Virtu Financial (Nasdaq: VIRT), a market maker and liquidity provider, reported its fourth quarter and full year 2023 financial results today (Thursday), showing declines in profitability compared to the prior year periods.

Virtu Financial Reports Decline in Q4

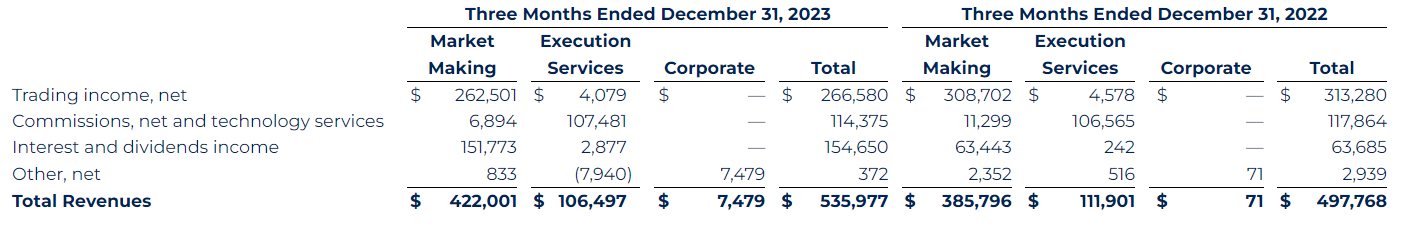

In the fourth quarter, Virtu's net income fell 83% to $6.7 million from $39.6 million a year earlier. Normalized adjusted net income, which excludes one-time and non-cash items, declined 31% to $44.1 million. Revenues rose 8% to $536 million, but trading income dropped 15% amid lower market volatility.

“Adjusted Net Trading Income decreased 4.8% to $260.9 million for this quarter, compared to $274.1 million for the same period in 2022,” the company commented. “Adjusted EBITDA decreased 20.7% to $99.0 million for this quarter, compared to $125.4 million for the same period in 2022.”

The decline in trading income reflects less favorable market conditions compared to the heightened volatility during the pandemic recovery in recent years. With markets normalizing in 2023, trading volumes eased across asset classes, crimping the opportunities for Virtu's market-making activities.

The decline is particularly severe considering that in Q3 the company showed really good results. The New York-based electronic market maker reported a net income of $117.6 million for the third quarter, representing an upturn of 47% compared to last year.

2023 Did Not Turn Out Better for Virtu

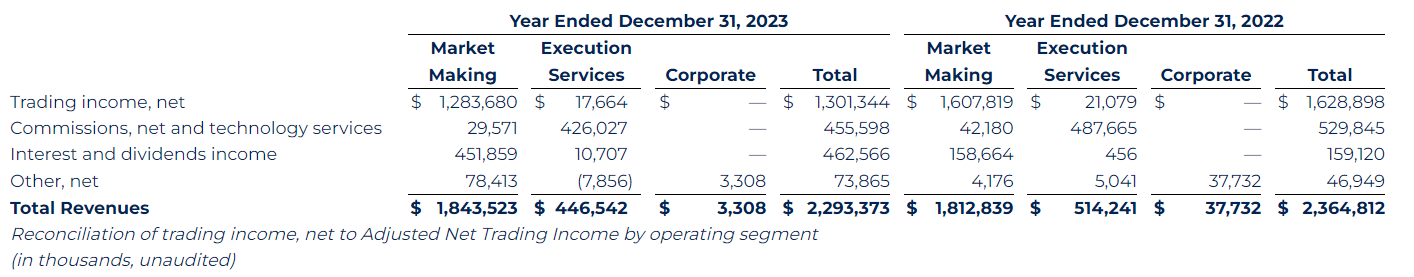

For the full year 2023, Virtu's net income tumbled 44% while normalized adjusted net income sank 42%. Total revenues slid 3% to $2.3 billion as trading income decreased 20%.

“Trading income, net, decreased 20.1% to $1,301.3 million for this year, compared to $1,628.9 million for 2022. Net income totaled $263.9 million for this year, compared to net income of $468.3 million for 2022,” the company added.

However, Virtu continues generating healthy adjusted EBITDA margins near 40% as it leverages its technology and diversified low-risk business model. The company returned $254 million to shareholders in 2023 via dividends and share repurchases. It also maintains a strong balance sheet.

In November, Virtu entered into a strategic partnership to provide clients with integrated FX Trading Analytics and Transaction Cost Analysis services. This collaboration allows 360T clients to leverage Virtu’s analytics for monitoring and analyzing their trades on the 360T platform. The partnership focuses on delivering data-driven insights to enhance FX trading efficiency for corporate treasurers and asset managers.