Much has been reported about gender equality in the finance industry. Every year new studies are undertaken to try and track changes in gender representation, salary and harassment. It being Women’s Day today, what are the latest stats on the state of gender equality in finance?

Gender Representation

A report on London published by FT paints a stark picture of female representation in senior roles. Their six month study, covering 30 of London’s top employers in banking, insurance, asset management and the professional services has unsurfaced some grim findings. The study revealed that despite a 50-50 split in gender balance in overall staff numbers, a meagre 19.5 percent of senior roles are held by women.

Of the different financial professions, the report reveals that banking is the biggest offender, with just 16.2 percent of London’s banks having female managing directors.

A study on London conducted by Emolument breaks female-employment figures down even further.

Female analysts comprise only 15 percent of positions at top-tier banks. US top-tier banks operating in London hire just over 10 percent of women as analysts. Women get even less roles as associates, a measly 11 percent (13 percent for US-based institutions operating in London).

While US-based London banks employ women in roughly 13 percent of their VP roles, women at European-based London banks only account for 6 percent of VP positions. Across all top-tier banks, women make up only 10 percent of overall directors and under 6 percent of managing directors, according to the study.

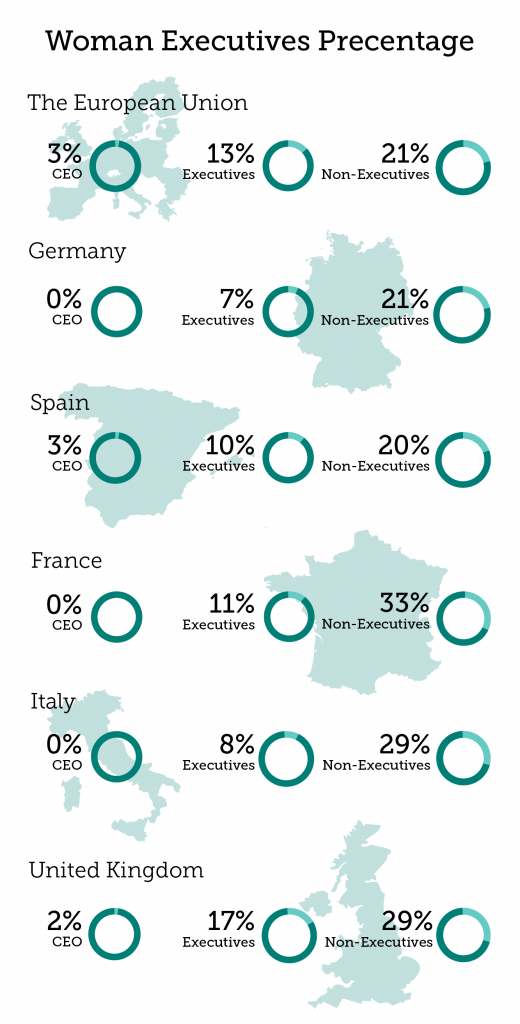

Expanding our scope to Europe, we see even less parity. Take Germany, for instance. Eurozone's financial bulwark, Germany has ample top-tier financial institutions. But according to a biannual study conducted by the European commission, out of 30 companies that the commission looked into, Germany had 0 women in CEO positions and around 7 percent of executive roles being filled by women. Even in non-executive roles, women only accounted for 21 percent of staff.

Source: European Commission - January 20, 2015

In the US the numbers are better, but just by a hair. According to numbers published by Institutional Investor in December, women represent 60 percent of all financial-services employees.

While an encouraging number, only 13 percent of executive-officer positions are held by women and only 16.6 percent of board seats are held by women—a figure that has, according to the site, remained stagnant for seven years. In hedge funds and trust companies, women make up 54 percent of all employees, but only 26 percent serve in executive-level positions. In the securities industry, the numbers are just as deflating, with only 18 percent of executive officer roles being taken on by women.

Japan is almost too dire to mention. There are absolutely no women sitting on executive committees of major financial firms in Japan. While Prime Minister Shinzo Abe set a goal to fill 30 percent of leadership positions in Japan with women by 2020, it’s Japan’s notoriously long work hours that are likely stifling female representation.

Glass Ceiling

The numbers reveal that women are often hired, at least in the US and London, at the same rate as men. The problem comes with advancement disparity. A big reason is that women face much more challenges in balancing work and family.

The professional brake pedal known as motherhood is probably the biggest hurdle. While most countries are keen to have women return after leaves of absence, it’s the pressure of working high-stress executive jobs mashed in with raising young children that becomes a nightmare. Sleepless nights, punishing travel schedules and, on top of that, having to be able to commit to a senior role on and off hours leaves many women reeling.

One potential solution is to encourage men to take paternity leave. If companies know men are just as likely to take paternity leave it would diminish the stigma it pins on women. It would also serve as a wake-up call to the financial services industry—once men experience first-hand the near-impossible balancing act involved.

Salary Inequality

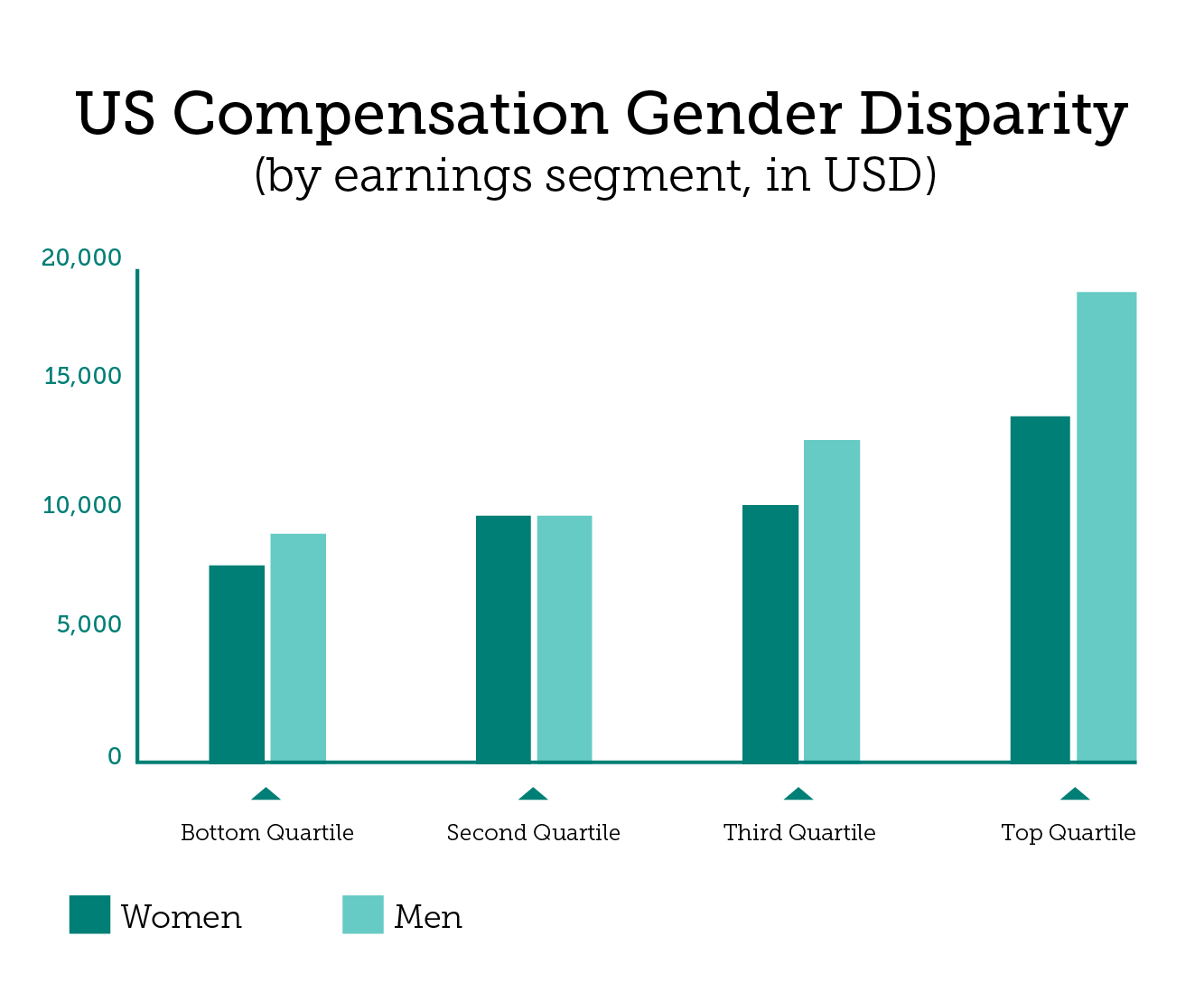

Both Wall Street and the Square Mile still give larger paychecks to men. In a survey published just last month by Bloomberg Business, figures revealed that female post-MBA investment and commercial bankers make significantly less money than their male counterparts in the US.

Source: Bloomberg Business - January 29, 2015

While many Wall Street jobs give men and women similar compensation at the outset, women make significantly less in investment banking post-MBA. According to the findings, women make an average of $11,114 less than their male peers—and that disparity increases dramatically into the hundreds of thousands of dollars as earnings go up.

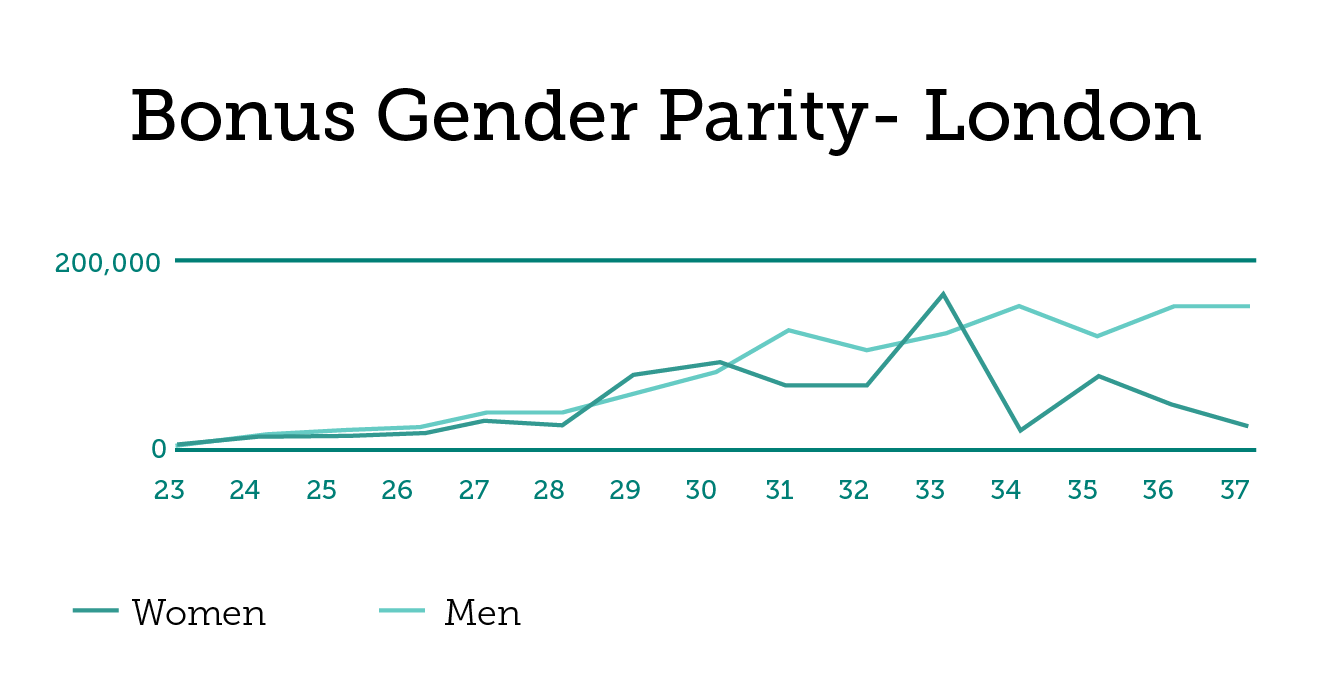

According to Emolument, the City gives us a similar snapshot.

Source: Emolument - 2013/2014

In terms of basic salary there is no discrimination against women until the early-30s age bracket. However, it’s not clear whether the decrease in pay to women at this age range is due to discrimination or women taking a less active role in order to raise a family.

Despite this drop, it’s the bonuses that create gaping differences. Beyond scrutiny and shrouded in secrecy, bonus figures are subject to huge gaps when it comes to gender parity, and this is what creates such a large discrepancy in London salaries between senior-level women and men.

Harassment

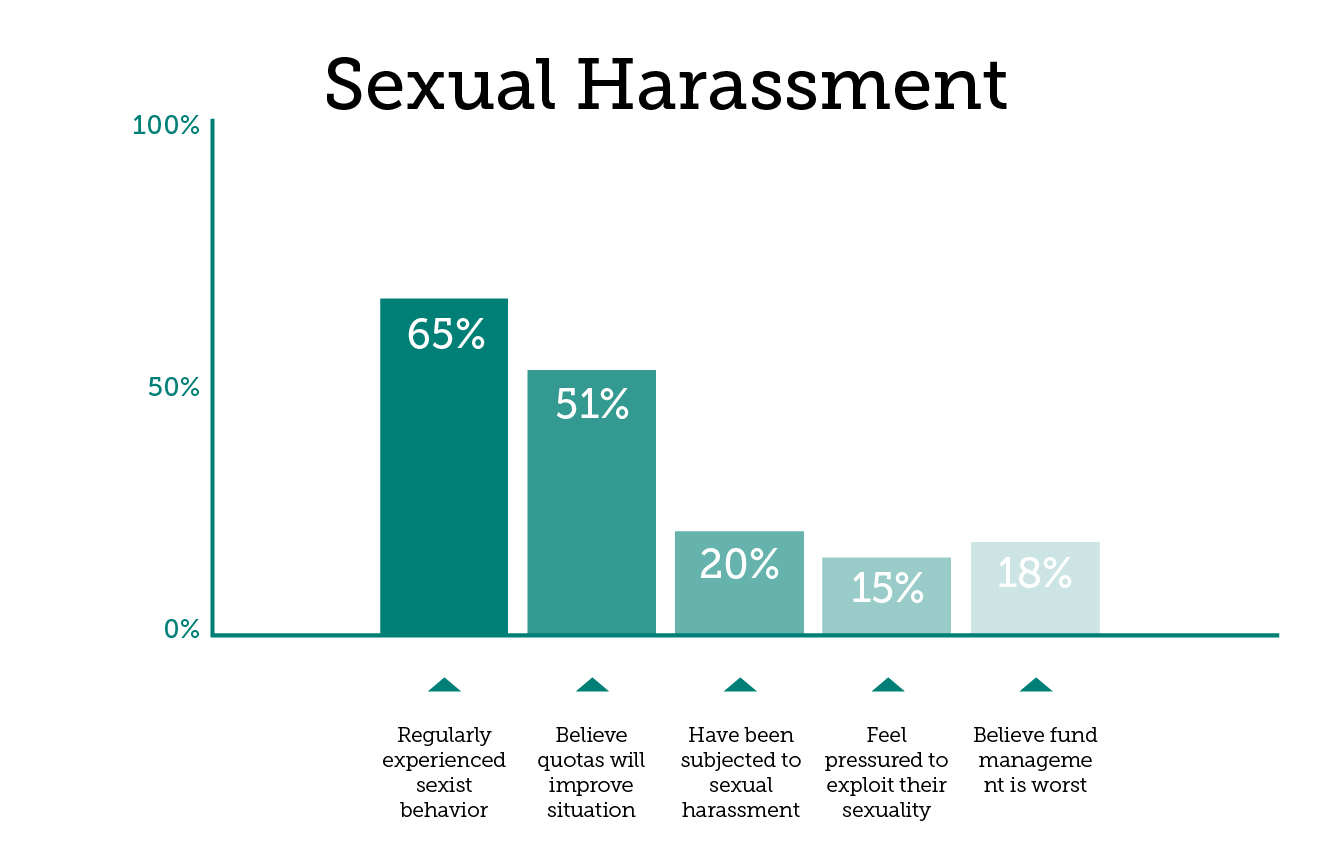

Finally, it’s important to address the ugly topic of harassment in the finance industry. FT conducts an annual global survey where it asks both men and women in asset management about gender discrimination (over 730 global respondents).

The findings of last year’s survey revealed widespread sexism, with the worst outlook for women being in fund management.

In all cases, roughly half of the percentage of men agree with their female counterparts. As well, more than two-thirds of men believe the situation for women has improved over the past five years, while only 37 percent of women agree.

Source: FT - November 30, 2014

Solutions

There are no easy answers. One oft-presented solution is quota filling. Proponents of the idea say that many other tactics have been tried unsuccessfully, while quota filling, by ensuring a certain percentage of women have senior-level roles, will solve the problem of representation directly as well as salary equality and discrimination indirectly.

The more women there are in senior-level positions, the less likely it is that they’ll be paid less, and the more likely it is that they’ll feel more empowered in reporting harassment.

Many countries and companies are paying more focus than ever to gender inequality in the finance industry, but there is still a long way to go. Today might be Women’s Day, but in the finance industry it, unfortunately, only comes once a year.