This guest article was written by Vadim Epstein from emet-trading-solutions.com

Inexperienced traders have always had problems raking income from the financial markets. This has been attributed to their inclination to hedging as a strategy. This article gives a finer focus on hedging and expounds on some simple strategies that do don’t need market ingenuity or any occult detectors to earn you money from the markets.

Hedging

Hedging is a process of offsetting losses by taking a contra position on the market that reduces accrued losses. Suppose you have an open buy position that has accrued some losses you don’t feel to close the position. You can offset the losses by taking a sell position of the same asset with the same amount. You will definitely reduce the losses that were accruing but at the same time you will freeze capital in your account. This is action is referred to as hedging.

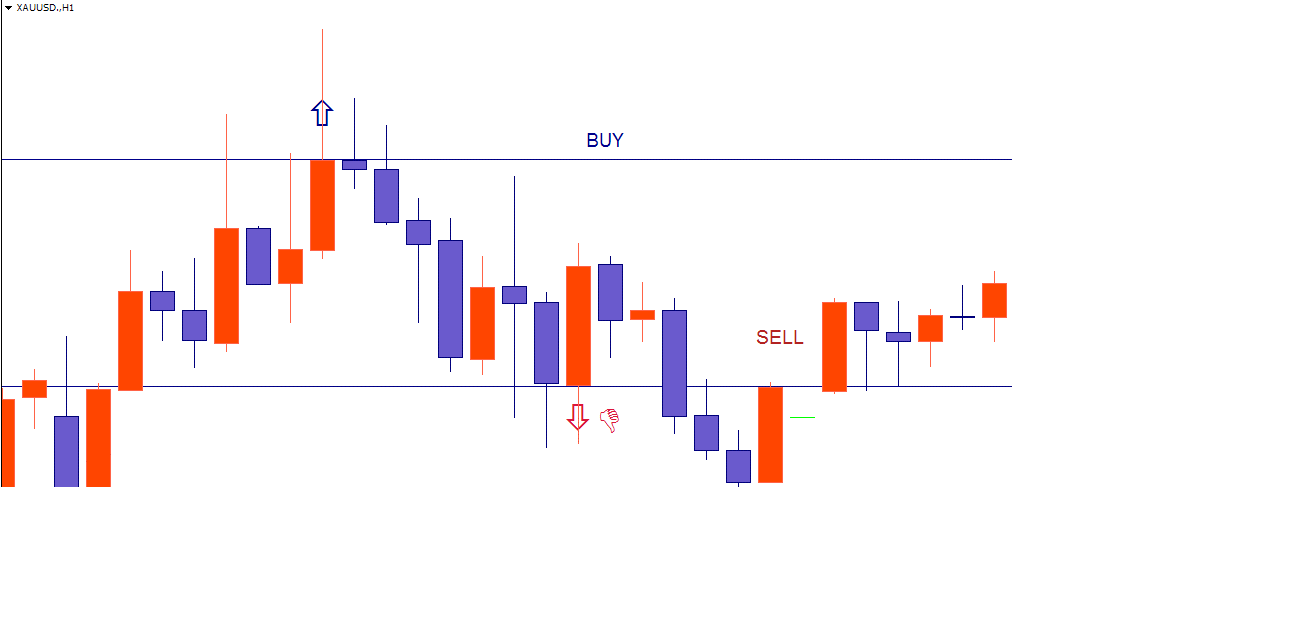

The figure above is an illustration of a poor hedging strategy that worked against the intended hedging purpose. From the figure above the trader tried to hedge the buy position with a sell order which after the market execution the prices retraced upwards making further losses.

From such a scenario you will agree that not everyone is knowledgeable on using hedging as a strategy to gain profits as well as to reduce losses. It is important to understand some basic technical tenets whenever it comes to hedging. Hedging is not a quick rush promo as it may be seen advertised by many internet promotional hedging robots that are on sale across the internet. Even without the robots you need to understand hedging. Know when it is appropriate to hedge, why you should hedge and what markets as to hedge. This are some of the insights that will be rarely addressed by the developers of these robots and it only require the skills of an advanced trader to correctly use hedging.

Technical approach to the trade—the key to success

Trading cost is a thing observed by many traders and should be of interest to any trader whether novice or a seasoned trader. One of the most common trading costs is spread. Spread is the difference between the bid and ask price. Whenever it comes to hedging it is a must to incur this cost twice since you will need to have two open positions. Whenever a broker’s spread is high this becomes a liability to the trader and has led to many traders changing brokers in pursuit of a broker with the least spread.

However, the MetaTrader4 (charting platform) allows you to close positions that you have hedged incurring only spread from one of the trades. This is done by a method referred as “OrderCloseBy”. This method is not on the open platform, it is only done via scripts and advisors.

Whenever it comes to scripts, advisors and indicators it is very important to exercise caution whenever you are choosing a developer. Your losses and profits will depend on the quality of the scripts, advisors and indicators that you have. Some developers don’t have an understanding of the financial markets and will produce scripts, advisors and indicators that are misguiding and are detrimental to your capital.

An important tip: Choose approved software manufacturers that you have no doubt on the quality of the development and it’s testing too. Random software from an online store may bring harm to your trading account. Therefore, you should exercise caution while choosing a developer for your scripts, advisors and indicators.

Hedging comes with its advantages if embraced well, it offers many money making opportunities What you should avoid

Hedging of a position in case you start to incur losses was and still remains to be common among traders. However, there has been a shift of this thinking and the new school of thinking from the experienced traders, suggest that you should not hedge whenever you are making losses. The new school of thinking suggests closing a trade that is accruing losses. The argument behind this is ‘cut your losses short and let your profits run’.

What should you do?

Experienced traders suggest that you should close a losing position and wait for the reversal of the prices and then open the same position again. By doing this you will not incur spread twice at the same time you will not freeze you capital. Avoiding losses 100% is almost impossible in the financial markets. Therefore in a bid to prevent losses you should use every means that try at least to minimize use of your capital.

Hedging comes with its advantages if embraced well, it offers many money making opportunities as discussed below.

Hedging in scalping

ECN are the preferred account type when it comes to hedging. ECN accounts have low spread and the broker doesn’t have a chance to do unscrupulous deals using the client’s money unlike with the money maker account types. Money maker account types allow the broker to play foul against you by stretching the bid and ask price when you close a profitable trade with a stop or a take profit. This is a thing that you will hardly notice with your bare eyes and although the spread manipulation is low, accumulatively it sums up to big amounts. By all means you should avoid falling prey of such scenarios.

Suppose you chose an ECN account that you intend to scalp using it. It is well known that an ECN account provides access to a wide network of Liquidity providers. The good thing about an ECN account is that there are no lags and the quotes are real time. The terminal quotes are triggered 300 – 1200 times per minute in the active trade. Such a scenario makes it hard for manual placing of orders, even with a high internet bandwidth. To cover up for the limitations you may allow for price slips but if you snooze you lose.

If you compare the bars formed by an ECN account to the bars formed by a regular account you will realize only some slight differences. The reason behind these differences is the active price movement within a bar. The ECN bars movements are more erratic compared to the regular account and at the same time the regular account has a lag. This movement from ECN accounts is what you need to harness and make profits from its movements.

Normally for the ECN account, only some of the ticks are processed by the trading terminal. You not necessarily need to make money from all the oscillations since these ticks will later be re-assigned to the trading server. The terminal should send a pair of the pending orders to the server on both sides of the current price, pending buy order and pending sell order. For this to happen, the pending buy order needs to be below the pending sell order. During this erratic price movement if it happens that both prices are touched and the orders executed, they should be closed back using the “OrderCloseBy” function. The difference between the opening prices and the warrants will be your profits. From one pair this is minimal since the price difference may be pips or even pipette(s). For you to realize profits the spread needs to be less than the gain.

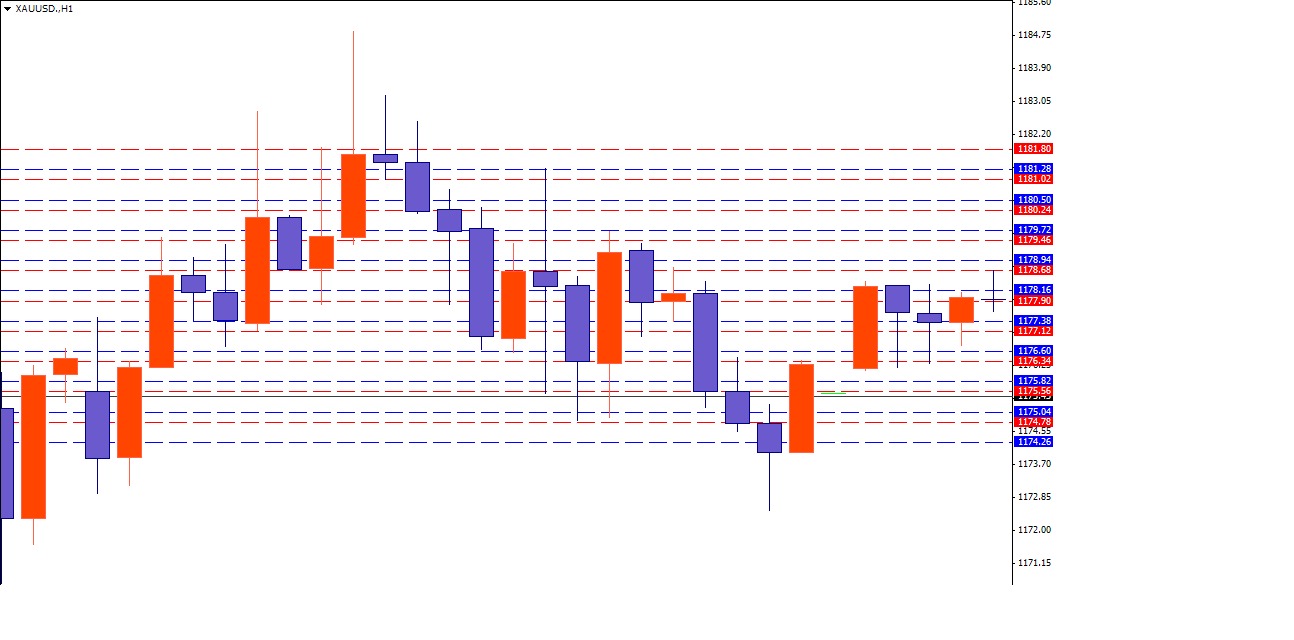

The above figure gives a vivid picture of opposite orders when they are in multiples. They are arranged in pairs a distance of two spreads. The blue dotted line represents the ‘buy’ while the red dotted line represents the ‘sell’. For clarity between pairs of orders in the grid, an interval of one spread was left. In live trade, there is no need for this because it degrades on the performance of the strategy twice. In a span of a day there are likely more than 50 pairs of orders that can be closed at a profit. If you optimize and put your pairs closer with a smaller gap, in a day you will likely to get a profit from orders of 150 different pairs. With this trading mechanism you will require minimum resources to maintain open position.

Trend motion

In the financial markets there is no Holy Grail. The only setback of this strategy is a strong trend motion. For instance In the case where the pending sell order is picked and the prices retrace upwards and not picking the pending buy order this will lead to a loss. Things can worsen when the trend gains momentum and the losses from the recent trade exceed the gains from the profitable closed orders. In cases where there is a strong trend, it is difficult to make a profit. To limit the losses that may accrue form the strong trend motion it is recommended to put the pending orders on the borders of price channel. The buy stop order should be placed on top of the upper boundary and the sell stop on the low points of the price boundary. Such a strategy apart from acting as a loss mitigation strategy it also enables you to make additional revenue from the price differences in between the boundary.

The only situation that results to a loss is when both orders are triggered because of the erratic price movements. But this loss can be offset by the gains from other closed orders.

Script allows for adjustment of price boundaries for this strategy. The same effects of adjustments are always reflected and passed to the advisors for the pending orders. This allows you to earn income at once on multiple currency pairs. However, for this to work it needs to be in time and should be congruent with the boundaries of the channel and it should stop the advisors work when the news is published.

The only limiting factor with this strategy is that the ECN account should have $1000 as the threshold amount. The next article will cover a strategy that allows starting with the least investment required to invest on the minimum level of ECN accounts.

Conclusion

1. Mistakes that arise from hedging are manageable and can be controlled.

2. The modern technical tools of a trader have potential to increase revenue opportunities.

3. High quality trading tools provide trading opportunities even when the market is calm.

4. The efficiency of your hedging relies on the quality of the software you receive from the developer as well as other programs that you use.