Ethereum: Quiet Tape, Regulatory Catalysts, and the Road to $5,000

Ethereum has delivered a rare combination of signals in recent days: falling trading volumes, compressed volatility, ongoing debates about staking exits, a new U.S. regulatory framework for crypto ETFs, and technical resilience in futures markets. Taken together, these form a picture of a market that is resting, not retreating, with unfinished business near its all-time highs.

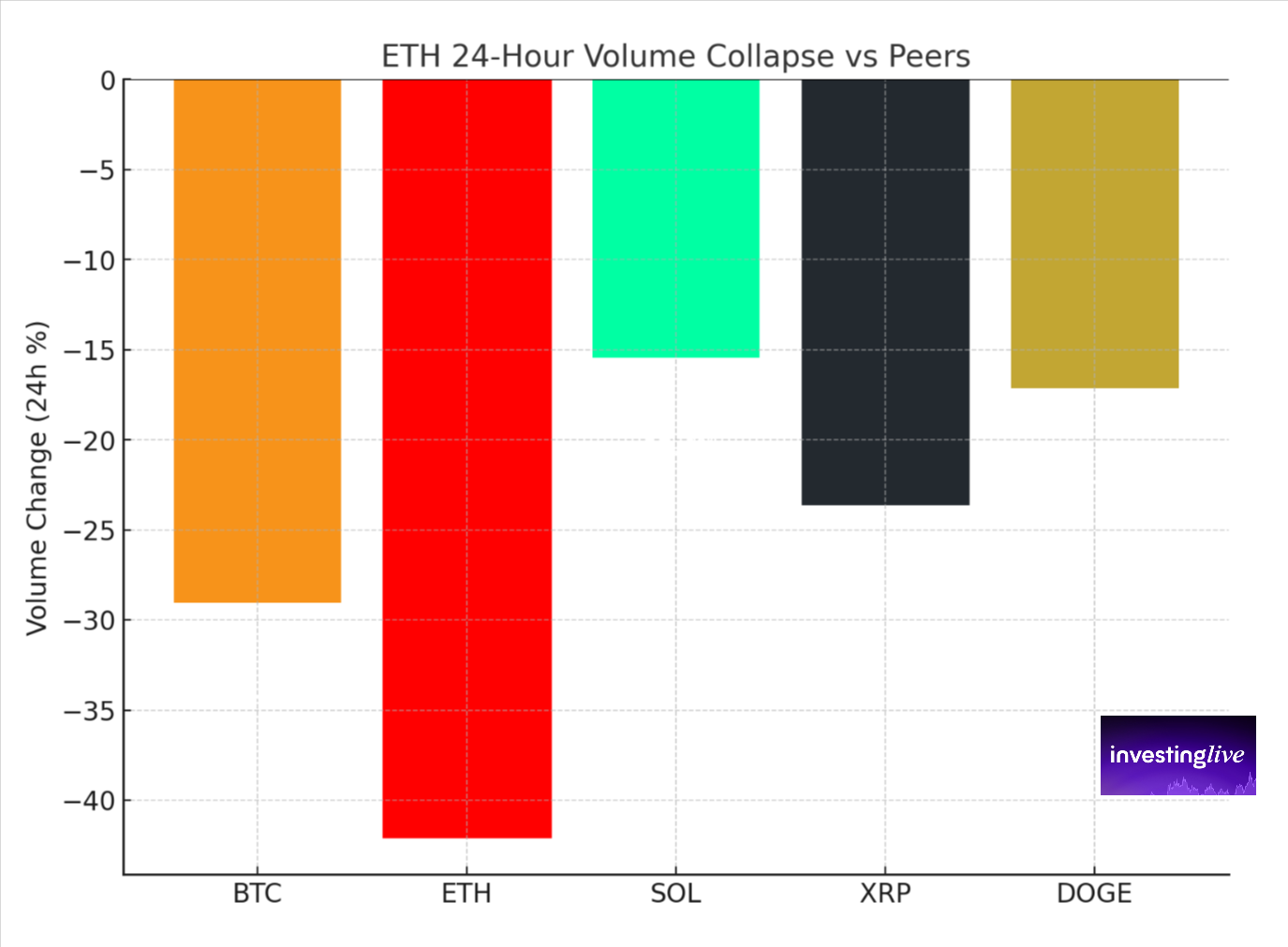

The 24-Hour Volume Collapse: A Market in Pause, Not in Flight

Over the last 24 hours, ETH spot volumes have dropped by more than 40%, even as prices remained broadly stable and open interest dipped only modestly.

This suggests traders did not exit en masse, but instead stepped back. Such sharp volume contractions are often a sign of indecision, and participants waiting for the next catalyst.

You can think about it this way: When prices fall on rising volume, it usually signals strong selling and more downside ahead, possibly more panic ahead. But when prices slip only slightly and then volume dries up (like it did in the last 24 hours), it often means participants are running out of steam. In Ethereum’s case, the recent mild pullback paired with a 40% collapse in trading volume suggests the market is pausing rather than breaking down. And possibly even setting up for a trading range phase, before a bullish reversal. In any case, it means sellers have lost momentum in the last 24 hours.

Implied Volatility Compression: A Market Expecting Less Drama

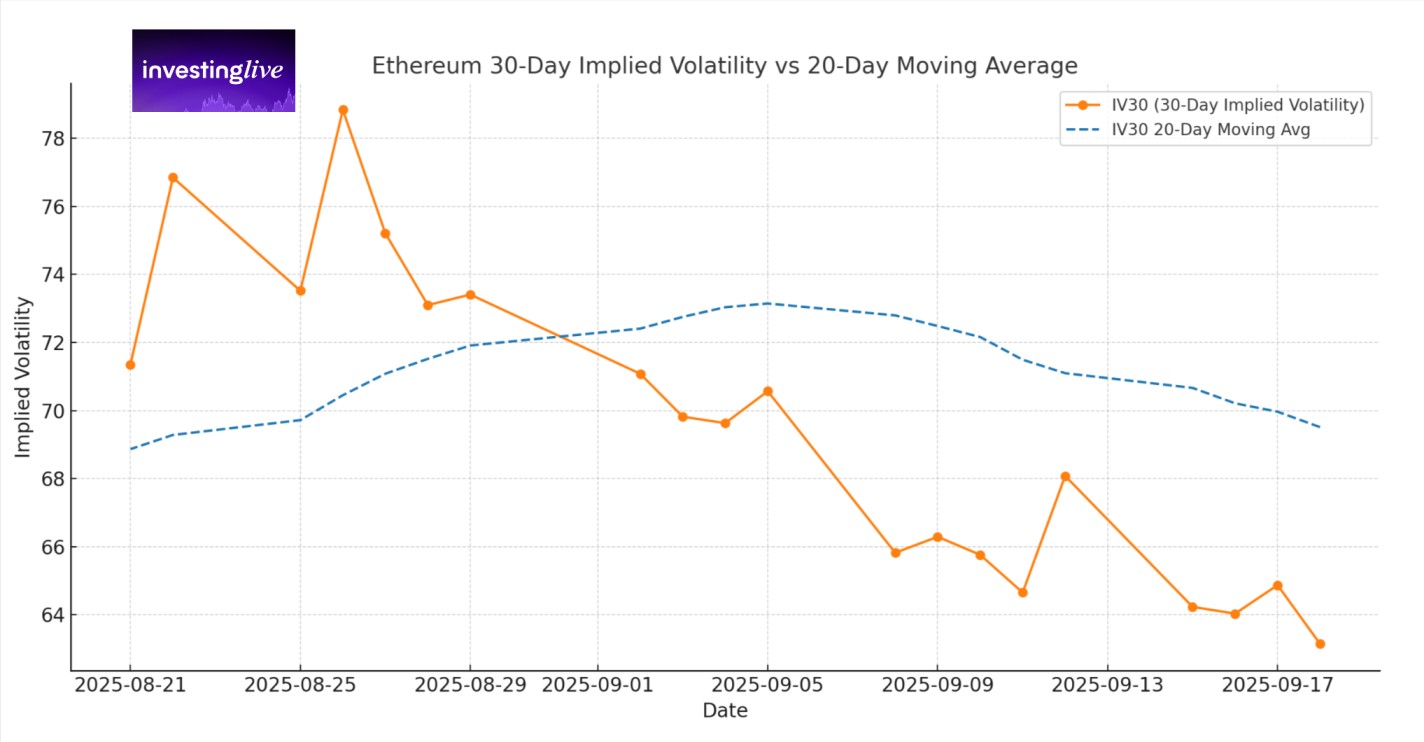

Options markets confirm this recent cooling for Ethereum, with no dramas of collapse.

Ethereum 30-Day Implied Volatility (Grayscale Ethereum Mini Trust ETF)

The chart shows Ethereum’s 30-day implied volatility (IV30) versus its 20-day moving average. IV30 has fallen from a late-August peak of nearly 79 to just above 63 by mid-September. The moving average is also rolling over, confirming a broad decline in volatility expectations.

Executive-Friendly Explanation

What is implied volatility? It is the market’s forecast of how much an asset might swing, reverse-engineered from option prices. Higher IV means traders expect bigger moves and demand more premium for options. Lower IV means they expect calmer trading and are willing to sell protection more cheaply.

Why does it matter for ETH?

Fewer fireworks in the near term: Falling IV means traders are betting that Ethereum’s price will be more stable in the coming weeks.

Compression sets up expansion: In markets, long periods of calm rarely last. A sharp fall in IV often precedes the next big directional move once a new catalyst (like regulation, ETF inflows, or a staking update) hits.

Institutional comfort: For executives managing risk, declining IV means derivatives tied to ETH are becoming less “expensive” to hedge with, which can improve liquidity and encourage more professional participation.

The takeaway: Ethereum’s options market is signaling calm, not chaos. That doesn’t mean risk is gone — it means the market is saving its energy for the next big story.

A Regulatory Catalyst Enters the Mix

A fresh regulatory spark adds fuel to Ethereum’s technical coals. On September 17, the U.S. SEC approved generic listing standards for new crypto ETFs, substantially streamlining the path to listing products backed by assets like ETH. Exchanges no longer need full case-by-case approvals, cutting potential timelines from nearly 240 days to about 75. This development not only reduces regulatory friction but also paves the way for more Ether-oriented and multi-crypto funds to launch quickly.

Read more on investingLive.

For a market waiting on catalysts, this is precisely the kind of policy shift that can attract institutional flows and reignite momentum.

The Staking Exit Debate: Vitalik Defends the Queue

At the same time, Ethereum’s internal design is under debate. Vitalik Buterin recently defended the 43-day staking exit queue, arguing it is a necessary safeguard. The design deliberately limits how quickly validators can withdraw, ensuring the network remains secure even during stress.

Critics counter that the queue hurts user experience and ties up capital. Proposals such as EIP-7922 (dynamic exit rates) and EIP-7251 (validator consolidation) aim to shorten waits without weakening security. The outcome of this debate may influence how institutions perceive staking liquidity, which is a key factor for broader ETH adoption.

Technical Picture: Anchored VWAP Signals Strength

On the technical front, ETH futures look resilient:

Anchoring VWAP to the August 22, 2025 high (just before the last contract rollover) shows price has consistently respected this benchmark. Buyers have stepped in at each test, confirming its importance.

Price remains above the first upper standard deviation band of this anchored VWAP, a further secondary sign that momentum still leans bullish.

The rising green support line, last touched on September 17, remains intact.

The retracement that began on September 12 looks more like sideways consolidation than real weakness. With a week of digestion nearly complete, the setup favors another attempt at the all-time high of $4,903, with the $5,000 round number serving as a natural magnet for flows.

Ethereum price prediction and reminder: Watch that VWAP (purple line below)

VWAP to Watch: 4472 (from an important recent high).

Current Price: 4531 (just above VWAP, but trending toward it).

Signal: If price sustains below VWAP, bearish momentum gains credibility.

Right now, bulls still hold the edge since price is above VWAP, but it’s a fragile lead. VWAP often acts as a battleground between buyers and sellers, so this level is critical to monitor

- These Two Crypto Experts Told Us How High Bitcoin, Ethereum and Solana Could Go

- FBS Analysis Shows Ethereum Positioning as Wall Street’s Base Layer

- Bitcoin Price Prediction 2025: Why BTC Price Is Going Up Today

Executive Takeaway

The key message for decision-makers is this:

Etherium volume has dried up but without mass liquidation, implying traders are waiting rather than fleeing.

Volatility expectations have collapsed, leaving ETH in a low-energy state that often precedes directional breakouts.

Ethereum futures remain technically strong, supported by VWAP and structural trendlines.

Regulatory clarity has improved, and staking reforms are on the table, both of which can act as powerful catalysts for capital flows.

In other words, Ethereum is not retreating, it was more resting in place, with the balance of evidence pointing toward another challenge of the highs. Without being an expert technical analyst, one can watch the same purple VWAP line mentioned. Only when 2 consecutive days close below it, can we start questioning the bull case. Till then, bulls are looking fine.

And Finally, the Statue

Of course, not all catalysts are policy-driven. Just before the Fed’s recent rate decision, crypto investors funded the installation of a 12-foot golden Donald Trump statue clutching a Bitcoin outside the U.S. Capitol.

The spectacle was part protest, part performance art, but it underlines an important reminder: crypto is no longer confined to trading screens or policy memos. It’s in culture, politics, and even street theater. And that blend of spectacle and seriousness is what makes the next breakout in ETH futures as much about psychology as about price levels.

This article reflects analysis and opinion only of Itai Levitan, Head of Strategy at investingLive.com, formerly ForexLive.com. It is not investment advice. Traders and investors should conduct their own research and assess risks before making decisions.