Vladimir Bezruchenko

This guest blog post is written by Vladimir Bezruchenko

ABOUT THE AUTHOR: Vladimir Bezruchenkois an independent trader based in Kiev, Ukraine. He has been actively trading from home since 2013. He specializes in US natural gas futures (NYMEX Henry Hub) and high-yielding commodity currencies.

The commodity natural gas is an energy commodity, a fossil fuel. Just like other forms of petroleum, natural gas is primarily used to generate power and drive things around us. It is therefore a vital commodity and has become increasingly important over the past years.

Types

Broadly speaking, natural gas can be divided into two categories: dry gas (almost pure methane) and wet gas (contains other hydrocarbon compounds, such as ethane, propane and butane). Dry natural gas is also known as consumer-grade natural gas and this is the type of gas this series will focus on.

It is important to note that wet gas and liquefied natural gas (LNG) are two completely different things. Wet gas is extracted from the depths of the earth, whereas LNG is simply a liquid form of dry gas that has been converted into that form by human-made technology.

Measures

Quantities of natural gas can be measured in two ways. One way is to measure the actual volume of the commodity itself. In this case, it is common to use normal cubic meters (cm) or standard cubic feet (cf). Another way is to measure the energy content of natural gas (the so-called “gross heat of combustion”) – i.e., the amount of energy released as heat when natural gas is burned. In this case, the most common measures are: joule (J), kilowatt hour (kwh) and British thermal units (Btu).

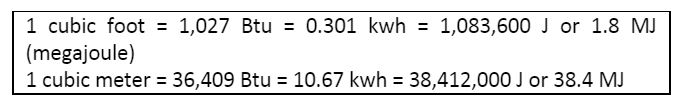

Below are approximate measurements and conversions for dry natural gas:

To put things into perspective, one Btu is approximately equal to the energy released by burning a single wooden kitchen match. So, burning one cubic meter of gas is equivalent to burning 36,409 wooden matches.

Natural gas pricing in the United States has moved from a volume-based pricing system to a heat-content pricing system. In other words, natural gas is bought and sold based on its BTU content, not on how many cubic feet it contains. That is why it is very important to understand the measurements in this market.

Demand

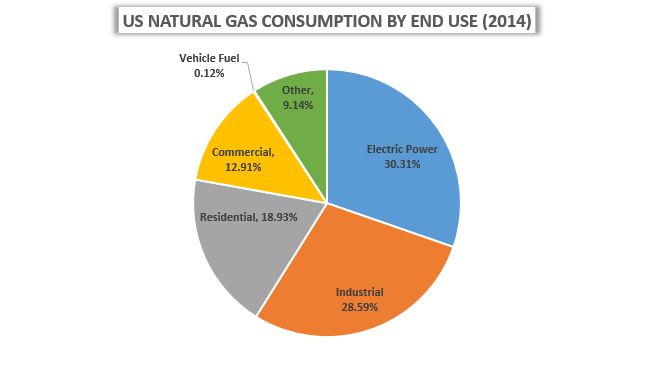

As an energy source, natural gas can be used in a variety of ways. It can heat homes and businesses, generate electricity, cook food, drive vehicles or serve as an industrial fuel. We can divide consumers into several categories:

- Population (residential consumption) – private dwellings, apartments.

- Businesses and non-manufacturing activities (commercial consumption) – hotels, restaurants, wholesale and retail stores, etc.

- Industry and manufacturing (industrial consumption) – chemical plants, mining and mineral extraction, etc.

- Power plants (electric power sector) – gas-fired power plants and utility companies in general, whose primary business is to sell electricity and/or heat to the public.

- Transportation (vehicle fuel consumption) – trucks, cars, container ships and other vehicles that run on natural gas.

- Other consumption (technical consumption) – include gas used in drilling operations, as a fuel in natural gas processing plants and gas used in the operation of pipelines.

Source: EIA

Supply

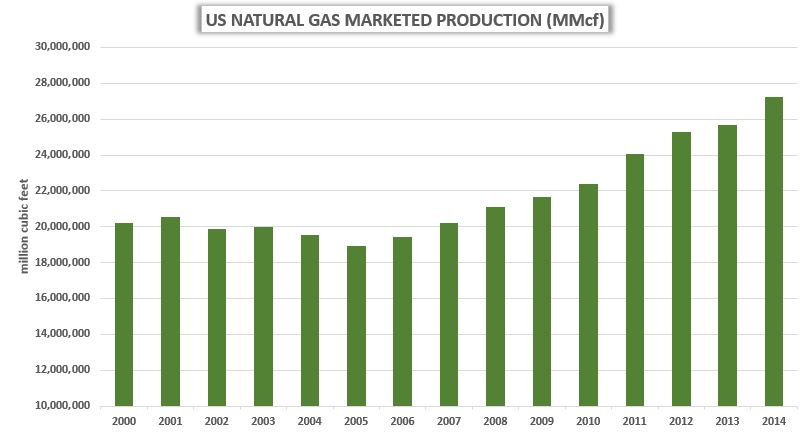

Natural gas can be found in various geological formations both onshore (for example, in the Rocky Mountains) and offshore (for example, in the Gulf of Mexico). Just like crude oil, natural gas is produced through basic deposit drilling and well system. However, natural gas deposits can have very different geological characteristics and therefore require different production techniques in order to extract it. The industry distinguishes between conventional and unconventional gas.

Conventional gas is trapped in various rock formations, such as carbonates and sandstones that have good porosity and permeability characteristics. It is easy, feasible and economic to produce.

Unconventional gas is more difficult and costly to produce, since it is found in places with more complex geological characteristics, such as coal beds and shale formations. However, recent technological breakthroughs have made unconventional gas supplies (particularly shale) commercially viable and completely changed the natural gas supply picture, especially in North America.

Source: EIA

Storage

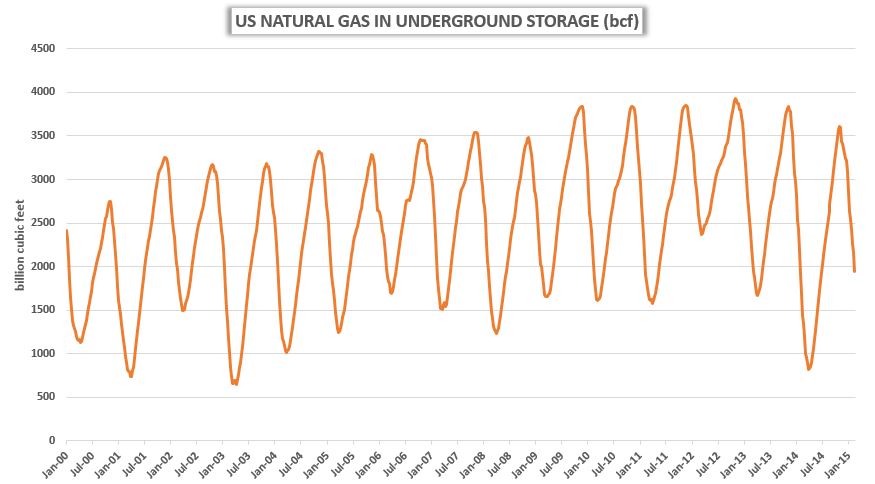

Producers accumulate natural gas in underground storage facilities for peak demand times. These storage inventories enable local distribution companies to avoid imbalances in the marketplace. For example, during wintertime the demand for natural gas usually exceeds supply as consumers use more gas (and electricity converted from gas) to heat their homes and premises. It therefore becomes necessary to withdraw natural gas from storage during cold periods (peak demand) and inject it into storage during spring, summer and fall months. Indeed, storage inventory has a very strong seasonal cycle (see graph below), which is key to understanding the very nature of the gas market in general.

Source: EIA

Price

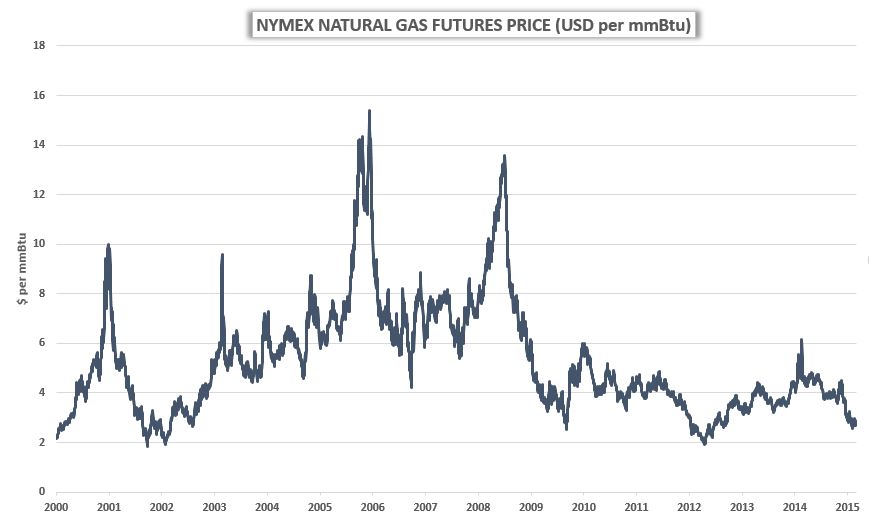

In the United States, natural gas futures trade on the New York Mercantile Exchange (NYMEX); they were launched in April 1990. Physical delivery is to a place called Henry Hub in Louisiana. The futures trade in US dollars per million BTUs ($/mmBtu).

Just like for any other commodity on this planet, the balance between supply and demand determines the price. As can be seen from the graph below, natural gas price Volatility has been very exciting in the 21st century.

Source: NYMEX

In the next part of our natural gas series, we will take a closer look at the demand side of the market.

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please apply here: UGC Form.