It’s the moment you’ve all been waiting for. This Tuesday, TP ICAP, a major inter-dealer broker, released its financial report for the first half of 2018.

The report contains a number of insights into the firm’s financial performance and its plans for the future. There’s even, surprise surprise, some mention of Brexit .

Being only the cream of the intellectual crop, we know how much our readers love to keep abreast of the latest industry developments. As such, we’ve taken the time to go through TP ICAP’s report and identify several need-to-know points for your reading pleasure.

So, without further ado, sit back and enjoy as we examine TP ICAP’s H1 report for 2018.

TP ICAP Revenue

Let’s begin by examining the interdealer broker’s finances for the first half of the year. According to the firm’s report, revenue was very much in line with last years.

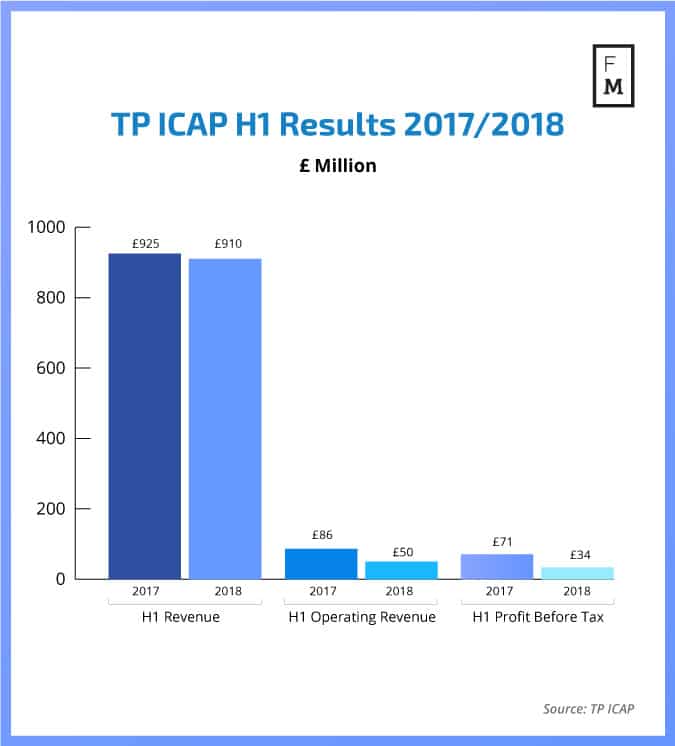

In the first half of 2017, TP ICAP reported total revenue of £925 million ($1.20 billion). This year that figure decreased, by approximately 1.7 percent, to £910 million ($1.18 billion). It is worth noting that on a constant exchange rate basis, revenues actually increased by 3 percent.

Comparison: TP ICAP's H1 results 2017/2018

In contrast to this, the firm’s operating profits dipped sharply. TP ICAP reported an operating profit of £50 million ($64.81 million) in H1 of this year, a 42 percent decrease on last year’s £86 million ($111.47 million).

Similarly, the firm reported a sharp decrease in profit before tax. Last year saw TP ICAP finishing H1 with £71 million ($92.03 million) in profit before tax. In the equivalent period this year, that number shrank to £34 million ($44.07 million) - a 52 percent year-on-year decrease.

The firm attributed these decreases to costs arising from Brexit and regulatory expenses. It also noted that costs from its £1.3 billion ($1.69 billion) acquisition of ICAP’s brokerage business in 2016 continued to affect operations.

London to Paris - TP ICAP’s Brexit move

Now that we’ve got those exciting numbers out of the way, we can discuss the headline-making news. That is TP ICAP’s decision to move its European headquarters from London to Paris.

The impetus behind this move is the UK’s decision to vacate the European Union (EU), proving conclusively that Brexit is actually a real thing and not just something people talk about on the news.

TP ICAP did not provide a huge amount of detail regarding its move across the English Channel. It noted only that it had made the decision to relocate in order to “to prepare for the UK's departure from the EU.”

The new headquarters, it seems, will become operational after the 29th of March of 2019. As you are likely all aware by now, this is the date that the UK is set to bid farewell to the EU.

Today’s report also noted that iSwap, a trading platform in which TP ICAP is a major shareholder, will be moving its headquarters to Amsterdam.

TP ICAP - new tech, new products

Beyond Brexit moves and financial figures, today’s report also indicates areas in which TP ICAP is attempting to grow and improve its business. Most notably, the firm stated that it now spends a whopping £130 million ($166.55 million) per annum on its technological efforts.

The report also gives some indication of how that money is spent. For instance, the interdealer-broker noted that it has plans to electronify “elements of client-broker interaction.”

It added that it would be creating hubs for the trading of similar products, as well as providing single points of access to Liquidity . The firm also stated that it would be attempting to make improvements to post-trade processes through automation. TP IPAC also claimed that they want to improve workflows, via enhanced technology, across both their commodities and brokerage business lines.

On the institutional front, TP ICAP stated it remains convinced the buy-side “is a significant opportunity for the Group.” It noted, however, that business development efforts in this area had been hampered by longer-than-expected efforts to receive regulatory approval and the delays stemming from agreements that must be made before transactions with clients can begin.

Data and Analytics

Outside of its major business lines, TP ICAP’s data and analytics services look to be receiving a significant ramping up in the near future.

Today’s report indicates the firm will be providing the division with a £9 million ($11.67 million) investment aimed at generating organic growth. This represents 60 percent of the £15 million ($19.45 million) that TP ICAP has earmarked for investment in organic growth.

TP ICAP has, according to its own report, made substantial changes to its data and analytics division over the past 12 months. This likely started with the appointment of Ed Sinclair, as the division’s CEO, in November of last year.

One major development has been the growing ties between the data and analytics division and the firm’s brokerage business. In today’s report, TP ICAP stated that the two divisions had formed a partnership that began with a programme of client audits that will ensure the inter-dealer broker is fully remunerated for the usage clients obtain from their products.

The firm also stated that, in the near future, its data and analytics team would be gathering more data from its brokerage business. It added that it is setting up a pipeline of regular product launches for its data and analytics division and that it will be providing data products through the cloud to reduce prices for clients.