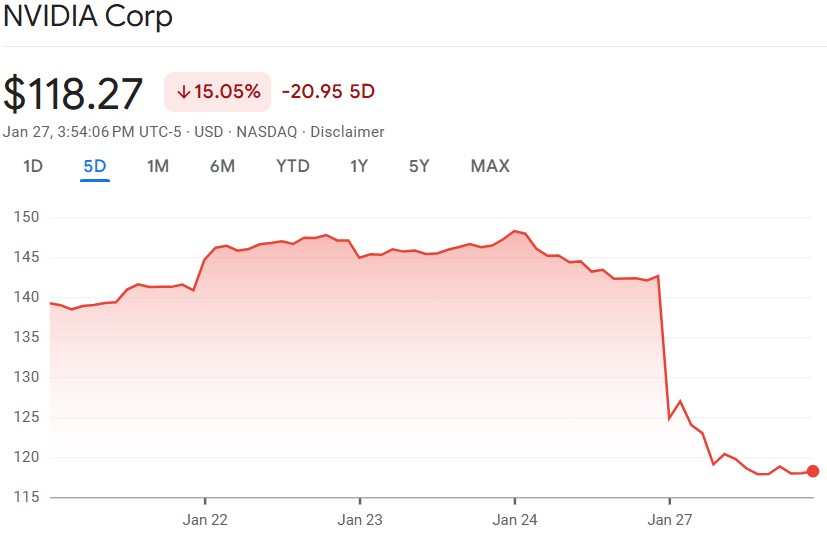

Nvidia, once the crown jewel of the AI boom, faced an unprecedented $560 billion loss in market value Monday, marking the largest one-day drop in US stock market history, Bloomberg reported.

What is Behind Nvidia Stock Fall

The selloff was sparked by mounting investor concerns over Chinese AI startup DeepSeek, whose low-cost approach to artificial intelligence is shaking up the competitive landscape and challenging Nvidia's dominance.

The semiconductor giant's stock reportedly plummeted as much as 18%, its worst drop since March 2020, leaving an indelible mark on the broader market. Nvidia's influence on major indexes also amplified the impact, with the S&P 500 shedding 2.3% and the Nasdaq 100 tumbling 3.6% before recovering slightly, according to a Bloomberg report.

DeepSeek, led by quant-fund chief Liang Wenfeng, has emerged as a formidable competitor with its latest AI model. Released last week, the model is open-sourced and has quickly risen to the top of Apple's App Store rankings.

Nvidia's reliance on AI spending has made it a benchmark for the tech sector. The company's chips are important to AI development. However, DeepSeek's progress has brought concerns as to whether Western firms have overinvested in costly AI projects.

US vs. China in the AI Race

The geopolitical undercurrent is impossible to ignore. The US has sought to limit China's progress in AI by banning the export of advanced semiconductors and restricting Nvidia's AI chip sales. However, DeepSeek's success signals that China may have found a way to bypass these restrictions by focusing on efficiency and innovation with limited resources.

Similarly, OpenAI and its partners, including SoftBank and Oracle, have committed $100 billion to develop AI infrastructure across the US. While the AI boom continues to drive major investments, Nvidia's record loss could impact the future of the industry.

Investors are increasingly wary of companies that fail to show sufficient returns on massive capital expenditures. With the rise of cost-efficient competitors like DeepSeek, the AI industry may be approaching a critical inflection point.

As the dust settles, Nvidia's historic plunge underscores the challenges of maintaining dominance in a rapidly evolving AI landscape, where innovation is no longer exclusive to Silicon Valley.