The Covid-19 Pandemic has tilted the global markets, making them volatile in a way we have not experienced in a while, and bringing many of us to try our luck as day (or night) traders. With so many new players in the market, I think it is a great opportunity to explore some of the Capital Markets Technologies and Smart Trading Solutions available out there. But before that, let’s take a moment to understand the bigger picture of these exciting segments and the players utilizing the technologies that are sprouting out of it.

How does WealthTech help us?

Whether the end-user is a corporation looking to better serve their clients, or an individual looking for affordable help to manage his investment portfolios, WealthTech (AKA Wealth Management Technologies), features an extensive array of technologies that will improve portfolio management strategies and yield.

WealthTech and Smart Trading Platforms differ from traditional portfolio management platforms through the usage of algorithmic processes, data science, and Machine Learning, resulting in more efficient trading methods, and more profitable financial outcomes.

Many of these Smart Trading Platforms utilize social trading, where traders and investors are able to observe and follow the trades of leading traders. There are several trading platforms and brokerage firms offering social trading features, such as eToro, Tipranks, Zulutrade, and more. Non-professional traders can highly benefit from social trading, where they can use strategies like “copy trading” or “mirror trading” to beat the market with crowd wisdom, provided by other traders.

Billions of dollars being invested in the stock markets each year by utilizing all kinds of technologies, we tried to examine what is the latest shout of this topic and who are the immediate suspects, and came up with several premier WealthTech solutions you probably should know -

Robo-Advisors are an emerging technology in the personal finance sector and utilize automation to enable a fully personalized approach to wealth management. A great example of this is Blooom, which uses a robotic advisor to help

Nir Netzer, FinTech-Aviv

retirees manage their portfolios and optimize their accounts to achieve peak performance. Focusing on 401k management, Blooom targets specific issues within a certain demographic while providing the highest security. Another good example we found is a digital tool by Wealthfront, called “Path”. This robo-advisor, based on Modern Portfolio Theory and automated tax collection, uses algorithms to optimize investment strategies and produce the best results for the end-user.

While the companies mentioned above are focused on specific end-consumers, robotic advisors and Artificial Intelligence are also being leveraged on a business-to-business (B2B) level. For instance, the company Responsive.ai helps wealth managers maintain trust with clients and increase their overall wealth by optimizing regulatory compliance, data science, and client analytics.

Through a hybrid approach, Responsive.ai is able to improve wealth manager communication among an array of other issues such as enterprise governance and API integrations. Another B2B WealthTech example is Cred, which works with investment firms to better engage clients. Sustained by Barclays, Cred uses client data to find the best way to serve the client’s wealth management initiatives.

WealthTech in Tier 1 Banks

To keep up with the competition, Tier 1 banks are on a constant chase to adopt WealthTech solutions in order to support their traders as well as their end clients to achieve better results. Here are two examples to put some light on the way it’s done in the big league.

JP Morgan believes that partnering with WealthTech start-ups will help them to innovate and to provide their clients with alternative investment offerings. They have invested in WealthTech companies such as iCapital Network, which builds modular alternative investment solutions and collaborates with Access FinTech, which aims to bring collaboration and deliver transparency to the financial services industry. This partnership will result in a trade processing solution that will likely provide real-time transparency,an accurate workflow to the firm’s buy side clients, and bring to greater satisfaction from their end.

Goldman Sachs recently acquired United Capital (now Goldman Sachs Personal Financial Management), a technology-driven investment advisor based in Newport, California. United Capital, serves high-net worth individuals and manages $22 billion. This acquisition enabled access to a new segment of high-net-worth individuals that will be able to enjoy the most exclusive services provided by United Capital’s technology and its FinLife CX digital platform.

Go with the Flow or Do it Yourself? Choosing the Right Trading Approach for You

So, you can of course give your trust and funds to your bank manager and put your hope in the traditional industry, or you can try and DIY, but the question that is still there is how to choose your trading tool?

In order to choose the best option, three key factors should be taken into account; price, technology, and features. We gathered a few trading platforms to try and answer this complex decision-making process -

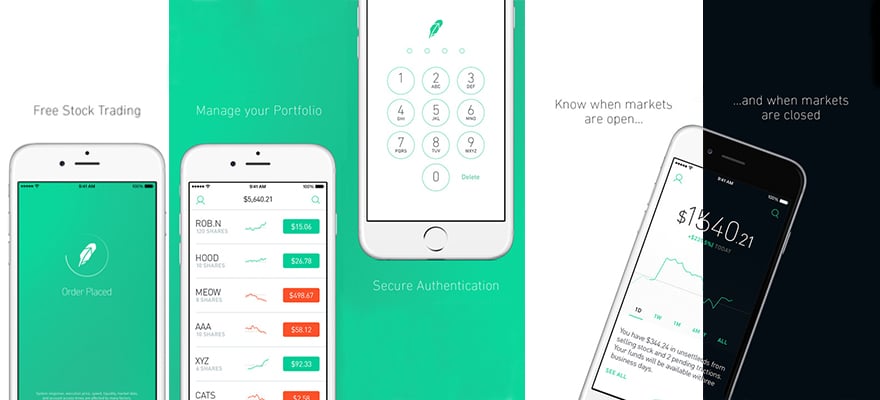

Robinhood is the most user-friendly Trading Platform on the market, which turned the commission-free trading phenomena into an industry standard. Robinhood offers zero-commission trading of Stocks, ETFs, Options, and Cryptocurrencies with no minimum deposit. Robinhood has also recently introduced Fractional Shares to its platform, allowing users to invest as little as $1 in a company, instead of having to buy the entire share. Robinhood also offers a free stock for creating an account and additional free stock for successfully inviting friends to the platform. These are the main reasons that this innovative platform is very popular among young investors, with an average customer age of just 31 years old.

TD Ameritrade, one of America’s largest online trading platforms, has more than 11.5 million funded accounts with over $1.32 Trillion in total client assets. TD Ameritrade’s trading platforms are available on web and mobile and offer commission-free trading of Stocks and ETFs, and Options.

MetaTrader is a Forex trading platform that offers social trading, algorithmic trading, expert advisors, advanced technical analysis, and is available on both web and mobile.

Each platform has its own areas of strength and weakness; however, the single trading platform for I enjoyed most is undoubtedly Interactive Brokers. Interactive Brokers provides its clients from around the world access to Global Capital Markets with a super professional user interface and uses advanced trading systems to offer low-cost trading of Stocks, Options, Bonds, and Currencies in over 120 markets.

In Conclusion – The Secret Sauce is probably AI

With more people investing and managing their portfolios, it is clear that more client eccentric approach, the mobile 1st experience, and other added values to ease and improve the trading experience, such as zero commission trading and no minimum deposits, are essential for greater client satisfaction. With that, we found that the secret probably lies in the data - deep customer insights and AI-driven trading.

According to a mutual survey conducted by Refinitiv and Greenwich Associates of trading industry leaders, Artificial Intelligence is, by far, seen as the most potentially disruptive trading technology in the next three to five years when 80 percent of participants expect AI or Machine Learning capabilities to be fully integrated into their trading process and that their firm will have internal AI expertise in the next 3-5 years.

But who’s late to come is the traditional financial industry, while most of the industry is rapidly investing and integrating AI into their trading systems, Asset Managers and Hedge Funds have lagged behind in AI adoption, with only 23 percent using some AI today, compared to 61 percent of total respondents that say they are either using artificial intelligence today or plan to adopt AI-based features in the next 12–24 months.

While the ideas presented in this article summarize the WealthTech’s main applications and functionalities, from fractional trading to Robo-driven portfolio management, this is obviously an evolving industry offering a plethora of other FinTechs that will doubtlessly have an impact on the method in which trading is conducted in the mid-range and long run, and we can’t wait to see the outcome.

If you would like to find out more about WealthTech and Trading Platforms, you’re most welcome to watch this Capital Markets virtual event hosted last week by the Israeli FinTech Association - FinTech-Aviv, shares additional insight on this super exciting sub-segment of FinTech - visit here.

Nir Netzer is the Founding Partner at Equitech Group and Chairman of the Israeli FinTech Association - FinTech-Aviv