Institutional foreign exchange (FX) volumes jumped across major trading platforms in January 2026, reversing December's pullback as currency volatility returned to global markets.

Institutional FX Volumes Surge 25% as Dollar Volatility Returns

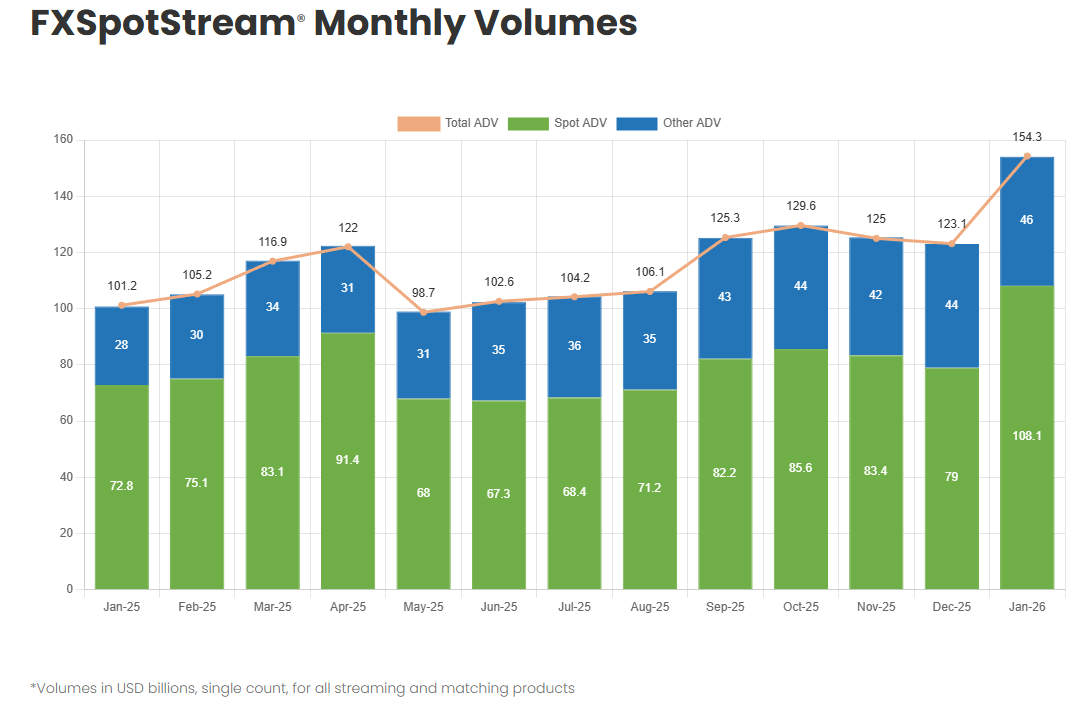

FXSpotStream's institutional ECN recorded total average daily volume of $154.3 billion last month, up 25% from December's $123.1 billion. The platform's spot ADV climbed to $108.1 billion, marking a significant recovery from the prior month's lull. The January figures reflect heightened trading activity as institutional desks repositioned following year-end.

Cboe's spot platform processed $1.33 trillion in total January volumes with average daily turnover of $63.3 billion across 21 trading sessions, rising 30% from December's $48.6 billion daily pace. The Chicago-based venue benefited from renewed dollar volatility that emerged in late January after weeks of relative calm.

The rebound followed December's cooling period, when currency volatility had subsided and institutional desks reduced risk ahead of year-end. Trading typically picks up in January as new capital enters the market and macro positioning resumes.

European Venues Post Strong Gains

Deutsche Börse's 360T platform recorded January volumes of $853.7 billion with average daily turnover of $38.8 billion, jumping 15% from December's $32.2 billion daily average. The German venue saw increased activity in euro crosses as traders adjusted positions following the year-end rebalancing period.

- Institutional FX Volumes Hit Three-Month High as Dollar Volatility Drives October Trading

- Institutional FX Trading Volumes Surge 12% as Dollar Finds Its Floor in September

- Institutional FX Markets Volumes Weather Dollar's Historic Plunge In July 2025

Euronext FX processed $732.8 billion in total monthly volumes with daily averages reaching $34.9 billion, up 16% from December's $30.1 billion. The platform maintained steady growth as corporate hedging activity picked up after the holiday period.

Both European venues outpaced their December performance as volatility in major currency pairs increased. The activity levels suggested institutional traders were rebuilding positions after the typical year-end risk reduction.

Tokyo Platform Shows Mixed Results

Tokyo Financial Exchange 's Click 365 retail-focused platform recorded 2.03 million contracts in January with daily averages of 96,878, rising 29% from December's 68,736. The yen-denominated platform showed stronger month-over-month growth as Japanese retail traders increased activity.

The Turkish lira-yen pair led volume contributors with 518,420 contracts, up 19% from December. USD/JPY trading reached 511,583 contracts, jumping 37% month-over-month. The Mexican peso-yen pair recorded 281,662 contracts, climbing 22% from the prior month.

January Pattern Mirrors 2025 Start

The January surge echoed patterns from twelve months earlier, when FXSpotStream reported near-record trading volumes to start 2025. At that time, total ADV reached $101.2 billion as the dollar hit multi-year highs.

The 2026 January figures exceeded those levels significantly, with FXSpotStream's total ADV climbing 52% compared to January 2025's $101.2 billion. Spot ADV in January 2026 reached $108.1 billion, up 48% from the $72.8 billion recorded in January 2025.

Other venues also showed broad-based gains when 2025 began, with institutional FX markets rebounding for consecutive months across Asia, the United States, and Europe. The pattern suggests seasonal factors play a role in January trading activity.