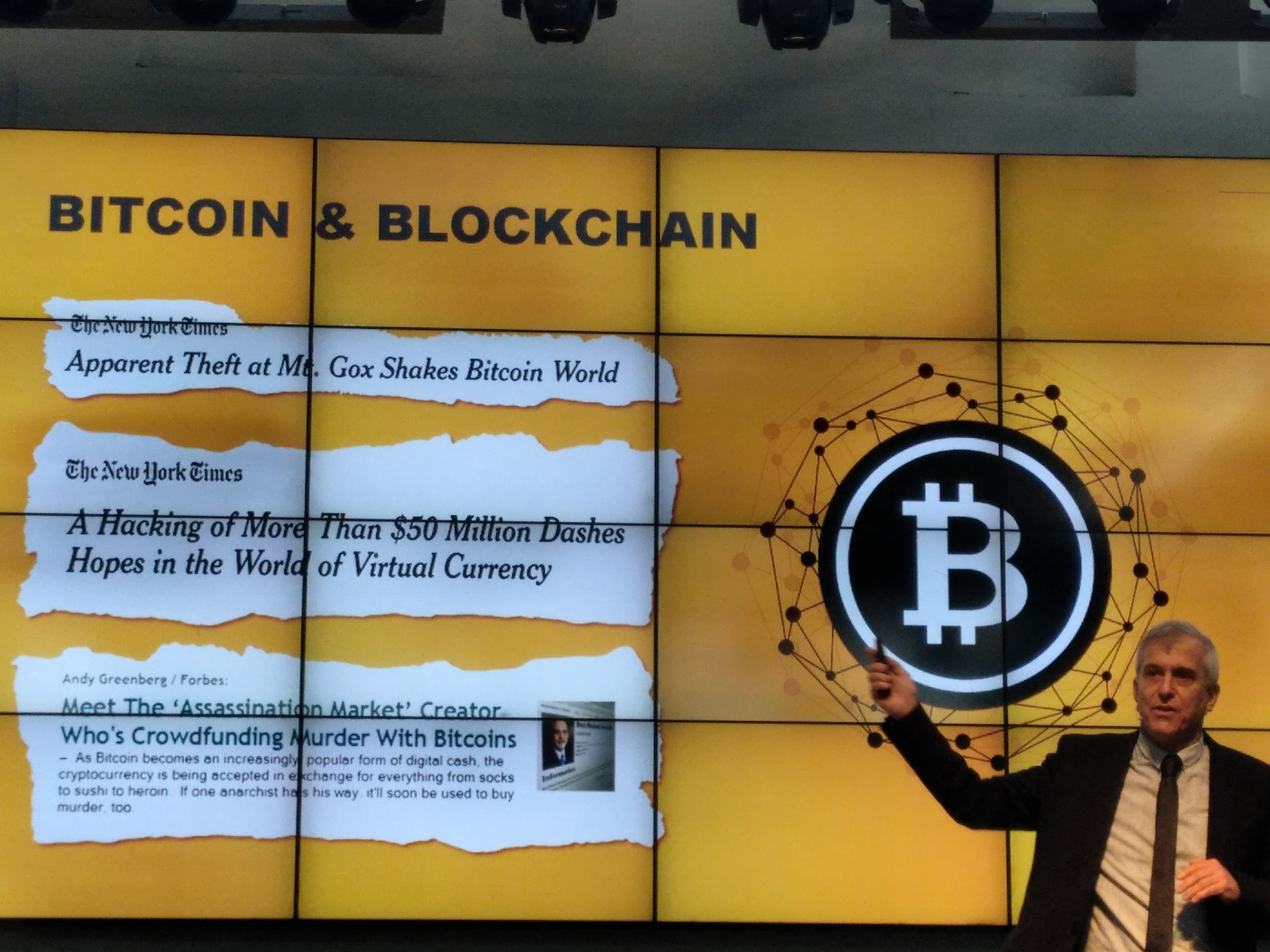

The MtGox experience is a perfect example for the potential risks and lack of trust that such stories produced. Do you want to compare banks to MtGox?! Are they qualified to handle money?! Are they safe enough? If something happens with your bitcoin who will you turn to? What entity will represent you? Who can you challenge? There is nowhere to go. Regulation is lacking.

We don’t want (and can’t) use a currency where we don’t know where it came from, where it goes and who is utilizing it and for what. Additionally, there is another issue – more than 51% of the miners are in China. Do we want to be at the mercy of the Chinese who could be manipulating the whole thing? When we (the financial industry) saw where the miners migrated to, we ran away from it. As you can see, there are many reasons the financial industry got frightened and decided to shy away from the Bitcoin.

It isn’t that we don’t like bitcoin – it’s a great innovation, but where is the trust? If the public really understood the risks they may not be trading with it. Trust is the key value of a financial institution – we are the entity to go to where you money is safe. We give you the vehicle to protect your money and bitcoin has no regulation to guarantee you will not be ripped off.

Banks whose primary value is trust shy away from areas that have even a remote association with something illegal.

As for banks using Bitcoin ?, I think if it wasn’t for Silk Road and the miners' locations banks will be more open to use it. Every institution needs to understand the risks even if they are theoretical, or even a perception and decide if and when they are acceptable.

Bitcoin as a concept taught us a lot but despite that, it is not something a bank, as a regulated-entity, will use. The industry adopted the technology engine, but dropped Bitcoin.

It’s incredible what blockchain (the Bitcoin's engine) managed to do - for eight years no one could break the blockchain network in spite of a lot of incentives. This showed that blockchain as an engine is very powerful and that is why it is being copied.

Initially the financial industry thought ‘we now have this powerful hammer, but where is the nail?’ Now we know nails are everywhere. I don’t think Satoshi (Nakamoto) imagined his invention could be used in so many ways and by so many industries.

I am strong believer that this technology will have a significant impact on the financial industry as well as other industries. Its impact goes far beyond the technology. The paradox here is that a technology that was supposed to introduce significant challenges to our industry coupled with the right strategy and approach can now open new opportunities and deliver significant benefits to our industry. It is no surprise that all of the major banks are investing and betting on its outcome – it is a unique technology that can help banks disrupt the disruptors.

Blockchain solutions in all their flavors (private, public or hybrid), like Facebook or other large scale networks solutions, drive their value base on Metcalf’s law. Metcalf’s law implies that the value of a network is proportional to the square of the number of users or nodes in the system (n2). This law also explains why the size and the growth of the network will be economically beneficial. In other words, the economics potential of such B2B solutions increases faster than the number of businesses connected to it. This indirectly also explains why such a solution is a challenge to Fintech (to the disruptors) and an advantage to the banks – who already have a large network of customers vs. startups and needs to rebuild such networks from scratch; disrupting the disruptors.

Yes, there is a significant amount of hype and challenges in this space but when it comes to the role of people the biggest challenges in this space are:

- Resistance to change – you can’t do Blockchain for yourself (as a company) you do it with business partners (external business partners) and customers. Your partners must be willing to be active participants. So, if you plan to use it for B2B, marketing is as paramount.

- So called experts - those that have read a few headlines and conclude they got it. The technology is transformational but at the same time complex too. What I find myself doing in many cases is attempting to explain to individuals what they read in one or two headlines or articles and in many cases I have to fight perceptions vs. realities e.g. ‘Blockchain is bitcoin’. So, there is a significant amount of education and awareness that needs to be developed prior to and during the initial phases of adoption.

- Not enough skilled developers and architects in this space. Partnering or contracting with those that have these skills is the most logical path."

Epilogue

After the interview we realized that the bank as we knew it is truly changing. Bank Hapoalim, is not only the largest bank in Israel it is also the most innovative one.

Blockchain technology is going to disrupt the world economy, and from a local perspective, it's good to know a leading financial institution is spreading the news in Israel so the country can adapt in time.