Having seen up close industry trends in the last couple of years, I can safely say retention remains one of the biggest challenges for brokers. Among various reasons, one substantial culprit is the lack of a structure or a system in place to help brokers manage this process.

That’s precisely the role of a quality Customers Relationship Management (CRM) system, translating into increased conversion and client life time value.

Let's have a look into the value creation process, which consists of a few elements.

First, we need to determine what value the company can provide to its customers, as the value that the customer receives determines the value he will provide back to the organization. Successfully managing this Exchange will maximize the lifetime value of your desirable customer segments.

The right questions

There are several questions every firm must constantly ask itself: how can we deliver value to our customers, how do we ensure the customer proposition is relevant and favorably attractive, and how do we ensure the customer experience is consistently positive. A good CRM system should be able to help you to answer these questions and translate into a better ROI.

Having a good CRM system allows you to acquire customers at a lower cost, acquire more customers, and acquire more attractive customers for a longer time. Researchers have

shown that it costs around five times more to get a new customer than it does to keep an existing one – just another example of how essential is a quality CRM system that understands your business, and allows you to boost your conversion and retention efforts.

So How does it work?

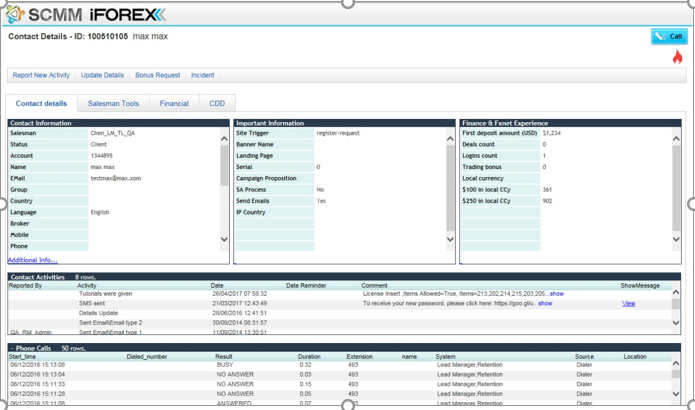

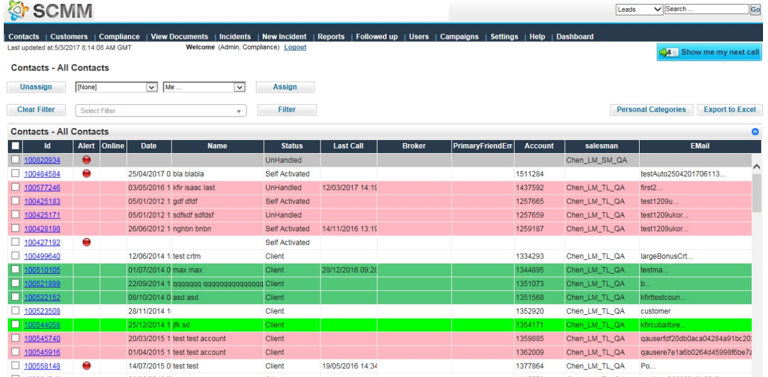

A good CRM enables firms to track and organize its contacts with its current and prospective customers. Nowadays a proper system must be based on advanced algorithms using big data and statistical engines, that will provide the sales or customer support representative with all the details he needs: which lead or client it should call next, and what proposition it should give to that lead or client.

This will assist to maximize the efficiency of the call, in order to increase chances of conversion or retention.

Having in place a robust software will enable your employees – namely sales and retention in the retail FX scenario – to store information about Leads and traders and their interactions, which then can be viewed by other departments as well, such as the marketing department which can use this information to create targeted propositions based on feedback received from different target markets or client populations.

The purpose of a good CRM is that it helps businesses use technology and human resources to gain insight into the behavior of customers and the value of those customers, or help in increasing value from existing ones.

It assists in the decision-making process and minimizes human decision making. The CRM system will tell the sales or retention person who to calls next and what proposition to use based on data and statistics and not based on gut feeling or personal inclination. Thereby increasing success chances.

One big advantage of a CRM is that it helps simplify marketing and sales processes. The CRM allows you to identify and target your best customers, increase chances or converting leads into clients, increase the lifetime of the client and plan and implement strong marketing campaigns reducing your marketing costs.

So where are all these features to be found? there are lots of providers out there with varying pros and cons. Whatever you choose, it is better to go with a solution which have already proved to work in the specific industry you operate in. You simply don’t have the time and resources for trying things out.

In the trading industry, one such example is iFOREXPRIME, which recently has expanded its scope by offering its robust services in the B2B space as well.

If you must go out and license or buy an external CRM system, it is an additional cost to take into account, and not necessarily cheap. For instance, if you have a MT4 system you will have to go out and add extra expense just to have a CRM.

Relying on a system which is incorporated in a proprietary trading system, however, grants you a smooth process.

A good CRM system allows the company to track and organize its contacts

Understanding client needs

As a retention manager tool, a good CRM system helps in understanding clients’ needs and alert the retention system on circumstances that may require human intervention in the client’s journey and experience. You are also able to review and send emails from the system as well as update details and get reports for activities.

The iFOREXPRIME system also has a compliance manager function. It handles leads and clients KYC processes, enforcing regulations which are a major issue today that is very important.

You can review all documents uploaded by clients, create a client economic profile and review answers provided to regulatory tests (such an appropriateness test). The risk department can also upload and track deposit confirmations from the system.

This CRM system has a support manager used by technical support team to solve client technical problems. Incidents created automatically and clients are identified by email. Sales and Retention can open incidents and track status. Whatever system you choose you need to make sure these functions exist.

As a retention manager tool, a good CRM system helps manage clients life cycle and experience

The digital communication and alerts defines what to send, to who, when and via which channel.

This is a very important function as you manage the client. The reward program allows the brokers to develop campaigns, create a message and a reward to share with their client base. The system can also propose and provide rewards.

Reward is a combination of tools that include bonuses, cashbacks, and spread improvements.

Bottom line

To wrap it up, with upcoming regulatory changes in the industry, the challenges of retention are here to stay. Spending so much on acquisition, when it comes to retaining those clients, brokers can’t settle for anything less than optimal. A solution built, perfected and tested with a proved track record by a leading FX retail broker is a good start.